Has your child ever wasted their money on stuff they stopped playing with before the refund period has even ended?

It's a pretty normal thing for kids to do. Yet, it makes you wonder if your child is learning any skills at all by being allowed to spend their money.

At this stage in the learning-to-manage-money game, your kid needs to start:

- Looking at their money as one pile, instead of a $5 bill here, some $1's there, and a $10 crumpled up in the corner of their room.

- Separating the thought to spend money from the actual transaction (I see you, checkout toy section).

- Prioritizing one thing over another thing.

Don't worry if they're not even close to this.

That's where The Kid Budget Sprint comes in – a system for teaching your child scalable budgeting skills.

Note: This is a digital product. You'll be given a link to download to enjoy immediately after purchase! Worksheets need to be printed out for you to use.

Budgeting skills are scalable.

If you learn to budget with a small amount, then you’ll know how to budget when you have a large amount. The amount is irrelevant.

Just imagine where your child will be by their 20s just by learning some of these skills now!

After the Kid Budget Sprint, your child will:

- Learn to plan their spending out up to a week at a time, so that they're not caught penniless again at an important event (after spending everything days before).

- Prioritize spending on one thing over another, so that they stop spending it all on impulse at the grocery store checkout aisle.

- Understand how to read receipts so that they can track their spending.

- Learn to look at their money as a whole, so that they can do cool things like pick up on spending patterns and increase their spending power.

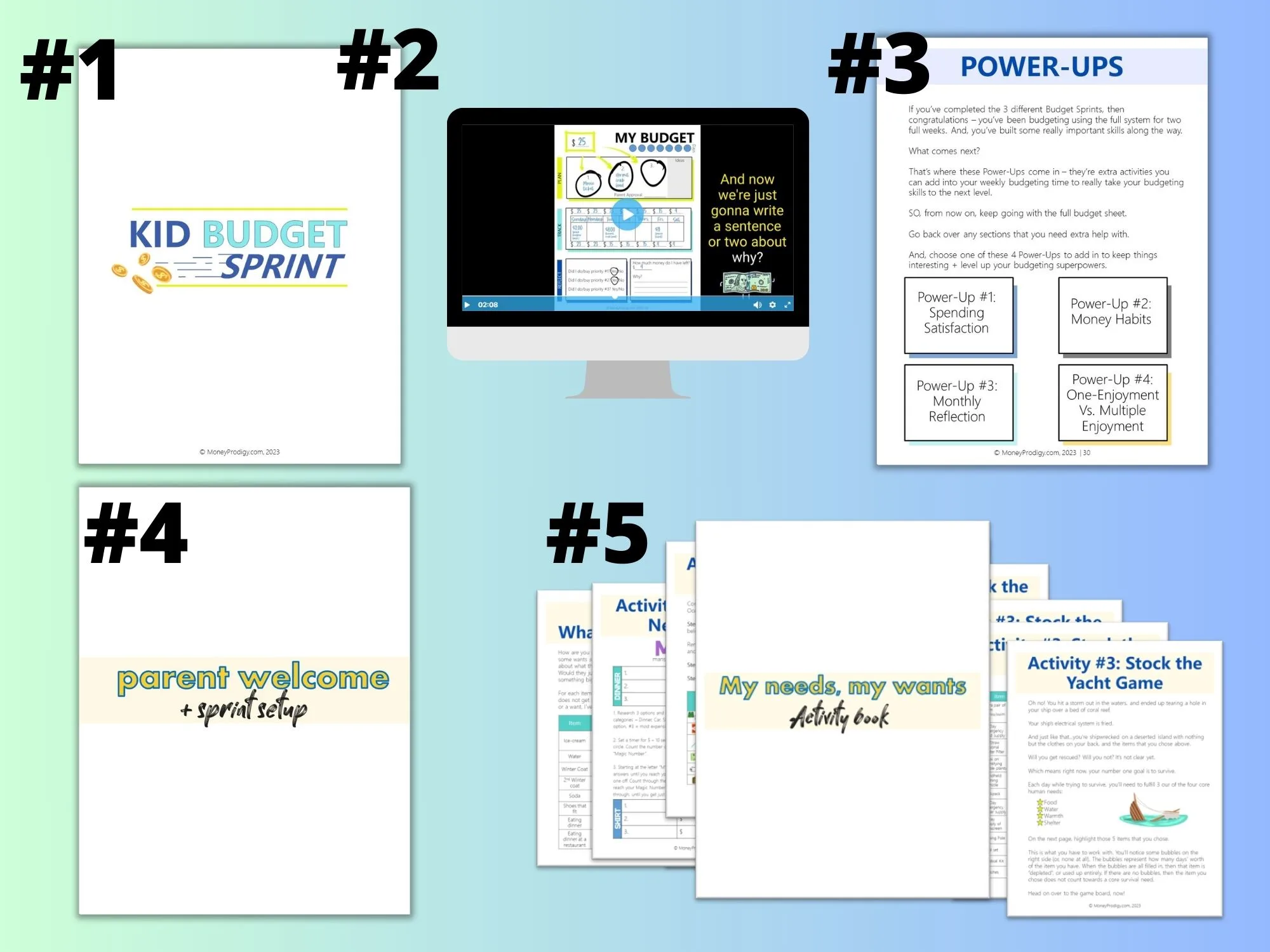

There's even 5 Video Walkthroughs covering:

- Kid Welcome + Intro to the Budget Process

- Parent Welcome + Budget Sprint Setup

- Budget Sprint #1: Plan

- Budget Sprint #2: Track

- Budget Sprint #3: Reflect

None of this is possible with a regular budget worksheet.

A regular ol' budget worksheet is not going to work.

Most budget worksheets offer the same:

- A list to fill in “income”

- A spot to fill in “expenses”

- A column for some simple math to make sure everything works out

And that’s it…

It's too complicated for kids. It doesn't relate to their life.

It doesn't break down each part of a budget to make it easily understandable so that your child can start to get some of those really, really, important budgeting skills that scale.

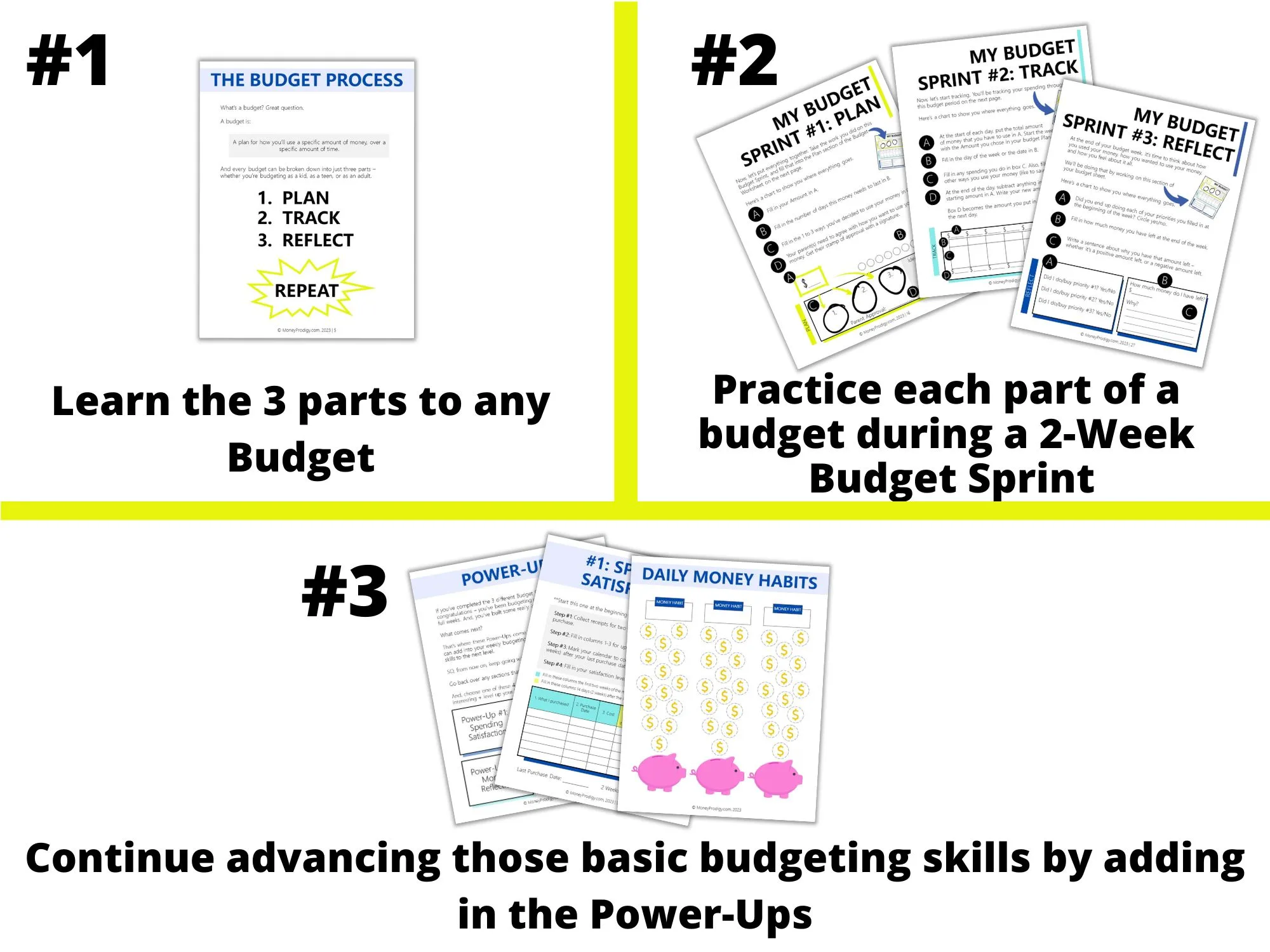

The Kid Budget Sprint is Different. Here's how it works:

PLAN

TRACK

REFLECT

- Learn the 3 parts of a Budget: Plan, Track, and Reflect.

- Practice each part of a budget during a 2-Week Budget Sprint that deep-dives into how to do it.

- Continue building on those basic budgeting skills by adding in “Power-Ups” (such as Daily and Weekly Money Habits)

Working through this system will help your child become more aware of their spending, prep them for saving money, and help them to prioritize one thing over another.

And you can bet those are skills they'll need as a young adult managing their first apartment and first paycheck.

Did I mention there's a Bonus?

I am GIDDY with excitement about this bonus.

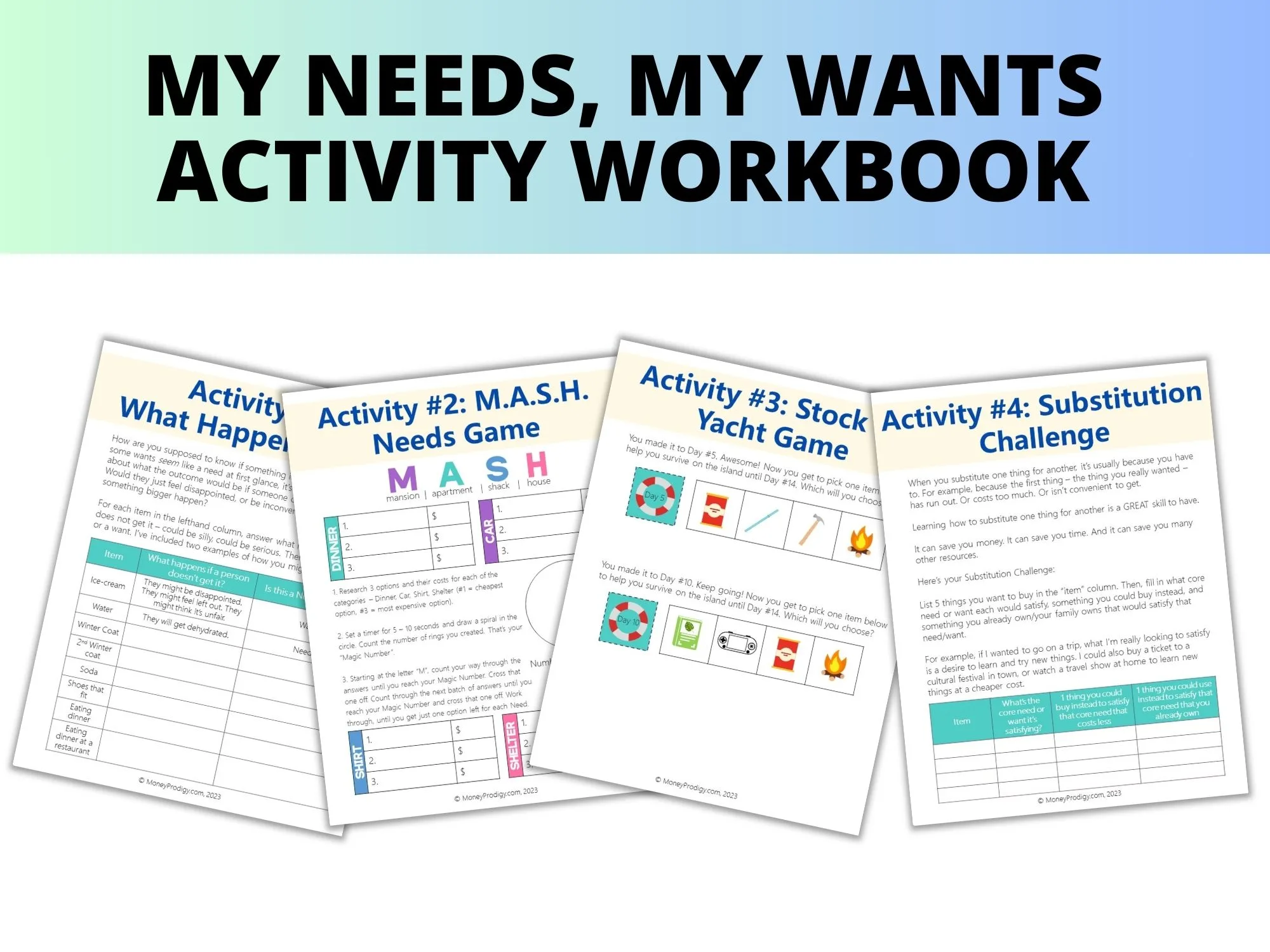

Because one of the things I hear from almost every parent I've ever talked to is their child doesn't understand needs vs. wants.

Your kids will explore needs vs. wants in the following activities:

- What Happens Now

- M.A.S.H. Needs Game

- Stock the Yacht Game

- Substitution Challenge

Note: This is a digital product. You'll be given a link to download to enjoy immediately after purchase! Worksheets need to be printed out for you to use.

What's Included:

- Kid Budget Sprint Workbook

- 5 Walkthrough Videos

- Budget Power-Ups (4 activities to advance your child's budgeting skills)

- Parent Welcome + Sprint Setup

- Bonus: My Needs, My Wants Activity workbook

Note: This is a digital product. You'll be given a link to download to enjoy immediately after purchase! Worksheets need to be printed out for you to use.

You know teaching your kids and teens about money is very important. I'm here to help.

I'm Amanda L. Grossman, a Certified Financial Education Instructor, winner of the 2017 Plutus Foundation Grant to create a kid money program (the Mt. Everest Money Simulation: A Kid's Educational Adventure), and a 13-year personal finance blogger.

Not only do I feel qualified to help you teach your kid(dos) and teens how to earn, save, and manage their money, but I darn well looooooovvvve these subjects.

Here's more about me.

Ready for your child to start using their money more confidently, and for you to feel like you're teaching them all those important money life skills you thought you always would?

FAQs

1. Am I going to get stuff in the mail?

No. This is a digital product that you print out. You'll need to print out the worksheets for your kid(s) to work through.

2. What age is this for?

I hesitate to put an age on things, because it's more about capability. BUT, I'll suggest between the ages of 8-13 to give you an idea.

3. Do we need to buy anything else to use this product?

Not much at all.

You'll need to print out the pages (either using your own ink, or the copy shop's), and you'll need a binder. I suggest a really fun binder that'll get your child's interest; but in a pinch, any ol' binder will work.

Also, a two-three pocket binder pouch is recommended (not needed).

4. What do I get again?

- Kid Budget Sprint Workbook

- Budget Power-Ups (4 activities to advance your child's budgeting skills)

- Parent Welcome + Sprint Setup

- 5 Videos to help guide them through the Budget Sprints + Setup

- Bonus: My Needs, My Wants Activity workbook