How do I teach my kindergartener about money? I read him these books about money for kindergarten AND give him an allowance.

How do I teach my kindergartner about money?

We personally use an allowance + these books about money for kindergarten to give our 6-year-old a great foundation in financial literacy.

In fact, a pro tip is to actually read them one of these books about money on the same day as they get their allowance or chore commissions.

I’ve paired allowance day and reading a money book with my own son and it's worked really well.

Why?

I’ve found that it teaches him about something that he can do with his money. And since he then gets money either right before we read, or right after, I can see his mind working in ways that it wouldn’t have otherwise.

It’s an easy and powerful duo.

Books about Money for Kindergarten

Check out these picture books about money that we read to our own kindergartener.

Hint: you could pair these with free money worksheets for kindergarten.

Money Book #1: Alexander, Who Used to Be Rich Last Sunday

Ages: 4-8 years

You remember Alexander, the kid who had that terrible, horrible, no-good day?

Well, the poor guy can’t catch a break.

In this book your child will see that Alexander used to be rich (and by rich, he means he used to have $1 his grandparents gave him) until he spent his money a bit foolishly. Honestly, what barely-out-of-a-car-seat-kid wouldn’t?

The biggest money lesson is that while there are always “opportunities” to buy things with your money, sometimes, they’re not good ones.

Great children's book about money management.

Money Book #2: Carnival Thrills and Dollar Bills: A Book about U.S. Currency

Ages: 1st-3rd grade

Okay…so I know this says 1st – 3rd grade, but I’m using this book with my own Kindergartener and we’re getting a lot from it.

And did I mention that it’s free?

This rhythming adventure has a group of furry friends earn money with their lemonade stand and then work through spending it at the local Carnival.

Kindergarteners are taught things like:

- You need to pay money to get into a Carnival

- Bills are made out of cotton and linen (not paper)

- Bills have lots of different symbols on them

In general – you’ll find your students and kids will get excited about looking at dollar bills.

Score your own copy here (they even deliver it to you for free).

While we’re talking about currency…

Money Book #3: Follow the Money

Ages: 4-8 years

Use this book to introduce your kindergarteners to where the money comes from and what happens to it after it leaves someone’s hands.

George is a newly minted quarter that gets used in a variety of ways. This book will give your child a great overview of money circulation + different ways that money can be used (like in a vending machine or as a donation).

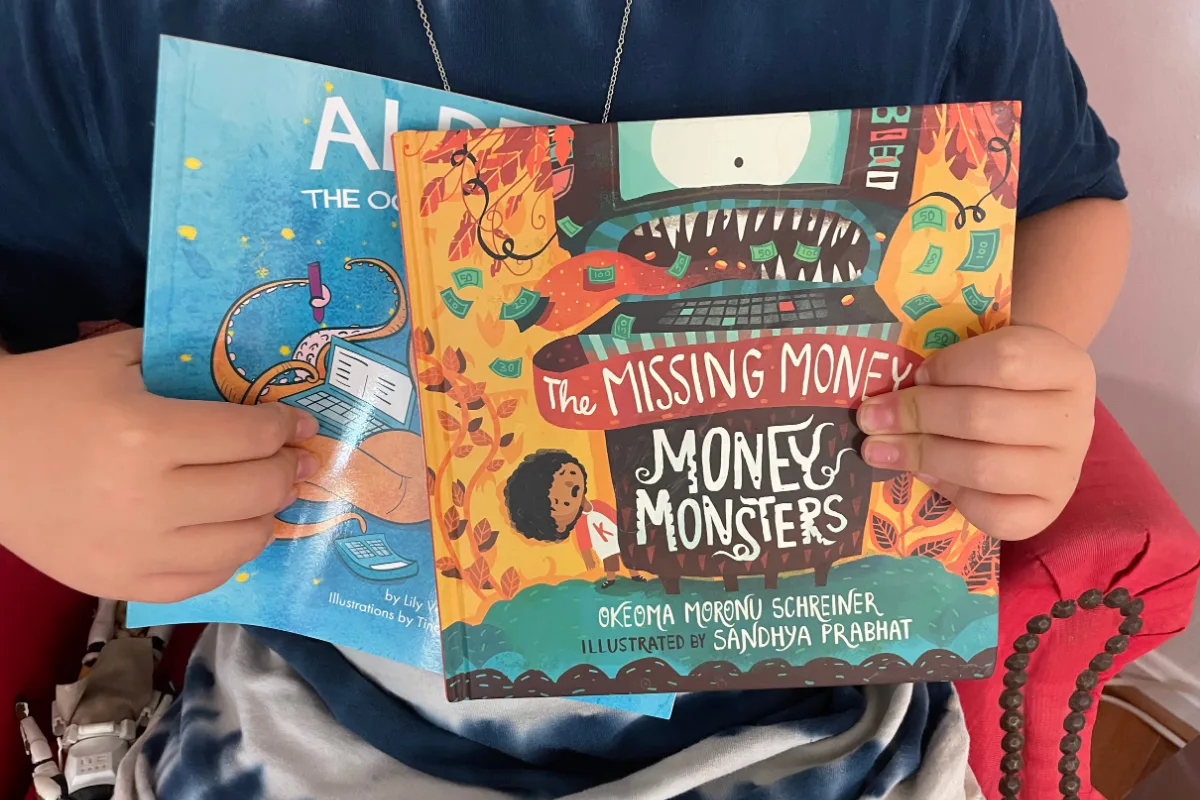

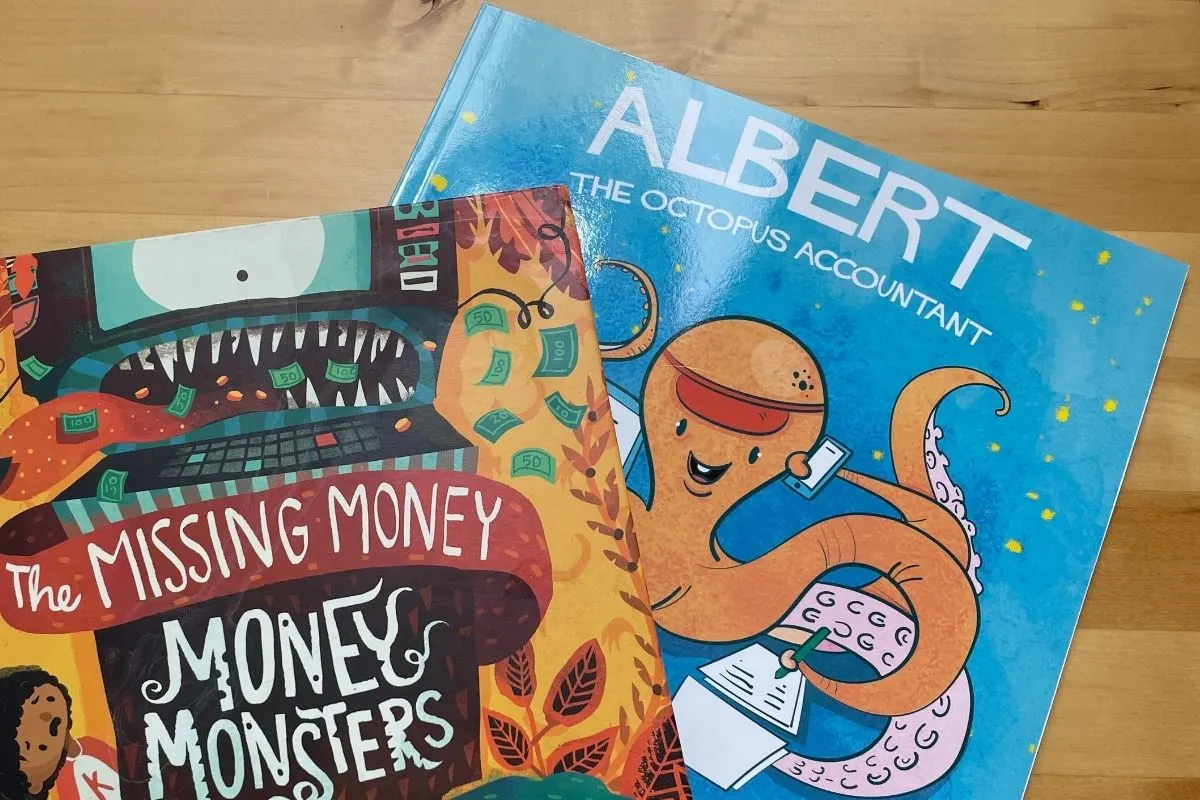

Money Book #4: The Missing Money Monsters

Ages: 3-6 years

This was a super-cute way to introduce our kindergartener to ATMs (aka, the Money Monster).

Little Kai starts to worry about the Chinese New Year money he received and deposited into his bank account.

Kai's parents talk him through how safe an ATM is, and how an armored truck takes his money from there to the bank, and how he can check up on his money at any time using a banking app.

When we’ve been out and about, I’ve pointed out ATMs to him and I could see the connection in his mind between this book and a real-life ATM.

Money Book #5: Albert the Octopus Accountant

Ages: 3-5 years

Here’s a way to introduce lots of bigger money concepts.

Things like:

- Things in their life that cost money, like clothes, food, holiday gifts parents give them, etc.

- Money is earned by working, and there are all different kinds of jobs

- Different forms of money

- Saving up for something

The illustrations are very vibrant and engaging – this is a great way to start connecting your kindergartner's world with money.

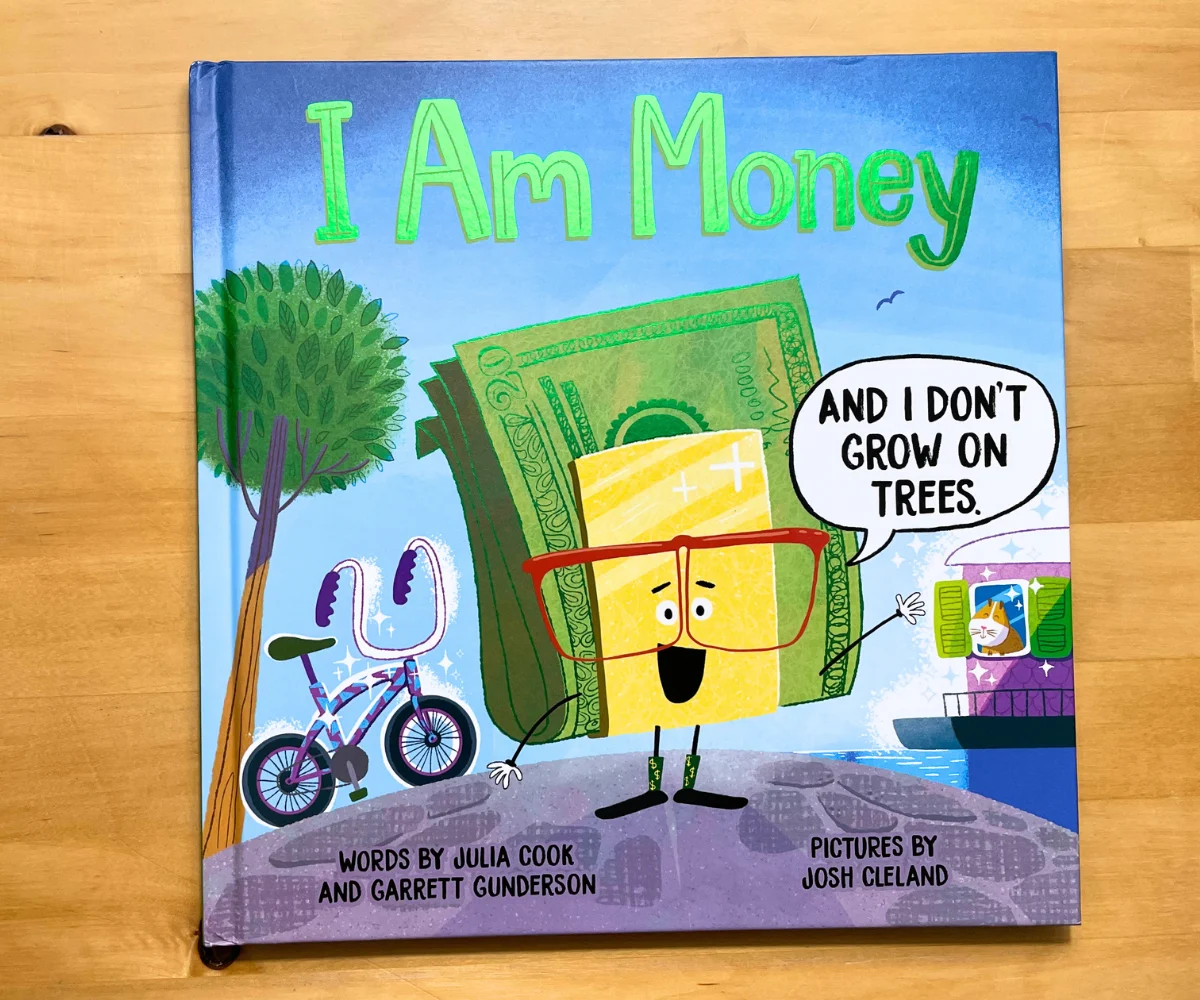

Money Book #6: I Am Money

Ages: 4-8 years

This is a beautifully illustrated book that touches on some valuable money lessons:

- Money wears lots of different outfits (like coins, currencies, cryptocurrency, credit cards/plastic, etc.)

- There are four basic things you can do with money (earn, save, spend, give)

- Investing in yourself is the most important way to invest your money

- etc.

I think some one-liners in here can be great conversation starters, such as how covering the basics can make you happy, but that money can't make a person happier. And how using plastic can increase spending.

A fun read!

Money Book #7: Bunny Money

Ages: 3-5 years

Bunnies Ruby and Max have saved up their own money to buy the perfect birthday gift for their grandmother: a beautiful music box with skating ballerinas.

At the store, they’re tempted to buy something else with their money (sounds familiar, right?). Not only that, but they didn’t research the cost ahead of time and so don’t have enough money to buy the gift.

They end up making a pretty bad spending decision − purchasing glow-in-the-dark vampire fangs that cost them their bus ride fare home. In the end, they spend their last $0.25 calling their grandmother to come and pick them up.

Money Book #8: Those Shoes

Ages: 5-8 years

I love how this book addresses a very sensitive (but important) subject in some students’ lives: wanting to buy something that their family cannot afford because they think it’ll make them fit in better.

A boy gets transfixed by the newest trend of shoes at his school. His jealousy is palpable. Unfortunately, his grandmother can only afford to get him the shoes that he needs − winter boots.

Even worse, his own “everyday” shoes fall apart at school. A helpful guidance counselor gives him a pair to have, but they’re what’s considered “baby” shoes and he gets embarrassed.

What happens? He finds that the one boy who didn’t laugh at his “baby” shoes actually was worse off than him. When he actually finds the shoes of his dreams − albeit one size too small − from a thrift store, he ends up gifting them to this other boy.

Money Book #9: Jenny Found a Penny

Ages: 5+ years

Jenny has her eyes set on something and she needs a whole dollar to get it.

She finds all the pennies, nickels, dimes, and quarters she can. She also earns a dime from sweeping her grandfather’s porch and sidewalk − this is one determined gal!

Unfortunately, she’s thrown for a loop at the cash register when she learns that not only does she have to save up for what she wants to buy, but also for the sales tax that is assessed on it.

An important lesson to teach kindergarten students.

Money Book #10: Splat the Cat and the Lemonade Stand

Ages: 4-8 years

Summer break is approaching, and when the teacher asks everyone what their summer plans are, Splat the Cat says he needs to earn enough money to pay for half his ticket to the Super Jumbo Water Park.

He comes up with the idea to do a lemonade stand, and his buddy steals the idea – they end up competing against one another on opposite sides of the street.

That is, until they figure out it’s better to work together.

Money Book #11: Lemonade in Winter: A Book About Two Kids Counting Money

Ages: 4-8 years

What’s one of the first rules of creating a product? Give the people what they want. And really, when they want it. Timing is everything.

As in, who wants to buy a cup of icy lemonade in winter (when these two decide to open up their lemonade stand)?

Another entrepreneur reality these two learn the hard way: you don’t make a profit if you spend as much money to make the product as you bring in selling the product.

Money Book #12: Berenstain Bears’ Lemonade Stand

Ages: 4-8 years

When Mailbear Bob comes by and offers to pay Brother and Sister Bear $0.25 for a glass of lemonade…their eyes get big.

They set up a small lemonade stand, and suddenly find themselves a steady stream of customers.

Soon, there’s a big block party centered around their stand. It’s a good summer day!

Money Book #13: Apple Farmer Annie

Ages: 3-7 years

I grew up on a small dairy farm, and get exhausted just thinking back to my cow-milking, hay-making, silo-filling days.

What I like about this book is that your child will start to get an idea of the process involved in farming and turning it into an end product − dipping their toes in entrepreneurship.

Annie, an orchard farmer, takes your child through (though in a really cursory way) picking apples, sorting them, producing sweet apple cider, applesauce, various baked goods, and then selling the most beautiful of all of them at the farmer’s market.

Money Book #14: Pigs Will Be Pigs

Ages: 5-8 years

The Pigs Will Be Pigs series, including this book, has been designed around the National Council of Teachers of Mathematics’ Thirteen Standards.

But that’s not the fun part about this book (nor did that sound fun, right?).

This pig family has eaten through all their groceries from the morning (yes, pigs will be pigs!), and they’re hungry for a snack.

The problem?

There’s only a dollar between the lot of them. So, they go about hunting for money in all kinds of peculiar places around their home. What I like is they don’t give the dollar denominations, but just the kinds of coins found, so that your child can do the math and add things up for themselves.

They are presented with a menu with prices, so your child gets a chance at the end to figure out what else they could have bought from that menu. A very interactive book (probably not best for bedtime, as you’ll want them to break out a pencil and piece of paper to work on a few things).

Money Book #15: The Ant and the Grasshopper

Ages: 4+ years

Though this story doesn’t specifically talk about money, it certainly implants the seed that preparing for something ahead of time is best (like saving money in an emergency fund for the unexpected!).

In this particular version of the classic Aesop fable, the ants consistently, and without hesitation, prepare for the winter months while the grasshopper focuses on games + entertainment in the Chinese Emperor’s Summer Palace.

It shows that consistent (and sometimes hard) work pays off. Preparation for tough times to come − financially or otherwise − is a good idea.

Money Book #16: Once Upon a Dime: A Math Adventure

Ages: 6-9 years

Looking for books about coins for kindergarten? Here you go!

I grew up on a dairy farm in PA, so I was so happy to find this story of Farmer Truman Worth in Birdhaven Hollow.

He has this tree that grew out of nowhere, and it's quite the money tree. It produces first pennies, then nickels, then dimes, etc. as he takes better and better care of it.

The farmer eventually renames the tree his piggy bank tree (and pigs named after presidents hang out underneath it).

Money Book #17: Sluggers' Car Wash

Ages: 6-10 years

This book shows a problem − kids wanting new sports uniforms for the playoffs they're in − and the fundraiser they intend to hold to fix it (plus they hope the parents will match what they raise).

The students work through how much they'll charge ($3.50) to wash cars, keep track of the amount of money each student contributes to buy supplies, etc.

Lots of money math (especially with how to make change)!

Check back − as I find more great books about money for kindergarten, I'll add them here. In the meantime, you'll also want to check out my articles on how to teach kids about money, teaching preschoolers about money, and books about money for preschoolers.

Amanda L. Grossman

Latest posts by Amanda L. Grossman (see all)

- 50 Banking Activities for Kids (Student Financial Literacy) - February 14, 2024

- 14 Christmas Activities for High School Students (they’ll Actually Find Cool) - December 1, 2023

- 3 Fun Selfie Scavenger Hunts for Teens (Christmas, Fin Lit, etc.) - November 27, 2023