Should kids get an allowance? We'll look at the pros and cons of giving a child allowance, plus helpful allowance tips.

Let’s face it: whether or not to give an allowance to kids is a hotly debated topic among parents.

That's because it's an important topic we want to get right for our kids.

Giving allowance for kids – whether that’s money given to your child outright, earned through chores, etc. – is like giving your child a set of money training wheels to prep them for what to do with the consistent income they’ll have one day.

IF you do it right.

But if done incorrectly? Well, it could instill some not-so-desirable money behaviors in your child that could hurt their future bank account balances.

You probably have lots of questions already, all of which we’re going to address here in this guide.

Things like:

- Should I just give my child an allowance, and how much allowance should I give my child, exactly?

- Should allowance be tied to chores?

- If so, WHICH chores…because it’s not like I get paid to do the dishes?

- Will giving an allowance teach kids financial responsibility?

- Should I get a kids' allowance app, and what's the best one?

- Etc.

Let's start with the pros and cons of giving your child an allowance.

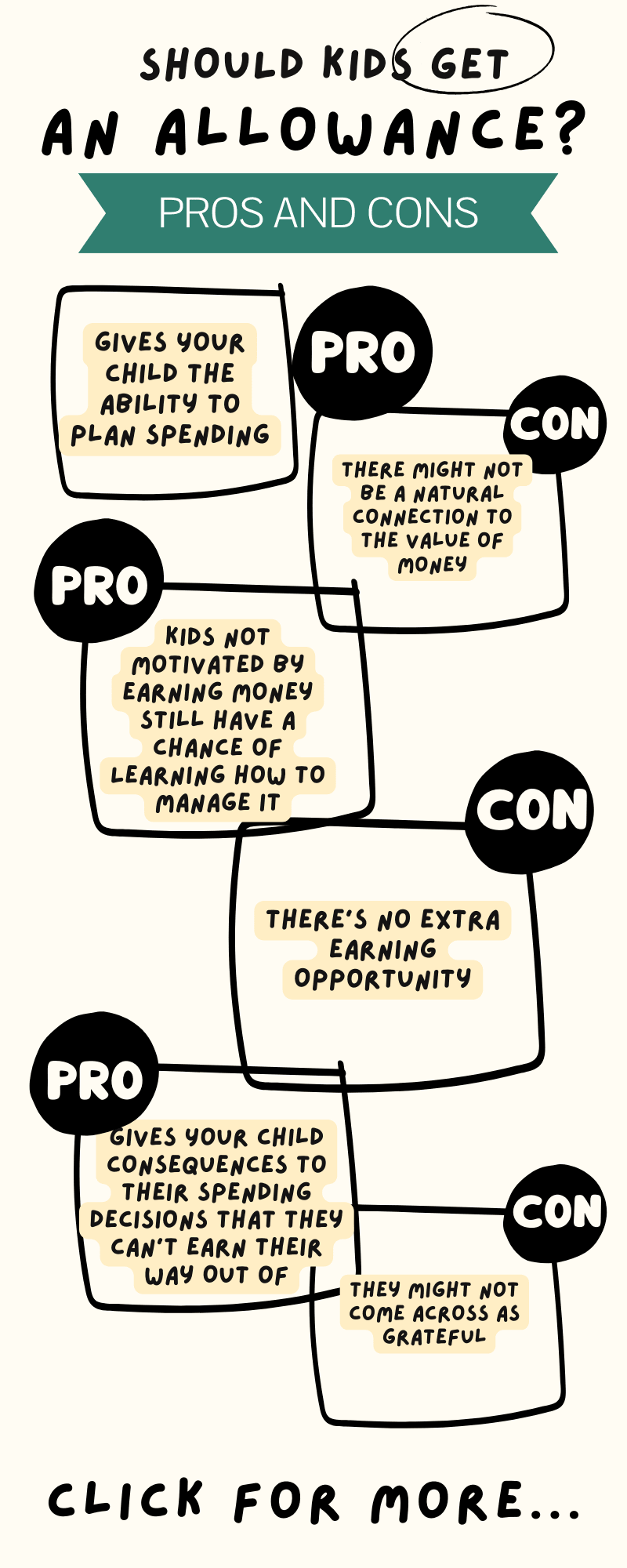

Pros and Cons of Giving Your Child an Allowance

Here's the section where we're going to break down the pros and cons of giving a child an allowance.

Why Should I Give My Child an Allowance? The Pros.

These are some reasons to give your child an allowance.

Pro #1: Gives Your Child the Ability to Plan Spending

Unlike chore commissions, which are based on a child behaving a certain way (i.e., completing tasks), an allowance is a consistent amount of money your child can count on receiving.

And if your child knows when money is coming, and how much is coming?

Then they can start to plan their spending.

Which is a precursor to being able to set savings goals for themselves and actually reach them. That's huge.

Pro #2: Gives Your Child Consequences (Both Good and Bad) to their Spending Decisions that they Can't Earn their Way Out of

With a consistent allowance, your child is forced to spend within their means.

It's not like they can earn extra money by doing more chores one week because they want to get a deck of trading cards, and then slack off the next week because they're not motivated to make a semi-impulsive purchase.

An allowance is an allowance – the same amount of money, week in and week out.

Which means they must work with the money they have to get what they want and to pay for what they need. If something costs more than the amount they get for a weekly allowance? Then they'll have to save part of one week's allowance and use it with their next in order to buy it.

This is money management at its very essence – figuring out how to manage a limited resource in the best way possible.

Pro #3: Kids Not Motivated By Earning Money Still Have a Chance of Learning How to Manage It

In a chore-based allowance system, kids who aren't motivated by money to complete chores are actually going to face a way worse consequence than having no money to spend.

The consequence is your child not learning how to manage money because they don't ever have any.

And before you think this couldn't possibly be a problem because every child is motivated by earning money, I can tell you for certain that I've heard from some parents that their child is not.

With an allowance, you're getting a consistent amount of money into your child's hands. Which means they'll definitely start learning how to use it, whether they're motivated to earn it or not.

Pro #4: You Can Get them to Pay for Things

You'll be slowly handing over more Money Responsibilities and other responsibilities to your child as they age. It's a natural progression of childhood – since one day, they'll be responsible for everything.

If you give them an allowance, then you can also give them one piece or category of spending that you used to cover.

That way, they're learning how to manage that part of their spending lives, and you might even save a buck or two from what you were spending before (both for an allowance + paying for whatever you now hand over to your child to take care of).

Examples include (remember, these are age-dependent):

- Cell phone data plan

- Vacation spending money

- After school vending machine money

- New school clothes budget

- etc.

Why You Shouldn't Give Your Child an Allowance – The Cons

These are some reasons to not give your child an allowance, or at least things you might want to tweak to make it work for you.

Con #1: There Might Not Be a Natural Connection to the Value of Money

Kids can find value in money in two primary ways:

- By what it can buy them

- By how much they had to work to get it

Since an allowance is not directly tied to work, you need to make sure they get the value of a dollar in the other way – by showing them what their dollars can add up to and eventually buy them.

Hint: you can work around this by coming up with a hybrid allowance system where they're not getting paid for specific chores, BUT, they don't receive their allowance if they don't contribute to the household. Here are several real-life allowance system examples.

Con #2: There's No Extra Earning Opportunity

Sometimes it can be fun to help a child meet a savings goal (something they really, really, want to buy) by giving them earning opportunities.

This isn't necessarily built into an allowance system as it could be with a chore commission system.

Psst: here's my article on should kids get paid to do chores – pros and cons.

Con #3: They Might Not Come Across as Grateful

An allowance is supposed to be consistent, so as long as your child meets the baseline requirements you have for them to receive it, they'll get the money each week/every other week/etc.

In some kids, this could develop into an attitude that's not altogether grateful. Meaning, they feel entitled to the money.

It just really depends on what your requirements are to receive it.

Should Kids Get an Allowance? My Personal Opinion.

I had an interesting conversation with a Work-at-Home Mother of a 9-year old + twins under 2. I asked her about her Kid Money System (aka, if she gave her kid an allowance, did she use chores to pay commissions, or does her child otherwise have money of his own to spend).

Because I feel it's so important to teach kids about money, I'm always curious to hear what others say.

She responded with something like, “I will give him money when I can answer the question, what does my 9-year-old child need money FOR?”

I totally got what she was saying, and at the same time really wanted to address this one. So, here we go!

Have you ever wondered, “Should kids get allowance…” or any money for that matter?

Today I’d like to talk about what the heck a 9-year-old, 8-year-old, or fill-in-the-blank year-old needs money for.

First off, what do kids NOT need money for?

Because I can certainly tell you what they DON’T need money for (and I’m sure you can, too): they don’t need money for another box of Pokémon cards. They don’t need a dime for more candy. And they certainly don’t need money to spend on snackie-type foods at lunchtime instead of the awesome lunch you are probably making them.

Here’s what your kids need money for:

- to make spending choices + face the consequences

- to learn from the mistakes + successes

- to repeat this process

You see, all those things I just said they don’t need more money for? Those were judgment calls made by me, a 35-year-old with a heck of a lot of experience with money + purchasing things + budgeting.

But your child? They have almost no experience with it. Especially if they don’t actually get to touch the stuff.

They don’t know about trade-offs, that making a decision to buy one thing means they have less to buy something else.

They don’t know the power of its value from doing something like not spending it all in one week, and watching it accumulate to the next week, several weeks, or even months.

They don’t know what it means to work 8 hours at a job just to pay for that pair of designer leggings they’ve got their eye on, nor do they have the wisdom yet to do the calculation and decide if it’s actually “worth” it.

By handling actual money and having some control (within a controlled environment) to spend it as they please, they’re going to get a taste of each of these things: trade-offs, understanding the value of money, decision-making in general, and budgeting.

Keep them moneyless? And the stakes just get higher and higher the older they get to get their money decisions right the first time.

And, let’s be honest, how many of us have gotten OUR money decisions right the first time?

Are Allowances Good or Bad? Depends on How You Do it.

If you set out to do an allowance the right way, then there is a treasure trove of money lessons your child can learn through it.

What do I mean by “do it right”?

Let me outline for you several pieces your allowance system has to have in order for it to be successful.

Pssst: don’t follow these? Then you’re probably not ready to start an allowance for your child.

Allowance Tip #1: Make it Consistent

There are various ways your allowance system (allowance/chores/commissions – whatever you call it) could be inconsistent.

Like….

- You forget to pay your child an allowance sometimes.

- You pay them at different intervals (so sometimes once a week, and other times, once every two weeks).

- You pay for chores, but the expectations you have for whether the chores were completed well enough for payment change depending on, well, whatever (the weather, your mood, your patience level that day – boy can my little guy test mine!).

- Sometimes bailing your kid out when they need a “loan” from their next allowance period.

- etc.

The reason why it’s super important to be consistent with whatever type of allowance you are giving to your child – whether it be through an allowance, chore commissions, employment, etc. – is because consistency is where the money lessons are.

Having a Consistent money source enables your child to:

- Plan Spending and Savings: If your child knows when money is coming, and how much is coming, then they have the precursor to being able to set savings goals for themselves and actually reach them.

- Feel Consequences: If you are consistent with when you give your allowance, and don’t give them an allowance earlier than the actual payday just because they overspent, then you set up a system where they start to feel the consequences (both good and bad) of their decisions.

- And It Helps YOU Clearly See if It’s Working (or Not): There’s no “right” or “wrong” way to give an allowance. But in a nutshell, it’s more about working towards the money-end goal of parenting your child – that when they’re out of your house as an adult, they’re in total control of both earning and spending their money. In order to do that, you’ve got to know if the current system you’re using is working, which means you need to be consistent with it. Is the problem in the system itself, or in the execution?

Allowance Tip #2: Make it Meaningful

With money comes responsibilities.

Sure, there is a heck of a lot fewer when you’re a kid (ahhh those were the days – when $5 a week meant I could fill my candy quota).

So, if you never hand over money responsibilities with the actual money…then you’re missing out on some key lessons in life.

And don’t forget that once you give them a money responsibility to take care of, you also will probably have to fork over more money. I mean you can’t expect them to take over the spending of their weekend activities on $3/week (unless you want them to lose motivation, that is!).

Allowance Tip #3: Make it Yours

There is no “right” allowance system or model.

I’m going to just put this out there, right off the bat. Because let’s be real – despite what the gurus think is the ONE answer for every single child, and despite how many articles on allowance jars you see out there, you and I both know that children are different.

What may work for one child, or a group of children, will not work for others. And after researching the allowance landscape for a few months, I can honestly say there are convincing arguments for each side of the allowance vs. chore commissions divide.

So, we all need to stop swinging mud at one another and start looking at the tweaks that can be made to any Kid Money System (what I call the system for how money gets into your child’s hand – it’s a bit more than that, but we’ll leave it there for now) to make it tailor-made for your family.

Reasons Why Allowance is Bad – When Allowance Does More Harm than Good

There are many mistakes parents unknowingly make that can derail allowances, making it the wrong choice.

Let’s talk about the major mistakes to avoid because when they’re made, your allowance may do more harm than good.

Allowance Mistake #1: Being Inconsistent

When you're inconsistent with various parts of your allowance, then your child misses out on lots of valuable lessons. They can lose momentum on their money goals, they may never set money goals to begin with since they don't know when the money is coming, and they fail to suffer any consequences from their spending decisions (because, hey, they can always blame you or whoever gives out the money because you don't always do it at the same time).

Allowance Mistake #2: Giving Too Much Money

If you give your child enough money to buy all their needs AND want each allowance payday cycle, then they’re going to miss out on a lot of the important lessons of money management.

Such as learning:

- how to prioritize spending

- how to plan spending

- how to save up for things that they want to buy (like how to save up for an iPhone).

Allowance Mistake #3: Giving Too Little Money

Do you fondly think back on the allowance you used to get/earn in your own childhood? You might also get to thinking, “my kid should get the same amount I did.”

But if you want your kid to get a similar allowance to your childhood amount, then you need to adjust for inflation.

In other words, the $5/week that I used to get when I was 9 years old? It couldn’t buy today what it used to buy back then, because products and services naturally increase their prices over time.

There’s a simple tool here you can use to plug in your old allowance figures and see what it would be in today’s dollars.

For example, the $5 allowance I used to get back in 1992 would be about $9 in today’s money.

Pssst: try not to do TOO much emotional adjustment with the number that calculator spits out for you, as the numbers don’t lie.

Allowance Mistake #4: Thinking that an Allowance is a Money Lesson

Let me just get this off my chest: giving children an allowance is NOT a money lesson.

Sounds crazy, right? I mean of course, it seems that if your kid gets some money into their hands and gets to make a few decisions with it, that they’re bound to learn money lessons.

But according to the research done by one man, who looked at over 50 allowance studies over the years, the money lessons don’t occur JUST from handing your child over money.

Nope. They occur in the follow-up (i.e., in the money conversations + expectations that you attach to the money you’re giving your child).

Professor Lewis Mandell, who headed up the study of looking at the last 50 years’ worth of allowance research, concluded that:

“in today’s busy world parents too often simply pay their kids an allowance with no discussion of what it is for or how to manage the funds.”

You’ve got to include money conversations and recap sessions where you go over what your child learned from their latest money blunders in order to pass on those money lessons to your child.

Pssst: by the way, that is the case for both if your child has to earn the money through some sort of chore system, or if they are given the money through an allowance.

Why Shouldn’t Kids Get a Larger Allowance?

Let me ask you this – if you looked in your checking account right this moment, do you have all the money that you need to cover your bills + all of your desires?

Actually, I just asked you a question I already have an answer for.

That’s because no one has enough money sitting in their checking account or wallet to cover EVERYTHING they could possibly want and need.

And you know what? Your child won’t ever have this as well.

Money is a limited resource, and they’ll need to learn how to prioritize the things they want to spend it on, just like you and I have to prioritize what we spend our paychecks on.

Because of this, you shouldn’t give kids a large allowance.

If you give your child a large allowance – and by “large”, I mean one that covers all their current wants and needs – then they won’t be able to learn how to do things like:

- Make choices

- Prioritize spending

- Save money for future purchases

And those are pretty darn important things to learn about money, right?

I hope you can see that figuring out the answer to whether kids should get an allowance really means figuring out a solid allowance plan to move forward with. If you decide to go that route, then yes, by all means, give your child an allowance! If you're not ready to fully commit to the process, then you might want to hold off on starting an allowance at all.

Amanda L. Grossman

Latest posts by Amanda L. Grossman (see all)

- 50 Banking Activities for Kids (Student Financial Literacy) - February 14, 2024

- 14 Christmas Activities for High School Students (they’ll Actually Find Cool) - December 1, 2023

- 3 Fun Selfie Scavenger Hunts for Teens (Christmas, Fin Lit, etc.) - November 27, 2023