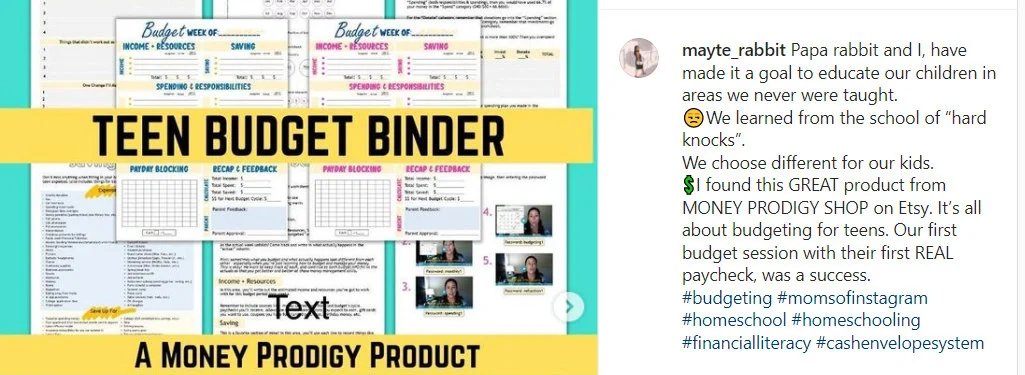

Teen Budget Binder

The toolkit and guidance your teen needs to become a pro money manager.

Trying to get your teenager to think beyond next week's allowance or paycheck?

At this stage, your teen needs to:

- Start putting a budget into real-world practice, so they're not still couch-surfing between you and a friend's in their late 20s

- Track the difference between what they DID with their money versus what they had PLANNED to do, so that they can physically see where to pay more attention

- Know what to tweak in their next budget (the foolproof way to grow their budgeting skills)

And a regular ol' teen budget worksheet is not going to get them there.

That's why I created the Teen Budget Binder − it's wayyyyy more than just a budget worksheet for teenagers.

The results are in: Parents AND teens are loving this.

Stacy Refeld (Daughters Eva, 16, and Amelia, 14):

“I bought the Teen Budget Binder to get my daughters started on budgeting for things they want to buy. I wasn't sure if they would use it, but I'm so glad I bought it anyway – my biggest surprise is finding out that my oldest daughter loves to budget now!

Looking back on one month of savings, she has already made so much progress towards her savings goals, she is more intentional with her money now, and she likes to budget. In getting started, I really found the worksheet with the percentages very helpful when guiding her through her budget. We referred back to them often. The Teen Budget Binder makes it simple for my oldest daughter to budget.”

After the Teen Budget Binder, your teen will:

- Never be caught penniless again when invited out with friends on the weekend, since thinking through upcoming expenses and income will be second nature

- Make working on their budget a go-to habit they're happy to do with their new money space (hint: their Teen Budget Binder)

- Learn to pay their responsibilities first and not need your help to pay their portion of car insurance, thanks to the quick-action Spending Plan (hint: this is different than a budget)

- Translate their budget-on-paper to the real world, a critical money habit they'll take with them to their first apartment

- Be able to audit their own budgets so that they learn how to manage their money quicker, and better

PLUS……………………………

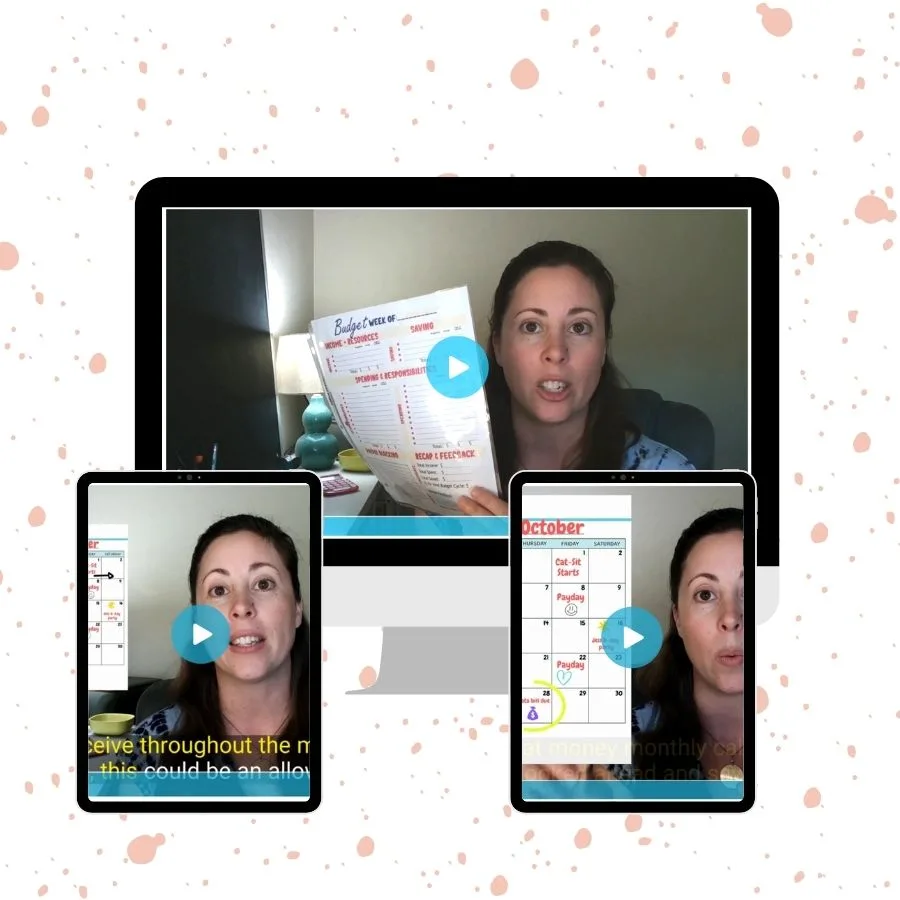

5 VIDEOS that walk them through:

- Binder Prep + Setup

- Spending Plan 101

- Money Monthly Calendar Creation

- Budgeting Worksheet Help

- Monthly Budget Reflection

(with captioning)

“The Teen Budget Binder has created a meaningful, ongoing project for my students in my transition program to practice.

It really helps them understand money management in a realistic, fun way! They understand the process of paying bills, saving for emergencies, and managing money for the things that they want to buy. They also understand that they can’t buy everything they want now. I love the ease of use, and how well-organized it is. – Melissa, Transition Teacher

Note: This is a digital product. You'll be given a link to download to enjoy immediately after purchase! Worksheets need to be printed out for your teen to use.

Working through this guided teen budget binder will help normalize money in their everyday life.

- They'll start planning how to use that birthday money windfall they get each year, instead of blowing through it one weekend at the local arcade

- They'll learn how to create their next budget and measure if it actually lines up with what they want most (plus how to tweak things mid-week in case their desires change on a whim)

- They'll learn the easy way to track their spending so that they'll never whine-ask you again “where did all my money go?!?”

- They'll learn how to put new budgeting skills into practice for the following week

Did I mention there's a bonus (worth $4.97)?

To make budgeting go even easier, your teen will get a set of printable teen money envelopes so they'll physically see where all of their money is going (and they can make a decision of where to spend less to make up for it).

(hint: there's enough designs that they'll find one or two they like)

You know teaching your kids and teens about money is very important (and the school system is not getting it done). I'm here to help.

I'm Amanda L. Grossman, a Certified Financial Education Instructor, winner of the 2017 Plutus Foundation Grant to create a kid money program (the Mt. Everest Money Simulation: A Kid's Educational Adventure), and a 13-year personal finance blogger.

Not only do I feel qualified to help you teach your kid(dos) and teens how to earn, save, and manage their money, but I darn well looooooovvvve these subjects.

Here's more about me.

Can you imagine how proud you'll feel when your teen divvies up their paycheck (semi-)responsibly…and they still have enough to buy something they want?

FAQs

1. I've tried to get my teen to budget in the past, but they don't listen to me. Why will they use this instead?

I hear ya on this one.

In fact, Stacy Refeld had the same hesitation before she purchased the Teen Budget Binder for her daughters, aged 16 and 14.

She said:

“I bought the Teen Budget Binder to get my daughters started on budgeting for things they want to buy. I wasn't sure if they would use it, but I'm so glad I bought it anyway – my biggest surprise is finding out that my oldest daughter loves to budget now! Looking back on one month of savings, she has already made so much progress towards her savings goals, she is more intentional with her money now, and she likes to budget. In getting started, I really found the worksheet with the percentages very helpful when guiding her through her budget. We referred back to them often. The Teen Budget Binder makes it simple for my oldest daughter to budget.”

Here's how I set this budget binder up to motivate and inspire your teen into action:

- It's sophisticated enough that they feel they're being treated like an adult, but the colors and design scream “THIS IS SO COOL”

- It's centered around what YOUR teen wants to accomplish with their money (internal motivation), but with parent approval signature boxes scattered throughout

- It covers some sticky teen money situations that'll help them work through what's held them back (like, how to get a job when they don't drive)

2. Am I going to get stuff in the mail?

No. This is a digital product that you print out. I've got a video (plus written instructions) that walks you + your teen through how to print this out and set it up into a year-long budgeting binder.

3. Will my teen actually be able to budget using this? I don't know what they do and do not know.

Great question − and one I've given considerable thought to while creating this.

I want teens from every skill and capability level to be able to pick up this Teen Budget Binder, excitedly work through it, and learn how to budget (plus how to master budgeting).

That's why I've:

- Written it with basic budgeting instructions at a teen-level, and then included ways to improve and flex those budgeting muscles from there so that the product grows with them as they enter young adulthood + beyond

- Given examples for the calculations I ask your teen to do, so that they can follow along

- Included examples of things to celebrate and things to improve upon, so that they're not aimlessly scrolling through Instagram when they're supposed to be auditing how last week's budget went

4. Do we need to buy anything else to use this product?

You'll need to print out the pages (either using your own ink, or the copy shop's), and you'll need a binder. I suggest a really fun binder that'll get your teen's interest; but in a pinch, any ol' binder will work.

Also, a two-three pocket binder pouch is recommended (not needed).