Do allowances help kids? Get help tackling allowance for kids, like picking your personal allowance system, and figuring out chores and allowance by age.

Allowance for kids can feel like a complicated subject.

First, there’s figuring out whether you should pay kids to do chores, or if you should give kids an allowance without chores tied to it.

And if you DO decide to pay for chores, you then have to figure things out like:

- how much should you pay your child for chores (juggling their age, responsibilities, etc.)

- chore oversight

- chore lists

Then there's figuring out how much to pay your child, and finally, how to actually give your child the money (a kids' allowance app? cash only?).

It's enough to make you want to pull your hair out.

That's why I'm going to help guide you through each of these decisions. At the end of this, you'll be able to pick out the right allowance system for your child, and for your family.

Not to mention, understand better how to tweak your system as they age (which is kinda important, considering kids tend to grow and change a lot!).

How to Pick Your Allowance Method

I want you to knock teaching your child financial responsibility out of Minute-Maid-Park (any Houstonians here?)!

To do that, you need an entire system that ties in the money goals you have for your child into its very design.

That way, kids can self-discover the critical money lessons you want them to.

Instead of just picking out an allowance method (which we'll do in just a moment), I want you to think about your child's allowance as one part of an overall system.

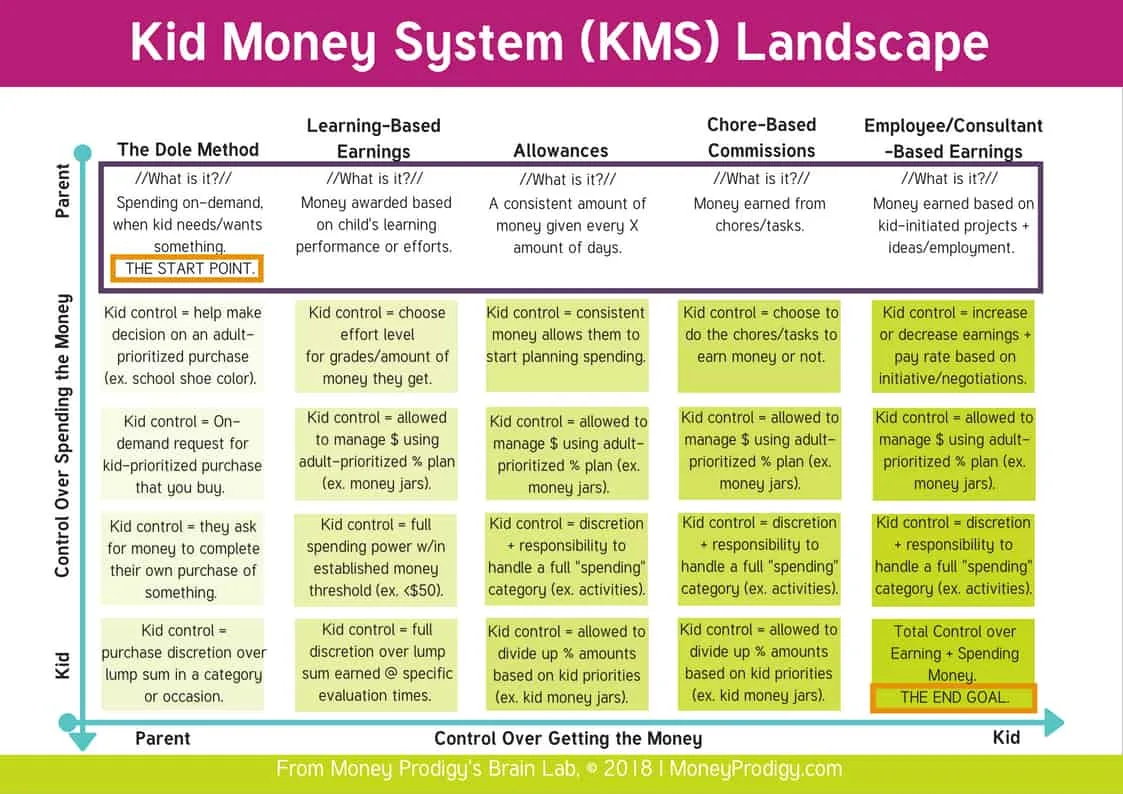

What I like to call your Kid Money System (KMS).

Kid Money System = your system-by-design that gets money into your kid’s hands so that they can enter the money-management learning cycle (decision-consequence-tweak-try again) where they self-discover the money goals + lessons you have for them.

It’s basically how you get money into your child’s hands, + the responsibilities you hand over to them so that your child can learn to manage money before they get their hands on a real paycheck from a job-job.

First up is to get the money into your child's hands.

There are 5 primary allowance methods to do that:

- Allowance: A consistent amount of money given to a child every X number of days or weeks.

- Chore-based commissions: Money paid to a child based on tasks performed by them.

- Learning-based earnings: Money paid to a child based on learning performance or academic efforts.

- Employer-based earnings: Money paid to a child based on kid-initiated projects, or employment.

- The Dole Method: Giving money to a child on demand, when they ask, and when you feel like it.

And within each of these methods to get money into your child's hands? Are varying amounts of control given to the child, and retained by the parents for both how the money is given, and how the money is spent.

Check out this chart I created to see what I mean (you can share this, just please give credit to MoneyProdigy.com):

Next up? Let's help you choose how much to pay your child.

How Much Allowance Should I Give My Child?

You've thought about the allowance method you want to try, or you may have already decided. Now, how much money should you give your child come “payday”?

I’m going to give you the average allowance for kids, or the “going rate”, so that you have some guidelines to go by.

But first, I want to tell you that:

When it comes to figuring out how much money to give your child for allowance, you should keep your eyes on your own paper.

What do I mean by this?

Many parents look to other parents to see how much they’re paying their kids, or to gurus (the most common advice is “give them $1 for every year they've been alive”).

But doing those two things will not account for two other very important considerations that influence the amount you should give:

- Money responsibilities they'll need to pay for out of their allowance

- The spending power that allowance will give your child

For example: 10-year-old Liam’s parents might be giving him $20/week in allowance, but expect him to pay his lunch bill out of this amount. And if you give your child $20/week from overhearing this from his mother, but haven’t passed on the same money responsibility to your own child, then your child would be getting a lot more spending power than Liam to burn through.

Maybe you want your child to have more spending power, OR, maybe you'd rather they didn't. But if you just go off of what other parents and gurus are telling you? Then you can't really adjust for what you want.

Here's what I consider to be the BETTER way to figure out how much allowance money to give your child:

- Get a Peer Range: Look at the average allowance given to other children their age (see below), plus informally ask around and see how much your child's friends get in allowance. This will give you a bit of a reference point.

- Calculate What that Money Means to Your Child (Spending Power): What does your child normally buy with an allowance, and what do they want to buy with their allowance (i.e., a possible savings goal)? Find out about what these things cost. This gives you an idea of the spending power they would have with the amount you're thinking about giving them. In my article on how much allowance should I give my child, I go more into depth about how important this step is.

- Figure Out Your Child's Money Responsibilities, if Any: What money responsibilities are you going to give your child alongside this allowance? In other words, what do they need to pay for out of their allowance? You want to account for this and make sure they'll have enough to cover it.

After going through all that, you want to then come to your own conclusion about how much allowance money to give you child.

Alright, all that aside, I want to give you some guidance to help (as a Mama, I know I like getting guidance!).

It turns out that the average going rate for an allowance is $8.74/week.

This was found after polling 10,000 parents of kids aged 4-14, across the U.S.

By age? Here's how the average allowance by age pans out (from a 2017 RoosterMoney.com study):

| Age | Average Allowance Amount (Per Week) |

| 4 | $3.97 |

| 5 | $4.89 |

| 6 | $5.81 |

| 7 | $7.30 |

| 8 | $7.66 |

| 9 | $8.20 |

| 10 | $9.00 |

| 11 | $10.10 |

| 12 | $10.96 |

| 13 | $12.10 |

| 14 | $13.34 |

And if you want chore prices? Here are a few articles to help with that:

- How Much to Pay Kids for Chores – Chore Pay Scale

- Printable Chore Chart with Money

- Should Kids get Paid to Do Chores? Pros and Cons.

- Age Appropriate Chores for Kids

- 19 Summer Jobs for Kids

Speaking of age and allowance amounts…when exactly should you start giving your child an allowance?

When Should You Start Giving Your Child an Allowance?

There’s actual research that shows kids are capable of learning how to save money around the age of 5.

But they can't really express the saving-money money behavior if they don't have any, right?

I'm just throwing this out there in case you're reading this and your child is still young and you're wondering if it's too early to start an allowance.

If you have an older child? No guilt trip here. Start anyway. Start today. Tomorrow by the latest.

The earlier you can start, the better.

Here's how to give your child an allowance.

Considering a Kids' Allowance App? My Reviews.

We've discussed your allowance method as well as how much you'll want to pay your child.

Next up, let's look at a few kids' allowance apps that you can use to manage your allowance payments.

An allowance app for kids can help organize your allowance system, provide a way to give oversight on tasks or chores, and you can even pay your child through the apps (some come with prepaid debit cards, and some without).

Articles to check out about specific apps to help:

- Best Allowance Apps for Kids

- Greenlight Vs. Famzoo prepaid debit card with app

- Greenlight Vs. gohenry prepaid debit card with app

One last thing I'd like to discuss with you…do allowances actually help kids to learn money management?

Do Allowances Help Kids Learn Money Management? It Depends.

You read that right, Mama Bear.

Because just giving children an allowance alone − whether from earning it through chores, projects, or handing it over − is not a money lesson that will make your child financially savvier than kids who never received an allowance at all.

And I'm not just saying that to grab your attention by scratching cross-grain.

There's real research to back it up.

Kids' allowance is not enough to teach money management (even if you pair it with one of those give, save, spend piggy banks).

The study where this information originally came from was by Professor Lewis Mandell, who looked through all of the allowance studies from the last 50 years and found a really crazy outcome: kids who received an allowance were actually LESS financially savvy than kids who did not.

EXCEPT − and this is a B.I.G. exception − when parents gave a child allowance + talked with their kids about managing their new money.

Now THOSE were the kids who moved ahead in money-savviness.

Kinda shocking research, right?

I mean, before pouring through a Library of Congress-sized room of research, I would've thought that kids who received an allowance would be about three rungs up on the ladder from kids who never got to touch the green stuff.

And in case you’re questioning the information, know that T. Rowe Price found something similarly convincing about the importance of money conversations on top of allowances in their 2014 Kids & Money Survey.

According to their results, Teachable Money Moments are über important.

Having said all that, an allowance can be one of the best ways to teach your kids about money. That is, as long as you have an allowance system + pair it with regular money conversations.

Feeling a bit more equipped to set up or tweak your current allowance for kids system? I hope so! Just remember – start somewhere. The tweaks and changes you'll need to make usually become apparent when you take action and see the day-to-day with it. Also, check out these examples of real allowance systems by parents, just like you.

Amanda L. Grossman

Latest posts by Amanda L. Grossman (see all)

- 50 Banking Activities for Kids (Student Financial Literacy) - February 14, 2024

- 14 Christmas Activities for High School Students (they’ll Actually Find Cool) - December 1, 2023

- 3 Fun Selfie Scavenger Hunts for Teens (Christmas, Fin Lit, etc.) - November 27, 2023