Investing for kids is a great way to save for their future PLUS teach kids how to invest. Let me show you how to get started.

So, you’re looking into investing for kids because you want to actually teach your child how to invest, and you need to know not only how to explain the stock market to a kid, but also the logistics of investing for a child (since kids – aka, minors – cannot invest on their own).

OR, you might be here because you want to invest FOR your child – so that you can save up for their future – without actually involving them in the process.

Either way, you’re in the right place.

Whether you want to invest WITH your kid, or you want to invest FOR your kid, keep reading – we’ll cover both in this article.

First up? I want to talk about deciding on which type of investing you want to do, and when your child might be ready to learn about the stock market.

Decide on What Kind of Kid Investing You Want to Do

If you’re reading this article, then you either:

- Want to invest FOR your child

- Want to invest WITH your child so that they learn how to invest for themselves

Keep your end goal in mind – whether that’s investing FOR your child, or investing WITH your child – as you go through the rest of this resource guide, so that you can sift through what you need to know versus what you can shelve for later.

If you’re in the first camp and want to invest for your child, without involving them, you can do that at any time – we’ll go over the mechanics of how to do this, below.

But if you want your child to be part of the investment process and learn how to understand the stock market? Then you have to make sure they’ve got a few other money lessons under their belt.

For starters, they should probably understand:

- What money is

- How to earn money (plus have a source where they actually earn/get money from)

- The difference between saving money and investing money

- What risk is, and the risks of saving money vs. the risks of investing money

Are you reading this list and thinking your child needs a few refreshers or crash courses before you guys start down the investing path together?

Not to worry.

I’ve got a couple of resources for you:

- Free stock market games for students and kids

- 7 Stock Apps for Kids

- Stock Apps for Under 18 (with built-in Parental Controls)

- Free stock market worksheets (PDFs)

- 29 Money Books for Kids (By Age) to Jumpstart their Financial Education

- Fun Ways to Teach Compound Interest to Kids

- 7 Investment Books for Kids and Teens

Let’s move onto how to explain the stock market to your child (skip this section if you don’t plan on involving them).

How to Explain the Stock Market to a Kid

One of the best ways to explain the stock market to a kid is to actually get them actively involved in it. Once they see how it functions, they’ll get more and more comfortable with it.

I mean, think about how you taught them to ride a bike. Did you have them sitting on the sidewalk, reading articles and looking at their bicycle chain all day? Or did you bust out the training wheels and let them take it for a ride (even though they fell more times then you care to remember)?

Not only do you want them involved in the stock market on some level, but if you can get them to see how it functions from the viewpoint of someone who is intensely interested in it (i.e., from a shareholder, or stock owner, point of view)? Well, then you’ve probably cut in half the difficulty in teaching a kid about the stock market.

Why is that?

Because a child who has a stake in something will naturally be more engaged in the process – which is half the battle!

In order to get your child very interested in learning about the stock market and actively participating it in, you can try a few different approaches.

Psst: not ready to get them actively involved in the stock market? No worries. Several suggestions below don’t involve investing money at all.

Investing activities, listed from least-skin-in-the-game, to most:

- Stock Market Book Club (with YOU!): Check out my article on investment books for kids plus teen investment books, and pick a book for the two of you to go through together. Make a point to get together (even at dinner time, or Saturday morning breakfast) and talk about the chapters as you both read them. Sort of like a Saturday morning investment book club!

- Following Along with a Fantasy Pick: Having them pick a stock, and then following it as if they were already invested in it (but not actually investing real money) is another way to get them interested in learning about the stock market. You can even make a little competition out of it between your kids/students, or between the kids/students and the parents/teachers. Whose stock has the most gains (percentage) in a certain time period?

- Take a Free Investment Course Online: I’ve gathered over 31 free personal finance courses for kids here, and you can find many that go over investing basics.

- Stock Market Games: Getting involved in a stock market game for kids and teens is a great way to get their feet wet. True, they won’t have any “skin in the game”, as they’re playing with pretend money. But, many of the stock market games for kids and teens that I’ve found are actually competitions and come with scholarship/prize money. That ups the stakes!

- Joint Investing: What I’m talking about here is a mini-project of sorts between you and your child. You would open up a small investment account with $50 or $100 so that the two of you learn to invest together. You’ll make joint-decisions, and test things out. It could be a fun kid-parent project you’ll remember years from now!

- Making them a Stock Owner: Buying a share of stock for them, and launching their investment education using that stock will keep them more interested in the ins and outs of the stock market then if they didn’t own any stock at all.

Another tip when figuring out how to teach kids about the stock market: always keep in mind your child’s stake in this so that you can build an investment education around it (even if you are wobbly-legged thinking of teaching investing to a kid).

You have to take your adult lens off, and see things from your child’s world. For example, if they own a stock, that would be their “stake”. You would then center every stock market conversation you have around their individual stock so that they can see how things apply in their own life. Talk about DRIPs, or talk about bulls and bears – sure – but use your child’s stock as the example in the conversation so that they can a) get interested in it, and b) apply the conversation and information to something meaningful to them.

Also, remember that any of the above activities will help your child self-discover how the stock market works (though some more than others – reading a book about the stock market is less engaging than, say, getting them involved in a free stock market game for students).

Is teaching investing for kids still making you queasy in the stomach? Don’t worry – I’ve got a fun and easy solution. I recently reviewed a copy of “I’m a Shareholder Kit”, and was very impressed. Not only does the book take your child through what it means to be a shareholder and what the heck the stock market is, but it also gives you a $20 discount on a stock through GiveAShare.com so that you can buy a stock for your child and your child can then learn about their new stock using the book.

Pretty great idea!

Next up, let’s look at investment accounts for kids.

Investment Accounts for Kids – What is the Best Investment Account for a Child?

Did you know that a child (minor) cannot legally buy a stock for themselves? This means that if you want your child to get their feet wet in the stock market, then you’ll need to be intimately involved in the process.

You’ll need to pick out an investment account for kids. Which one you want depends on a number of things. Such as:

- Do you want to make long term investments for your child?

- Will you be trading investments, or are you more of the sit-and-see type (hint: if your child is involved in this process, then your answer might be different)?

- Will you be buying individual stocks in kid-friendly companies so that your child can identify with them, or are you looking for kid-friendly mutual funds?

Let’s go over the best investment accounts for what you’re looking for.

Types of Custodial Investment Accounts

First up, you need to know the different types of custodial investment accounts you can get for a child.

1. Custodial Brokerage Account

A brokerage account is what you open with a brokerage firm so that you can buy stocks, bonds, Real Estate Investment Trusts (REITs) and other forms of investments. Basically, you open the account, you deposit money into the account, and then you buy your investments.

Your child will need one of these in order to invest (unless they buy stocks from individual companies, some of which have programs). However, you cannot just open a brokerage account for your child under their name.

Instead, you have to open up a custodial brokerage account.

You become the custodian, which opens up a fiduciary relationship between you and the child – meaning you have to both invest and spend the money in the account in accordance with the best interests of the child.

As custodian, you’re given full rights to make trades, just like you would with your own investment account. Also, since you’re the Custodian, these are not your assets and you are not taxed on them.

2. Custodial Roth IRA

Does your child have taxable income or wages, at least for one year?

Then, depending on your investing goals for your child, you might want to open up a Custodial Roth IRA (Individual Retirement Account) for them.

These accounts grow tax-free, and your child can actually use the money not only for their retirement (which is, admittedly, a loooonnnggg ways off), but also to either buy their first home or to pay for college expenses (though some restrictions apply).

The account goes into your child’s control when they reach 18 (or 21, in some states), and they can withdraw the money tax-free in retirement.

3. Custodial Traditional IRA

This is a different type of retirement account that you can open for your child, if they have taxable income or wages. Again, the money grows tax-free.

However, they will have to pay income tax on it upon withdrawal (in retirement). This type of IRA account also has less perks, because you cannot withdrawal money tax-free/penalty-free for either a first-home purchase, or to pay for college.

Because of these things, it’s generally more preferable to open a custodial Roth IRA (if an IRA account is the way you want to go).

4. Custodial 529 Savings Account

It’s important to know that you can have either a 529 Savings Account (really, you’re investing), OR, a Custodial 529 Savings Account – and both can be used to pay for your child’s college education. Here’s a great article on the differences between a regular 529 Savings Account in your name, versus a Custodial 529 Savings Account.

It’s worth noting that you can also just buy stocks directly from a specific company, such as the Disney direct purchase investment plan.

You would own the account with Disney, since your child is a minor. You should also know that the difference between buying stocks individually from a specific company and buying stocks through a custodial investment account (such as with a brokerage) is that with the investment account, you can use funds to choose from various different stocks.

Also, the minimum investment when buying stock directly from a company can be much higher (for example, you’d need $175 to buy a stock from Disney directly, OR, you can also buy just part of a stock – fractional shares – through a brokerage account).

So…how do you go about choosing the best investment account for your child? Let’s talk about it.

Things to Consider When Picking the Best Investment Accounts for Kids

There are several things to consider when picking out the best investment account for your child.

Tip #1: The first thing you need to consider is whether or not the brokerage firm you choose even offers the custodial investment account that you want. For example, not all brokerage firms allow custodial IRA accounts.

Here’s a list of custodial investment accounts to get you started:

- Fidelity Custodial Investment Account and their Custodial IRA Account

- Charles Schwab’s Schwab One® Custodial Investment Account, and their Custodial IRA Account

- TD Ameritrade Custodial Investment Accounts

- Vanguard Custodial Investment Accounts

- E*Trade Custodial Investment Accounts, and their Custodial IRA Account

Tip #2: There may be college financial aid consequences to opening certain types of accounts. For example, if you open a custodial investment brokerage account, then 20% of its value will be used when evaluating financial aid eligibility. That’s because a custodial account is considered an asset of the student, not the parent.

Tip #3: You likely want one that allows for fractional shares when looking to pick the best brokerage firm for your child. That’s because your child may not have enough money to buy an entire share of one of the companies I talk about below. With fractional shares, they can buy just a portion of a share, and still get the company they want to invest in.

Problem solved!

Tip #4: You’ll want to consider the fees involved on the account, especially when you might not fund it with much money to begin with. Will you be paying per trade, and how much? Are there minimums you need to fund the account, and can you realistically meet them?

How Do I Buy Shares for Kids?

We’ve addressed that you cannot buy stocks in a company if you are under the age of 18. That means you, the parent, are going to have to do the share-buying for your kids.

So next up, I want to go over the mechanics of how to invest for your child – whether you involve them in the process or not (check out these stock apps for kids).

Here are the steps to investing for your child:

- Decide on What Type of Custodial Investment Account You Want: We’ve discussed these above. You’ll need to make a decision and move forward.

- Open up a Custodial Brokerage Account: You’ll need various documents depending on what type of account you’re opening, such as identifying information for both you and the minor, a way to route money to the account (such as bank account number and routing information, or brokerage account information if you’re transferring from another investment account), and contact information. You’ll also need to fund the account with at least the minimum required.

- Decide on What Type of Investment You Want to Make: Depending on the brokerage firm where you sign up, you can decide to buy an individual stock, buy into a mutual fund, buy fractional shares, etc.

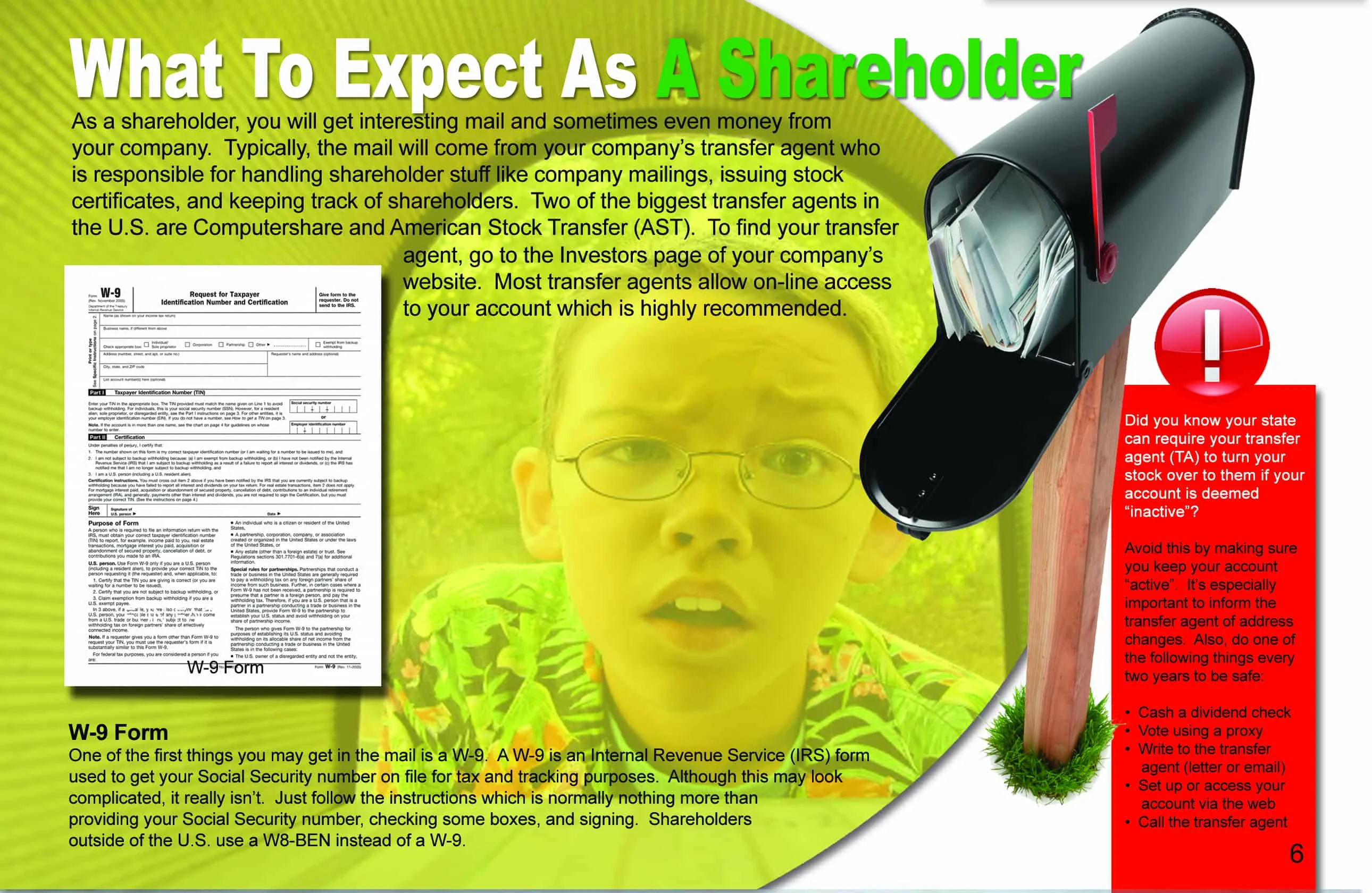

- Decide on What to Do with Dividends: Dividends paid out are income, which is one of the reasons why you need to decide what to do with them. One suggestion – that I do, personally – is reinvest dividends by selecting the DRIP option on your account.

So, how exactly do you pick the stocks and mutual funds to invest in? Let me give you a little help.

Picking the Right Stocks for Kids

If you’re looking to involve your child in the investment process, then finding kid-friendly mutual funds, or stocks for kids is a great way to go. These are mutual funds and stocks that your child will find much more interesting than an adult would (remember – raising their curiosity about the process will make teaching kids about stock markets way easier).

Note: I’m not recommending any of the following mutual funds or stocks because I think they will outperform others; rather, I’m recommending them because I think they’ll engage your child more. I’m not a financial advisor, so these are not recommended based on performance.

Best Stocks for kids

When looking for stocks for kids, you generally want to buy stocks from companies your child would recognize in real life. I mean, how cool is it for a kid to not only wear Nikes, but to be able to say they own a share of the company? Would they look at their Nintendo games differently if they knew part of their financial future was dependent on that company making good decisions? Most likely.

Three things to keep in mind when picking good stocks for kids. First, try for a company that sends an annual report in the mail (could be difficult to find, though) – this will be a treasure trove of information for your child to get their hands on (most of which they won’t understand…but reading annual shareholder reports is a great habit to get them started on early!). Secondly, you want a company that pays dividends, if at all possible. And thirdly? Find a company that has extra perks for their shareholders (though, mostly, the perks come from direct holders of the stock, not if you buy through a brokerage account).

These can be tough to find – especially stockholder perks, and printed shareholder certificates (which, generally, cost a lot of money to obtain now, from $100-$500).

Here are a few company stocks that might be a good fit for your child:

- Hershey’s: This stock is not only for a company your child likely has tried out (yummy chocolates!), but they also pay dividends. Their annual report is only available online, by PDF.

- Bloomsbury: This is the company that published the Harry Potter series. If your kid likes to read, then they might get stoked about the 35% discount shareholders can receive on any books. They also pay out dividends, but the Annual Report is only available to view online (via PDF).

- Disney: Shareholders (of even one share) are given the benefit of purchasing a collectible stock certificate (cost is $50, plus tax). Disney also pays a dividend. Their annual report is only available by PDF.

- Amazon: Your child has likely asked you to buy them something off of Amazon. Why not get them stock in the company? Note, this is a hugely expensive stock ($1,751/share at the time of this writing), so you’ll likely need to purchase a fractional share.

So, what happens if your child wants to buy a specific stock…but they don’t have enough money to buy even one share? This happens all the time – especially when some of the stocks listed above go for hundreds of dollars for just one share.

No worries. Many brokerage firms allow you to buy what’s known as a fractional share, meaning you own part of a share. This is great for kids getting started with investing, especially if they have a small amount of money.

Ways for Kids + Teens to Come Up with Investing Money

So, you’ve decided to involve your child in the investing process. How are you going to get money into their hands so that they have some to buy investments with?

I’ve got a few ideas and resources for you both.

For starters, you can make a radical move with chore commissions or allowances and decide to simply pay part of your child’s commissions or weekly allowance in stock shares. How fun would that be? You’d be investing in their long-term future, plus you can help teach them about those stocks now that they’re owners.

Psst: notice how I said to use just part of their chore/allowance pay as investment money? That’s because I’m a big believer in getting actual cash in your child’s hands. Your child must learn how to actually spend money, and it’s best to learn the lessons of spending money with actual cash, not with plastic. And if you tie up too much of their allowance in investments, then you’ll be depriving them of a lot of money lessons. Balance is key. I would say, why not start with 25%?

Your child can also get a job outside of the home. I’ve created a listing of 25 teenager jobs (ages 13+), as well as a guide on 25 online jobs for teenagers in case they don’t have a license and you don’t feel like chauffeuring them around.

Once they have a source of money set up, then the two of you can talk about what percentage of it you would like to go towards investments.

Wow. Did you make it all the way to the end? We’ve covered a ton to think about and action steps to take when investing for kids. Whether you decide to involve them or not, you’ve likely got some decisions to make on how to move forward. Good luck, and let me know what questions you have in the comments below!

Amanda L. Grossman

Latest posts by Amanda L. Grossman (see all)

- 50 Banking Activities for Kids (Student Financial Literacy) - February 14, 2024

- 14 Christmas Activities for High School Students (they’ll Actually Find Cool) - December 1, 2023

- 3 Fun Selfie Scavenger Hunts for Teens (Christmas, Fin Lit, etc.) - November 27, 2023

Money Sonata

Monday 28th of October 2019

I would certainly want my kids to dabble in the stock market and before I setup a custodian account for them, I'm going to invest some of their allowance in one or two units of shares from my portfolio and then literally give them the profit from those units when I sell them. When they're old enough to earn, they won't be hesitant about taking on the risk. And of course, I'll come back here to check out these resources to give them a crash course in stock trading:)

Amanda L. Grossman

Friday 8th of November 2019

I'm excited you want to get your kids investing in the stock market!