Kids and teens can get practice with the banking system with these banking activities for students.

The banking system is going to play a big role in your child's and student's money futures.

And guess what? It's changed at a faster pace in the last decade than it used to in a whole century.

Things like contactless payments, fintech apps, or even 24/7 account access weren't around when I was a child.

Digital financial literacy is a need and a must for every child, and yet, the foundations of money and banking still need to be learned first.

That's where these banking activities for kids and teens come in – to help you teach age-appropriate parts of banking they'll need to know to navigate their adult lives.

Banking Activities for Kids

First up are banking activities for kids, then high school students, and finally a section on banking lesson plans.

1. Comparing Places to Save Money

Age Range: Grades K-5th

Students will learn about the difference between saving money at home and saving money in a bank or credit union through activities like acting out savings stories, going over vocabulary words, and answering questions about financial product images.

2. Junior Banker Store Tour

Age Range: Grades elementary and middle school

Do you have a TD Bank in your area? You can request a Junior Banker tour to show your students banking up close.

3. Break the Bank Game

Age Range: Grades elementary and middle school

This is a free online game where students must battle the blue pigs from Mr. Boar's Payday Loan company to save the bank.

They can do the following:

- Move and Attack

- Buy New Hammers (to attack Mr. Boar's pigs)

- Buy New Pigs

- Get Attacked

- Pay Down Debt

Banking Activities for High School Students

1. Banking Fact or Fiction Game

Age Range: Grades 9-12

There are some common myths lingering around about banks and credit unions, and this game offers an opportunity to not only get your students up and moving, but to separate fact from fiction.

You'll read out the statement, and then students need to walk over to one side of the room (the “fact” side), or the “fiction” side.

I love how one of the first fiction statements addresses something I used to think as a kid, too: “Banks and credit unions are part of the government”.

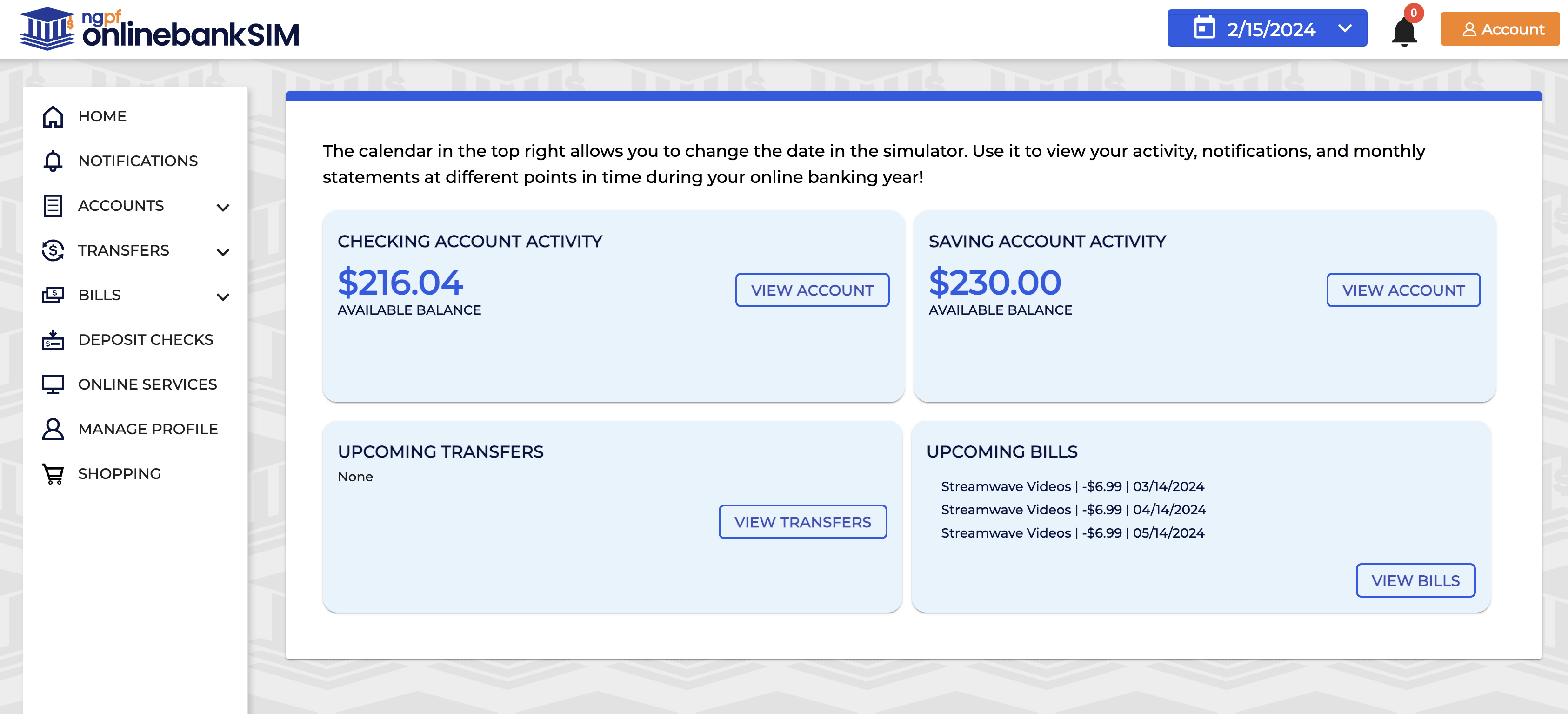

2. Online Bank Simulator

Age Range: Grades 9-12

Students can get a great practice run of how digital banking works with this online bank simulator. It's a very detailed simulation, with each student starting with a $250 balance in both checking and savings.

They then must navigate to their online bank (the simulator), check up on their balances, set up direct deposit, buy a tank of gas, pay bills, etc., and answer questions about the state of their accounts.

It's a really great banking activity.

3. Banking Products and Services Card Game

Age Range: Grades 9-12

Here's a very simple card game you can play with a whole high school classroom or in groups that goes over different banking products and services.

4. Getting Banked Research Project

Age Range: Grades 9-12

There are lots of differences between a bank and a credit union, and I know I didn't understand that as a teen.

As a class, you'll review some key banking terms. Then you task your students with choosing a local bank or credit union to research (either in person or online) using a guided worksheet.

How Banks Work – Teaching Banking to Elementary and Middle School Students

No matter how much the banking system evolves between now and when your students are old enough to navigate it on their own, the basics will always remain the same.

This section offers lesson plans that teach those banking basics, with lesson plans broken down by grade level.

Turns out, banks, themselves, are great resources for creating and giving away banking lessons teachers and parents can use.

Psst: just looking for worksheets? Here's my list of free banking worksheet PDFs.

1. FDIC's Money Smart for Young Adults Lesson Plans

Age Range: Grades Pre-K through 12

The FDIC offers free videos, lesson plans, real-life exercises, teacher slides, and teaching banking worksheets.

Not every lesson is centered around banking, but you'll find the following to teach students about banks:

- Grades Pre-K – 2: Lesson one goes over currency, counting money, the history of money, and things like that. Lesson 6 covers borrowing and lending.

- Grades 3-5: Lesson 4 explains what banks are and what interest does and discusses the benefits of saving money in a bank. Lesson 5 goes over the differences between credit and debit.

- Grades 6-8: Lesson 7 covers a variety of banking and savings options, the benefits of why you'd want to create a savings account, and understanding compound interest.

- Grades 9-12: Lesson 4 covers compound interest, how to research bank savings products, and explains how savings interest is computed. Lesson 5 has students analyzing differences between financial institutions explaining the difference between checking and savings accounts, and explaining the benefits of FDIC-insured accounts.

2. Wells Fargo's Hands-On Banking Guide for Teachers

Age Range: Grades 4-12

Wells Fargo offers this 92-page guide on teaching kids about banking for teachers (parents, included!) all about the You and Your Money – Introduction course for students and kids. Worksheets are included!

Hint: Be sure to look at the intro page, where it tells you how to get a free CD-ROM of the program for your classrooms.

- Here's the kid online version of You and Your Money – Introduction.

- Here's the teen online version of You and Your Money – Introduction.

3. TD Bank's Wow! Zone

Age Range: Grades K-12

This is actually a comprehensive financial education program, but it has banking components you can use to teach your students and kids about banking.

Notable Banking Lessons:

- Grades 2-3: The History of Banking and Savings, and Checking Accounts and Alternative Banking Methods.

- Grades 4-5: Check it Out! and Intro to Credit.

- Grades 6-8: Checking Accounts and Alternative Banking Methods.

- Grades 9-12: Checking Accounts and Alternative Banking Methods.

Bonus Tip: If you live in one of the following areas, then you can ask for a TD Bank volunteer to come teach some of this to your class! Connecticut, Delaware, D.C., Florida, Maine, Maryland, Massachusetts, New Hampshire, New Jersey, New York, North Carolina (Wilmington & Hampstead), Eastern Pennsylvania, Rhode Island, South Carolina, Vermont and Virginia.

4. American Bankers Association's Teach Children to Save Program

Age Range: Grades K-8

The ABA Foundation has a program to help teach kids how to save money, with some specific banking lessons in it.

Bankers sign up for this program, and you can find participating banks near you, here.

5. ConsumerFinance.gov's Banking Card Game

Age Range: Grades 9-12

Students will learn some common banking financial terms they need to become familiar with before they become adults, in a fun, team-based game.

Banking concepts include:

- Bill-payment service

- Mobile banking

- Money transfer

- Certificate of Deposit

- Online banking

- Credit builder loan

- etc.

6. Stash101

Age range: Not given.

One of the offerings with a free Stash101 educator account is an interactive, banking simulation you can take your students through. It includes checking, savings, and credit card simulations.

Not only that, but they have transaction simulations that include:

- Automated paychecks

- Automated bills

- Digital checks

- Wire transfers

7. NeoK12's Banking for Kids Program

Age Range: Grades 6-12

You can find 18 videos on topics such as:

- What is Money?

- Money Creation

- A Brief History of U.S. Money

- The Fed and Money Creation

- Understanding Money and Banking

- Etc.

8. InCharge.org's Financial Literacy for High School Students

Age Range: Grades 9-12

You'll get a teacher's guide and a student guide for each of the lessons. Specific banking lesson plans include Lesson 6, which is all about banking services, Lesson 7, which is all about credit, and Lesson 9, which is about financing a car loan.

They'll ultimately need to decide on whether or not it's a good banking institution for them.

How to “Normalize” Banking for Kids (At Home)

One of the ways to teach banking for kids is to normalize the banking process to them, such as lessons on banking careers, money recognition, and interest.

I mean, up to this point, they’ve likely gotten used to putting coins and dollars into a money jar. Perhaps they keep some of their dollars in a wallet or a purse.

But the bank? It’s probably just a place where they see their money disappear to – a few times a year, at that.

Banking is going to become a big part of their lives as they get older. So, let’s talk about family finances, particularly how to establish a family banking day to help them establish their own healthy banking habits.

What is a Family Banking Day?

Everyone needs to go to the bank, at some point.

It might not be often – thank goodness for things like direct deposit!

But at some point, you’ll need something. In fact, even though I haven’t been to the bank this entire year, last week I needed to go and get some business checks so I could pay my estimated quarterly taxes to the IRS.

It was the perfect time to take my almost-3-year-old.

What if, instead of avoiding the bank like the plague, you establish a family banking day – a day when the whole family does a little field trip on the way home from work/school and everyone takes care of their banking needs at the same time?

This would help out with several areas of teaching your kids money management skills and your teens money management skills. For starters, your kids would watch you do banking, and get comfortable with that. Not only that, but because you are consistently taking time to get to the bank and take care of things, you are showing your child that money management is a priority to you.

Secondly, your child would have more opportunities/cues to put their money into their savings account. Which means more might actually make it there.

And thirdly, it’s a fun family tradition. Maybe not every time. But anytime you can have a reason to get everyone in the same car and go on a little trip together is an opportunity to bond. That’s a win, in my book!

Different Banking Lessons to Teach them Around this Day

Doing this will naturally bring up some great teachable moments for you.

I’d like to point out several ways to use these days as money lessons for your child.

- How to Correct a Banking Mistake (and question authority, respectfully): Banking mistakes happen. And yes, I was the 13-year-old who went into a bank and showed them their mistake! Long story short: I noticed I was $93 short in my checking account when I was a teen. And there was NO WAY I had spent that money. So, I headed to the bank immediately. The banker was nice enough to sit down with me, condescendingly explaining that people – especially kids – overspend on their accounts all the time. I asked her to look again, and behold, she found that someone else’s check for $93 had mysteriously been taken out of MY account!

- Money in Savings Tends to get Spent Less than Money in Your Wallet: You might want to talk to your child about how putting money into a savings account, where it takes several days to move it to checking and get to it, means the money doesn’t get spent as easily. In fact, they might experience that as they get better about saving.

- Change Matters Too: Periodically have your child roll up the family’s change jar using coin wrappers you get from the bank. Then deposit them into the family’s savings account, your own, or your kids’ – your choice! This shows your child that coins really do add up.

- Compound Interest is Pretty Cool: As your kid gets more and more comfortable putting money into a bank and seeing savings account statements (either online or on paper), they’ll start to notice things. Like, maybe they notice they’re getting paid for their money. That’s an upgrade from a money jar! Something you’ll want to point out to them is that not only are they getting paid for their money, but their interest earnings are earning them money as well. And if you’re not comfortable explaining compound interest? Asking a bank personnel to explain it to your child is a great idea.

- You Can Check Your Balance at the ATM: Show them that they can check their account balance at the ATM on the receipt, or online, or by asking a bank teller.

- Periodically Change Passwords: Now’s a great time to teach your child the need to periodically change their online account passwords.

Alright – so how do you set up banking for kids through a Family Bank Day?

How to Start a Family Banking Day

Here’s what you’ll need to do to start this tradition:

- Schedule a Day: Choose one day a week/bi-weekly/month where everyone gets to update their banking needs by physically going to the bank or an ATM to make deposits, transfers, etc. It’s best if you put it on your calendar in your family command center so that everyone knows when they’ll need to be ready for it.

- Explain to Your Child What They Can Do at the Bank: You’ll want to explain to your child all of the things they can do at the bank, by explaining all of the things that you do at the bank. You know, make deposits, general account maintenance, set up online banking, associate your accounts together, etc.

- Get Everyone a Bank Account: It’s hard to do banking if your child doesn’t have a bank account! Your first family banking day is the perfect opportunity to open a savings account for them.

- Take Turns Doing Your Banking: You guys can all stand in line, or line up at the ATM (try for less busy times if there will be multiple transactions). Each person gets to take their turn making deposits or withdrawals, as needed.

- Take Stock of Your Account Balances: Remind your child that it’s a great opportunity to see how their savings account is growing.

Bonus: since your kids know that a family banking day is scheduled into each week, every other week, or each month, then they’ll start to learn to plan some of their money handling needs out ahead of time.

How to Keep Up the Family Banking Day

It’s likely you won’t have chores to do at the bank every other week, or even every month.

And that’s okay. In fact, some of your family banking days might just be you driving by and when you get close, asking if anyone has any banking needs to take care of today.

If the consensus is “no”, then just keep on truckin’.

I’ll give you a list of ideas for things you can do at the bank, in case you want to go each time, no matter what (yes, I know that many of these things can be done online as well):

- Roll up change and deposit it.

- Order new checks.

- Open someone a new bank account.

- Close down an old bank account and move the money over.

- Take care of business banking needs.

- Get change for things you need to pay cash for.

- Use the ATM.

- Open up a savings account for your family savings goal.

Other variations you can do: choose a family digital banking day, where everyone learns how to use their bank’s app to deposit checks and views their statements online, from home. These things certainly aren’t going away, so it’s good practice for them.

Also, don’t be afraid to make several of your family banking day trips ATM trips, with you guys depositing and withdrawing on different accounts as needed.

Remember, banking for kids is all about normalizing the banking process for them – something Family Banking Days will surely do.

Amanda L. Grossman

Latest posts by Amanda L. Grossman (see all)

- 50 Banking Activities for Kids (Student Financial Literacy) - February 14, 2024

- 14 Christmas Activities for High School Students (they’ll Actually Find Cool) - December 1, 2023

- 3 Fun Selfie Scavenger Hunts for Teens (Christmas, Fin Lit, etc.) - November 27, 2023