Mt. Everest Money Simulation: An Educational Adventure

Tasked with teaching students personal finance?

Perhaps you've got some clear, state-mandated requirements you're trying to work through. OR, things are kinda fuzzy.

Either way, you want something that makes money lessons stick with your students regardless of what they've been taught about money at home (and that keeps them interested to want to learn more).

Because we both know that in order for a student to truly learn the material and “get it”, not only does their imagination need to be captured, but the subject needs to be relevant to their lives.

But let's be real: how exciting is paycheck taxes, insurance, and budgeting for a future goal to a bunch of students who are busy thinking about who they're going to sit next to at lunch today?

A done-for-you money education program your students won't snooze through (with everything you need for a smooth run)

So, how do we both capture your students’ attention, AND keep them engaged long enough so that when they're 27 and they want to start saving for their first home, they'll be able to figure out how to do it (plus work out a budget to see what kind of home they can afford)?

The Mt. Everest Money Simulation: A Kid's Educational Adventure, has helped over 600 students do just that.

People have been knocking down my digi-door asking how their kids and students can get signed up.

SO, for the first time ever, I decided to make this available to educators and classrooms, as a self-study (Educator License comes with it).

Note: This is a digital product. You'll be given a pdf with links to download each of these files, including the PowerPoint presentation and a Google Slides presentation.

“I just wanted to let you know my 8th-grade AVID class and I had a wonderful time with our Everest adventure! The Google slides worked perfectly, and the money worksheet was perfect. It was also very good to revisit some math skills (operations with percent!!) that I thought were solid but sure were not!

I loved the embedded introduction to compound interest, insurance, and emergency savings as well. Most teams, of course, chose the cheapest company, with no insurance AND, no emergency fund. I think I had 2 teams of 3 that actually made it without going wildly into debt. You would have LOVED hearing the groans about the Yak Dung – totally unexpected loop! Thanks for giving me some fun for the end of the year!” ~ Amy McFeely, Bachelor of Music Education (UPS) M.Ed. Special Education (UW)

Let me tell you more.

Here's a quick synopsis (just 1 minute, 43 secs. long):

Here's how we'll keep your students engaged during the money simulation

You are the new leader of Erik’s Everest Ground Support Team.

Erik is a fictitious, 28-year old who dreams of summiting Everest.

The only problem is? He has no idea how much it will cost, and what he has to do to save enough money to get there.

Psst: And by the way, this program is based on real, actual events that have occurred or could easily occur on the mountain, backed up by research I conducted from over 30+ Everest and mountaineering books, interviews of summiters, 100+ hours of footage, etc. I'm kinda a brainiac + perfectionist that way.

As valuable members of the Everest Ground Support Team, your students and you will work together to:

- Reach a target money savings goal for Erik to climb Mt. Everest, based on 5 key decisions you and your students make as a team.

- Craft a realistic savings plan for how to reach that target money goal.

- Come up with solutions to 3 money problems Erik encounters while on the Mountain.

No two simulations turn out the same! There are too many cool variables involved for that.

And it comes with a full Operations Manual, to guide you and your students through the whole thing.

Psst: And the best part? Your students will be too engaged with the whole process to realize they're learning some of those personal finance reqs you need to get through.

But don't take my word for it – just look at what some of the students who have gone through this have to say:

“When my Mom asked me if I wanted to do the Everest Money Simulation, I was nervous about meeting new people and wasn’t sure if I would know enough about money to be helpful. I really liked interacting with other kids like me, and being part of a team. I learned how important it is to set a money goal, and what it takes to meet a goal in time for whatever you are saving for. I think it was a fun way to learn with other kids about money! Now, I think about money more. I think more about things in the future, and what I might need to save to get there. I’m more comfortable working with other kids, and I’m more curious about Everest – I want to know more!” ~ Moses, Age 10

“The Everest Simulation was so interactive and interesting. I liked the setting, and how you had to save Erik. I also liked how interactive it was – you had your own paper and you were able to see the other people in the simulation.”~ Riley, Age 10

What's Included

Here's what you get:

- A choose-your-own-adventure PowerPoint presentation (also available in Google Slides) packed with everything you need to run the simulation, including audio dispatches from Erik, gorgeous Everest scenery, and video

- Operations Manual with instructions for how to run a short or the long version, so that you know exactly how to run this simulation

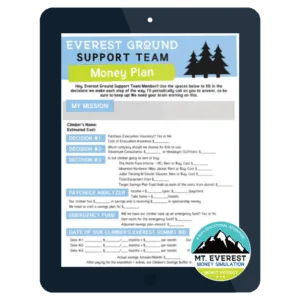

- Money Plan Worksheet each student uses to calculate 9 various money calculations (these are directly transferable to everyday adult money skills)

- Everest Ground Support Team recruitment poster to get your students get excited about the upcoming simulation

- Pre-Simulation warm-up money quiz and post-simulation Cool-Down money quiz, so that you know some of what your students have learned

- Everest hint cards, so that you can break your students up into groups and help them make decisions together

- Badge templates, in case you want to make badges for each Everest Ground Support team member

Note: This is a digital product. You'll be given a pdf with links to download each of these files, including the PowerPoint presentation and Google Slides deck.

You know teaching students about money is very important. I'm here to help.

I'm Amanda L. Grossman, a Certified Financial Education Instructor, winner of the 2017 Plutus Foundation Grant to create a kid money program (the Mt. Everest Money Simulation: A Kid's Educational Adventure), and a 13-year personal finance blogger.

Not only do I feel qualified to help you teach your students how to start how to manage that money, but I darn well looooooovvvve these subjects.

Got questions? Some FAQs.

What Age is this for?

Great question – I've run this simulation with kids aged 8 to 18, and it seems to work well within this range.

What permissions do I get when purchasing this?

Here's the copyright information:

EDUCATOR LICENSE TERMS OF USE

“This product is to be used by the original downloader only. Copying for more than one teacher, classroom, department, school, homeschool co-op, or school system is prohibited. No part of this may be sold or included as part of a product. Sharing with your students via email or password secured site like Google Classroom is allowed. Copying any part of this product and placing it on the internet in any public form (even a personal/classroom website) is strictly forbidden. Failure to comply is a copyright infringement and a violation of the Digital Millennium Copyright Act (DMCA).

I try very hard to make resources the best I can for students and educators. However, I’m human – so if you find any mistakes in this resource, or if you have any questions about its use, or any ideas for what you’d love to see, feel free to e-mail me at [email protected].

© 2022 – 2025 Frugal Confessions, LLC All rights reserved.”

What are the technology requirements?

You'll need:

- PowerPoint OR Google Slides

- Screen/projector

- Scissors for each student

- Calculators for each student

- Pen/paper/scratch paper

- Printouts for each student (including the Money Plan, the Warm-Up, the Cool-Down, and the survey)

- Avery Name Badges 5395 (IF you want to use the badges – optional)

Note: online versions of PowerPoint do not have the same capabilities as the full version of PowerPoint. I have not tested this on the online version yet. There is the Google Slides deck available now.

I have some students who are complete money newbies, and others who have had allowances for years. Will this program be appropriate for everyone?

This program is meant for money newbies, plus those that have been handling their money for a few years.

Why is that?

Because, quite honestly, even most adults are handling their money wrong (and they've had their hands on it for years!). There are many things your students will learn if they're more advanced, and we'll be starting from the bottom up for those who are pretty new to money.

Since it's housed in an adventure program, no one will get bored working through it, no matter which category they fall into.

Why Mt. Everest?

Because the highest mountain on earth — almost-insurmountable to all but a few — is the perfect backdrop to broaden your students' money frame of reference.

Even if the average person had the strength and endurance to summit Everest, the money that it costs ($65,000 is a typical estimate) puts it far out of reach for almost everyone.

Everyone, except those who know the secret to realizing their dreams: craft a realistic savings plan, and have the gusto to see it through.

Your kids will learn how to nail a realistic savings plan for Everest. And after learning how to do that, they'll be able to nail any savings goal they could think of.

How do I know if the kids have really learned the information?

Each simulation begins with a small test of money questions, and ends with that same test. The first test establishes a baseline money knowledge, and the second test will show us how much money information the kids have gained through the program.

We have limited time available. How long will this simulation take?

The entire simulation program from start to finish takes between 2.5-3 hours.

However, I know you're working under time constraints!

So I've developed ways to shorten the program without losing any of the quality. You can get it down to 2 hours if you have to. Plus, it's separated into four modules, so you can do it over a multi-day period if need be.

My class is really large/small. Does this work for both small and large groups?

Absolutely. There are variations built into the program depending upon a large or small group

How can we make sure to cover each of our state's money reqs or guidelines?

State money teaching requirements and guidelines vary substantially, and they also vary by grade. The program is designed to meet some of these requirements. There are also areas in the program where additional sections can easily be added to address specific state requirements, and I've added these in (such as the paycheck analyzer, rent-to-own financial lesson, credit, debt, etc.).

Are you teaching my students to climb Everest, (*ahem*) something I don't want them to do?

Don't worry. I outline all of the dangers and improbabilities a climb on Everest entails. So they'll get the full story from my end on how difficult an Everest Summit bid can be.

What if some of my students are too shy in the large group setting to actually answer questions, will they still learn?

Each child will be responsible for filling out an Everest Ground Support Team Money Plan as you all move through the simulation, with your oversight. They can also work in smaller groups on some of the money issues Erik encounters on the mountain, which will give each student a better chance of wanting to speak up.