The best app for tracking chores and allowance, whether you pay for chores or not.

Maybe you’ve tried a chore chart, but keeping on top of it just didn’t work for you.

Or, maybe you haven’t even tackled this area of your life – allowance, chores, etc. – and you know that you need allowance apps for kids right from the start.

The good news is that there are tons of great apps for tracking chore and allowances for kids.

The bad news? Is the same thing.

How are you supposed to choose the best one for your family?

I’m going to help you sift through the market for allowance apps for kids, plus the best app for tracking chores and allowance for YOUR household (not to mention, tracking how your child uses their money).

Psst: don’t let the word “allowance” trip you up; the app choices below will be based on whether you pay chore commissions, need to organize chore tasks without any pay, or any other way you choose to get money into your child's hands.

But first stop? You've got a few decisions to make before you choose an app.

The One Step to Do BEFORE You Choose an App for Tracking Chores and Allowance

Before you can choose an allowance or chore app, you’ve got to know how you want things to look.

That's because a chore or allowance tracking app is not your actual Kid Money System. It's just a way to organize and track everything.

Key decisions about your Kid Money System to make first:

- Your Money Goals for Your Child: Choose a few money goals for your child. What do you want your child to learn about money?

- Your System Foundation: Choose your system foundation (the dole method, learning-based earnings, allowance, chore commissions, consultant-based earnings).

- Your Payday Details: How will you pay your child (cash, prepaid gift cards, an allowance app, etc.)? How often will you pay your child, and on what day of the week?

- Clear Money Responsibilities to Pass Onto Your Child: Now that your child will be getting consistent money, what money responsibilities are going to hand over to them?

Don’t worry – I won’t leave you hanging. Here's how to give your child an allowance.

How you set up your Kid Money System is what will determine the features you need in an allowance and chore tracking app.

Pay Attention to these When Deciding on an Allowance App

- Recommended age

- Whether or not the app comes with a prepaid debit card

- Whether or not the app makes you pay for chores, give rewards for chores, or just keep track of chores without incentives

- Whether or not the app can link to your checking account for easy transfers, or if it's a money tracking app only

- If your child can set savings goals and/or do other money managing tasks to further their money education

Best Allowance Apps with a Prepaid Debit Card

Allowance and chore apps that are tied with a prepaid debit card your kid, tween, or teen can use to spend their newly earned money can benefit your home in several ways.

First of all, it eliminates the need to stop by the ATM for each allowance payday cycle. Secondly, it teaches kids about how to manage plastic, and that that plastic is tied to a money source – their own “income”.

This is also great for kids who want to make their own online purchases (without you having to do it for them), and if you don’t want your child to carry around cash for security purposes (like if they’re going on an overnight school trip).

Here are my favorites below.

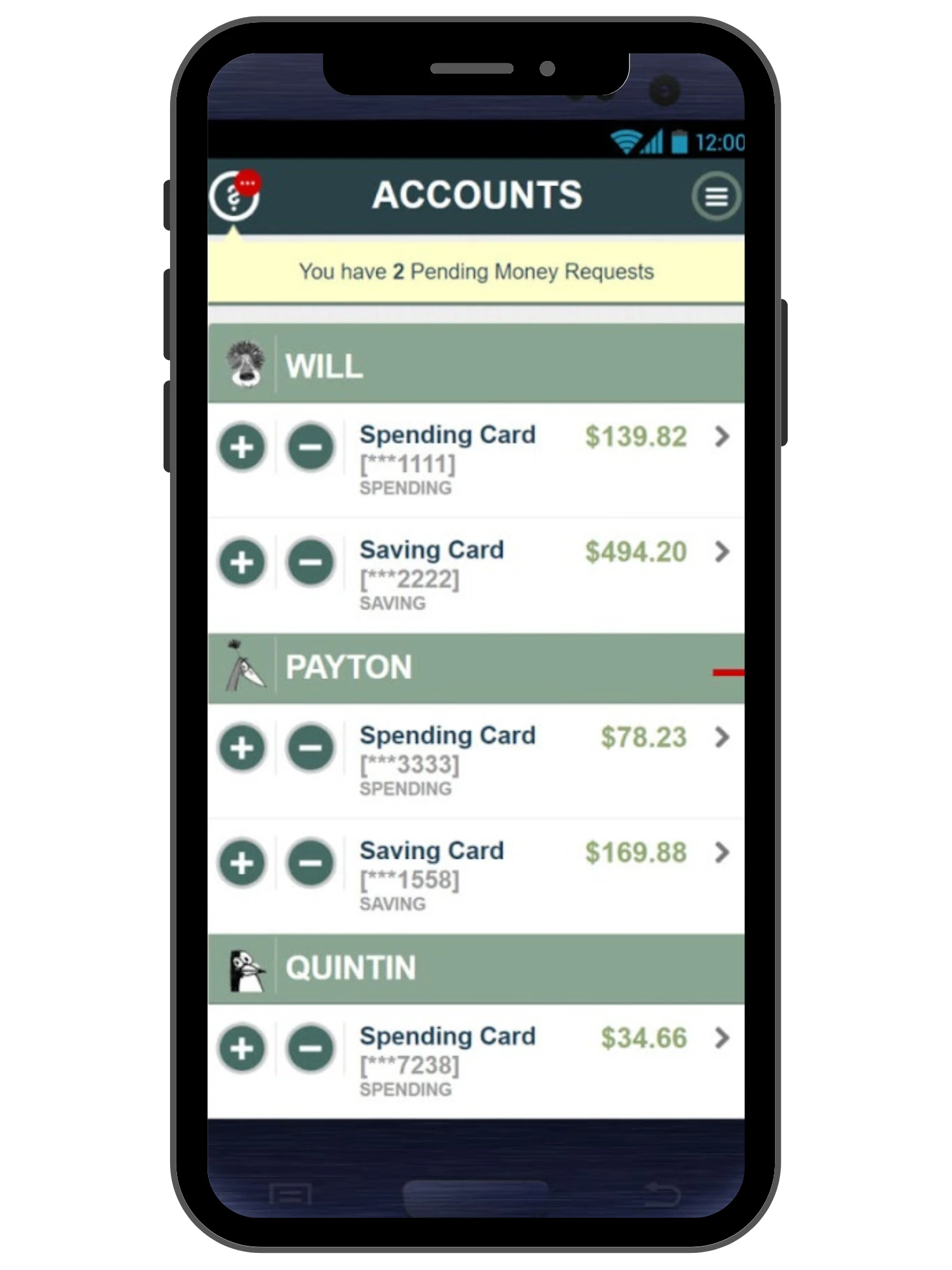

1. Allowance App Name: FamZoo

Allowance Functionality: You can use this app to automatically pay out a recurring allowance, either as a fixed-dollar amount, there’s also a calculator that calculates the amount by age of your child. Also, you have the ability to pay for chores, set them as recurring, give due dates, and even penalize. If you would like to penalize for chores you have to redo by making your child pay YOU for them (I’ve heard of parents doing this), then you can use this feature, too.

- Age Range: All Ages

- Cost: $5.99/month for the whole family (option to pay in advance to save money)

- Parent Spending Controls: Parents can lock and unlock the card for spending.

- Saving Incentives: Parent can add incentive for savings reward, paid out of parent's primary funding card.

- Investing Capabilities: Not available

- Charitable Giving: Kids can set up a donate account within the app and set aside money for giving through automatic deductions.

- Money Management Tools: “Bill payment” for the child’s portion of a shared family expense, child loan tracking, kids can split payments between multiple accounts (save, spend, give, etc.). Reimbursement feature: if you want your kids to understand how much something costs, but to still pay for it yourself, then have them purchase it and ask (through the app) for reimbursement.

- Digital Wallet Access: PopMoney, Venmo, Apple Pay, Google Pay, and Samsung Pay

- Security: Users push funds onto a FamZoo card, so the app never knows the user's main bank checking account info.

- Cash Back on Purchases: Not available

- Teen Paycheck Direct Deposit: Teens can direct deposit right to their prepaid debit card.

- Reload Sources: Parents can reload by direct deposit, bank transfer, MasterCard rePower, PayPal, PopMoney, Apple Pay, Google Pay, and Samsung Pay. No bank account? That's fine. You can still reload your kid's cards at participating retailers (fee involved).

- Mobile/Web Dashboard: Mobile AND web access

Is FamZoo safe? FamZoo explains, “We always have users push funds onto a FamZoo card, and never know the user's main bank checking account info.” This way, your personal bank information is not open to security breaches within their app, nor can your child “accidentally” drain your checking account.

What Makes this App Different: This award-winning, family finance app packs quite the punch. In fact, it’s called a Virtual Family Bank, and I can see why. For example, kids can also pay their parents with this app, which is helpful for family-shared bills, money responsibilities you've given them to pay for, or if they owe you interest from a loan on their next allowance payday cycle. The card also offers detailed decline information for transactions your child tries to make. Common decline reasons include insufficient funds on the card, Incorrect PIN entered, PIN security block in force (after 3 incorrect PIN entries), billing address mismatch, locked card, blocked merchant (sometimes our card processor deems a merchant as sketchy and blocks transactions there). Finally, you can do informal loans to your kids through this app, and charge them interest with everything calculated and tracked for all eyes to see. That's a good money lesson, in itself!

Pro Tip: The feature of kids being able to pay parents will be useful when you hand over money responsibilities to your child, such as having them pay part or all of their data plan each month.

Available On: iOS, Google Play, and Desktop

Psst: Ever wondered what's the difference between Greenlight and FamZoo? Here's my review on Greenlight vs. FamZoo.

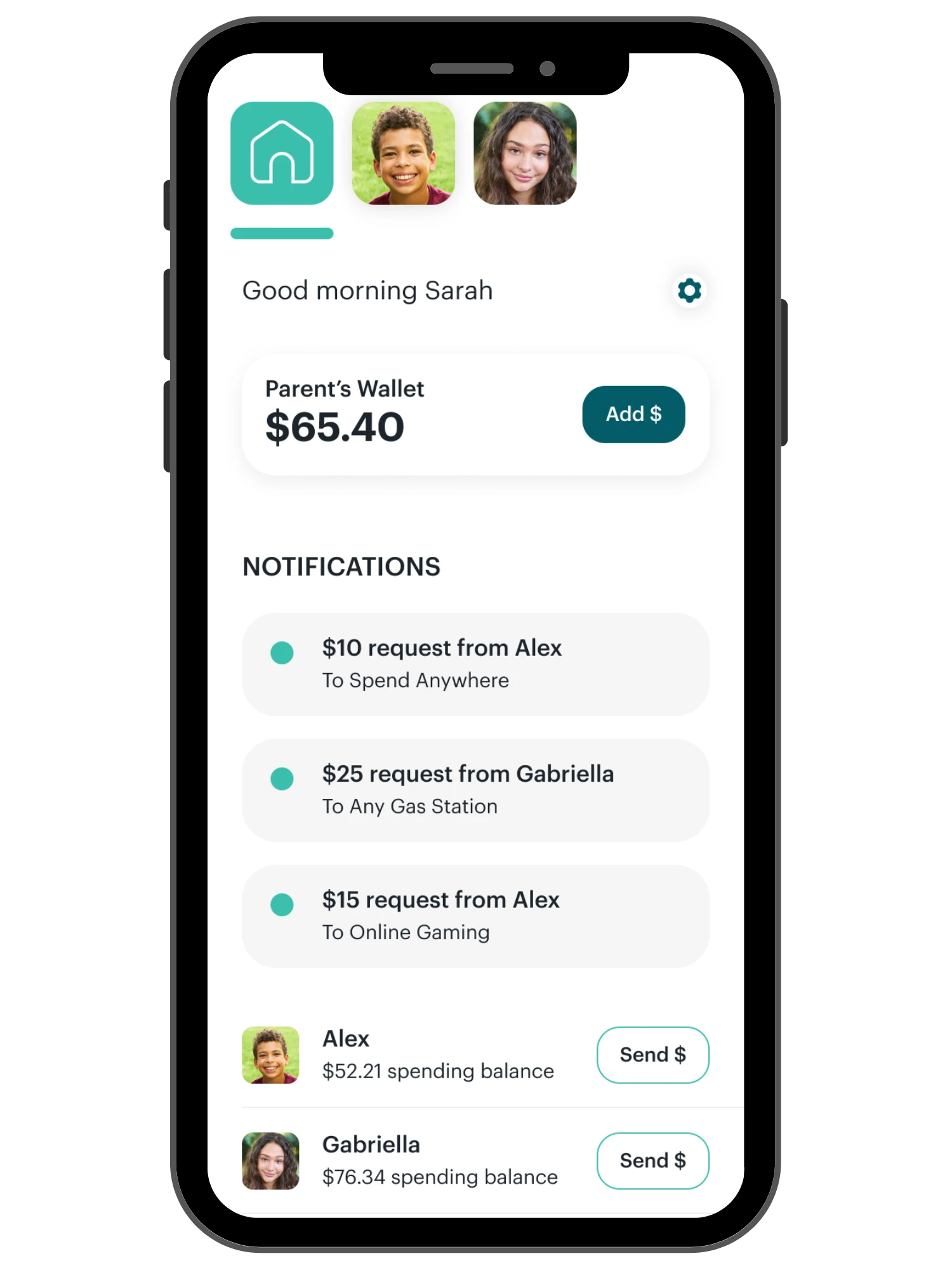

2. Allowance App Name: Greenlight – Famzoo Alternatives

Allowance Functionality: Parents can set up one-time and recurring chores that are tied to payment or not. Parents can choose a standard, flat-rate allowance or connect allowance to chores. Greenlight will calculate the payout. When it's time to pay, parents can choose All or Nothing, or Partial Payments, depending on chore completion.

- Age Range: 8-18 years (U.S. only)

- Cost: $4.99-$9.98/month (up to 5 kids)

- Parent Spending Controls: You can lock and unlock all spending, set up store-level spending limits, and set up category spending limits.

- Saving Incentives: Earn 1% savings reward with linked bank account, and 2% with the Greenlight Max plan, save the change roundup capability, and/or incentivize your child to save more by paying them an interest rate on money saved.

- Investing Capabilities: Kids can use the Greenlight + Invest app to research stocks, invest an amount of their choice and track progress over time (parents must approve buys)

- Charitable Giving: Parent-approved donations, starting at $10, using CharityNavigator.org

- In-App Learning: Toggle "Learn Mode" on, and they'll be guided on how to interpret financial data when investing

- Digital Wallet Access: Apple Pay, Google Pay, Samsung Pay (kids must meet minimum age requirements)

- Gifting: Friends or family can send a Greenlight Gift money to a child's account

- Cash Back on Purchases: Earn 1% cash back on purchases with the prepaid debit card (Greenlight Max plan only)

- Teen Paycheck Direct Deposit: Teens can direct deposit their paychecks to their Greenlight account

- Reload Sources: Parents can reload by direct deposit, debit card transfer, bank transfer, Apple Pay and Google Pay

- Mobile/Web Dashboard: Mobile app access only

- Allowance/Chore Functionality: Parents can set up one-time and recurring chores that are tied to payment or not. Parents can choose a standard, flat-rate allowance or connect allowance to chores. Greenlight will calculate the payout. When it's time to pay, parents can choose All or Nothing, or Partial Payments, depending on chore completion.

You can search the app for specific stores and add money to just that store, OR, you can add money and the money can be spent anywhere using “Spend Anywhere”. You and your child both receive real-time notifications when a purchase has been made.

You also have control to turn their card off whenever you’d like.

Pro Tip: Your child can request money to be added to their card. This would be a great tool to use for parents who want their kids to be on top of their allowance paydays. You can have your child keep track of what they’re owed from chore commissions or for allowance pay, or even for extra projects around the house, and then they can be in charge of requesting that money on the payday. If they don’t request it? Wait it out and put the onus on them – this is a good lesson to teach your kids so that they stay on top of their money in life.

What Makes this Different: There's a 1% cash back earned on purchases (Greenlight Max plan only), and a 2% savings reward paid for by the app with the Max subscription (1% savings reward paid to all account types). Kids can text/send a photo from right within the app if they’d like to buy something (and you’re not around). They can also make requests for specific amounts of moneys, and you can either accept or decline the request. There are also store-level controls parents can place, which means you can choose what can be spent at specific stores. That gives you a lot of control over purchases!

Available on: iOS & Google Play

Psst: you also might want to check out my article on Greenlight vs. gohenry app.

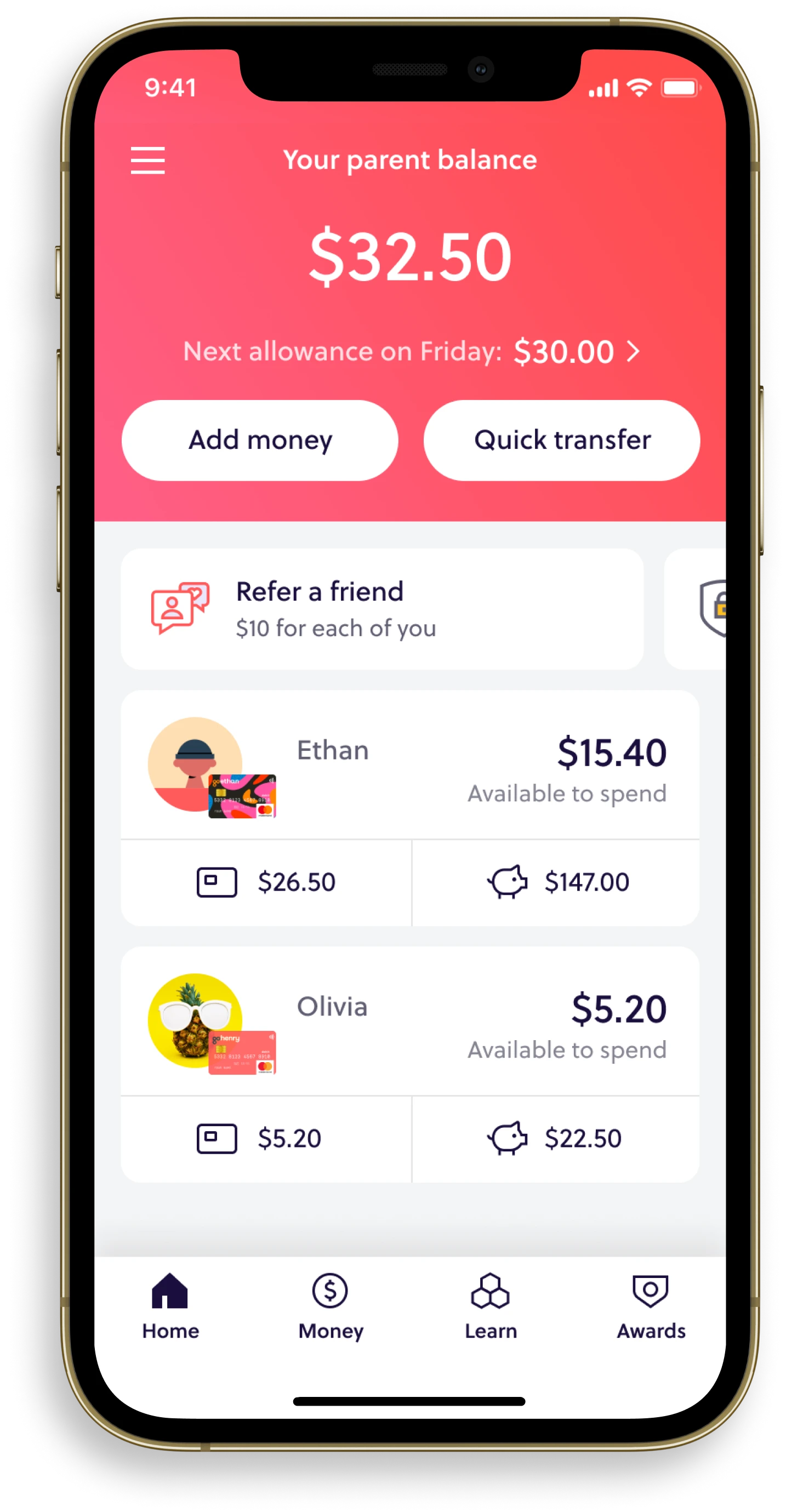

3. Allowance App Name: gohenry

Allowance Functionality: You can make either a one-time allowance payment, or set up automatic weekly transfers. You can also set up tasks/chores for kids to complete for money. Kids can track their chore progress, how much they've earned, and how much money they'll get once all chores/tasks on their list are checked off. You have the option of only allowing parents to check off chores as completed, for more oversight.

- Age Range: 6-18 years (available in U.S. and U.K.)

- Cost: $4.99 or $9.98/month (up to 4 kids)

- Parent Spending Controls: You can lock and unlock spending, or cut off spending for each of these: online, in-store, ATMs. You can set up weekly spending limits, single spend limits, and ATM spending limits. Contactless purchases are limited to $50 regardless of any parental limits.

- Saving Incentives: Parents can reward kids for saving regularly through the task feature (set up a task such as ‘save $5 a month’, and set the amount they’d like to reward as a one-off or weekly payment)

- Investing Capabilities: Not available

- Charitable Giving: Kids can donate directly to the Boys and Girls Clubs of America from their "give" category

- In-App Learning: Money Missions are stories, quizzes, and videos your child can do to earn points/badges for learning K-12 Personal Finance Education National Standards

- Digital Wallet Access: Not available

- Gifting: Parents can invite relatives and friends to contribute to their child’s earnings via giftlinks; kids can send a personal thank you note back

- Cash Back on Purchases: Not available

- Teen Paycheck Direct Deposit: Not available

- Reload Sources: Debit card; does not accept prepaid debit cards, checks, or American Express cards

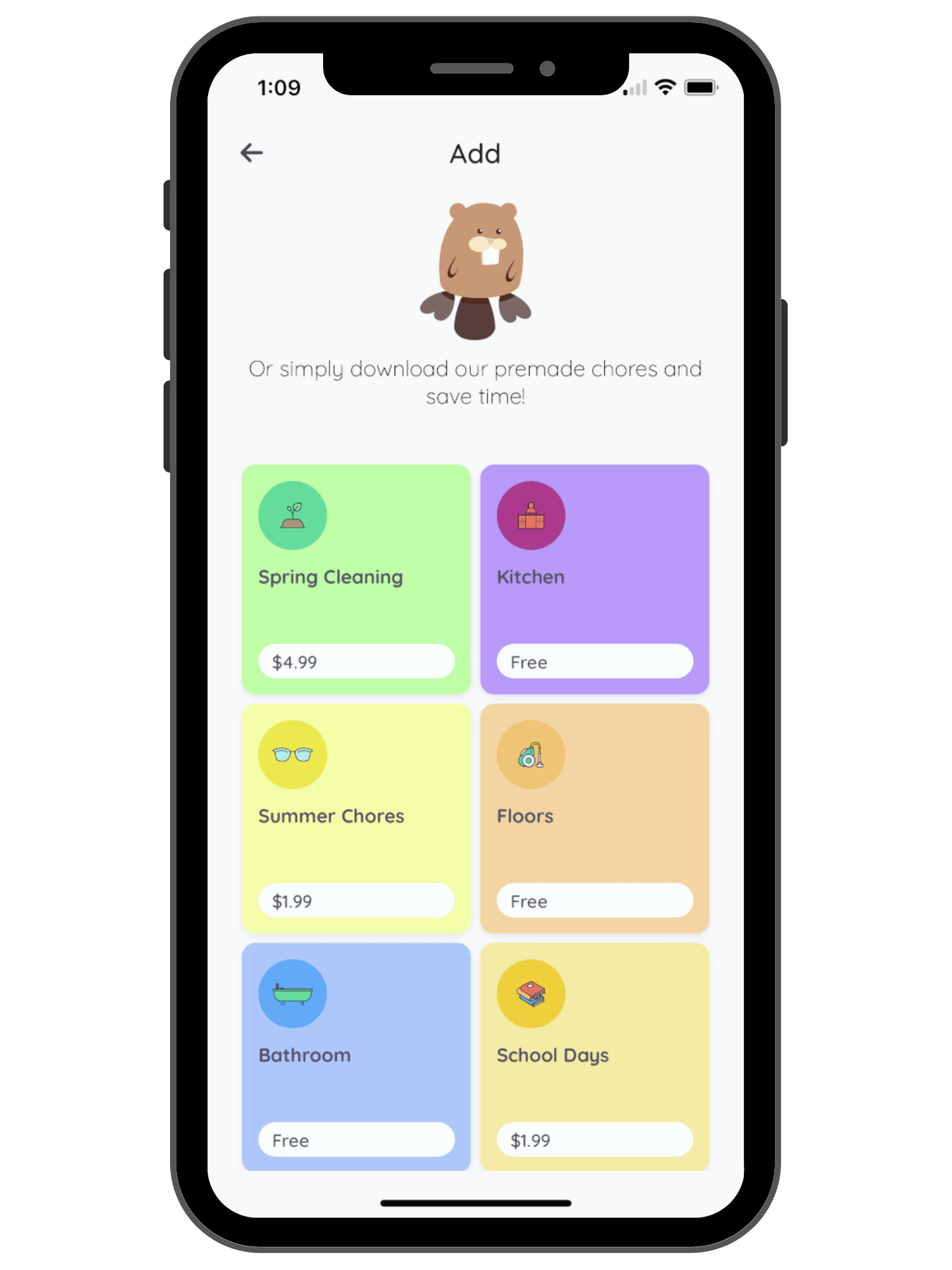

4. Allowance App Name: BusyKid

Allowance Functionality: You can use the BusyKid prepaid debit card + app with either an allowance or a chore-based allowance system. Parents can assign chores via app with an attached monetary amount. Once the chore is completed, the amount earned will be accumulated until Friday, which acts as payday. Since actual money is moved from your bank account to your child through the app, parents must approve the Payday text message sent through the app each Thursday in order for the child to get paid on Friday.

- Age Range: 5-17 years

- Cost: $4.00/month when paid annually (up to 5 kids)

- Parent Spending Controls: All money transaction must be approved by parents, who receive real-time notifications for each money transaction. Parents have the option to lock the Save, Share and Spend areas with "Lock Money Transfers". Parents control how much allowance goes into the Save, Share and Spend areas.

- Saving Incentives: Parents can send bonuses either straight to the child’s card to spend, or to their account to be allocated into save/spend/give. Parents can also match savings.

- Investing Capabilities: Unlimited Investing with more than 4,000 companies and ETFs available.

- Charitable Giving: Kids can donate directly to over 60 charities.

- In-App Learning: Not available

- Digital Wallet Access: Not available

- Gifting: BusyPay™ is exclusive to BusyKid and allows family & friends to add money to a kids account through QR code ($1 fee). Kids can even send money to siblings and other kids.

- Cash Back on Purchases: Not available

- Teen Paycheck Direct Deposit: Not available

- Reload Sources: Parents can reload by checking account, debit card, credit card, Apple Pay, and Google Pay. Using a credit card or debit card will result in a transaction fee.

- Allowance/Chore Functionality: Comes preloaded with chores or activities and an allowance amount based upon your child’s age (you can customize this). Auto-Allowance allows you to automatically pay an allowance (rather than pay for chores) every Friday or twice a month (your choice).

The activity stream shows all money transactions or completed chores (if the kid/teen) is doing them.

There are save, share, and spend areas, and these are actually controlled by the parent. However, the child can click the “move money” button to move money between categories. If you don't want your child to be able to do this, then you can enable the feature “Money Lock”.

Children can then choose what to do with their “spend” money from three options:

- Cash Out

- Stock

- BusyKid Visa® Prepaid Spend Card (parents can fund directly)

Kids can also choose to donate a portion of their allowance pay to one of over 60 charities that they choose, from the app.

All money transactions must be approved by parents on the Activity/Registry tab, and this is also where parents can approve or deny chore completions.

What Makes It Different: BusyKid actually recommends chores TO you, depending on your child’s age. As your child ages, the chore options change (you can still add in your own, as well).

Available On: iOS & Google Play

Psst: you might want to check out my review on BusyKid vs. Greenlight app.

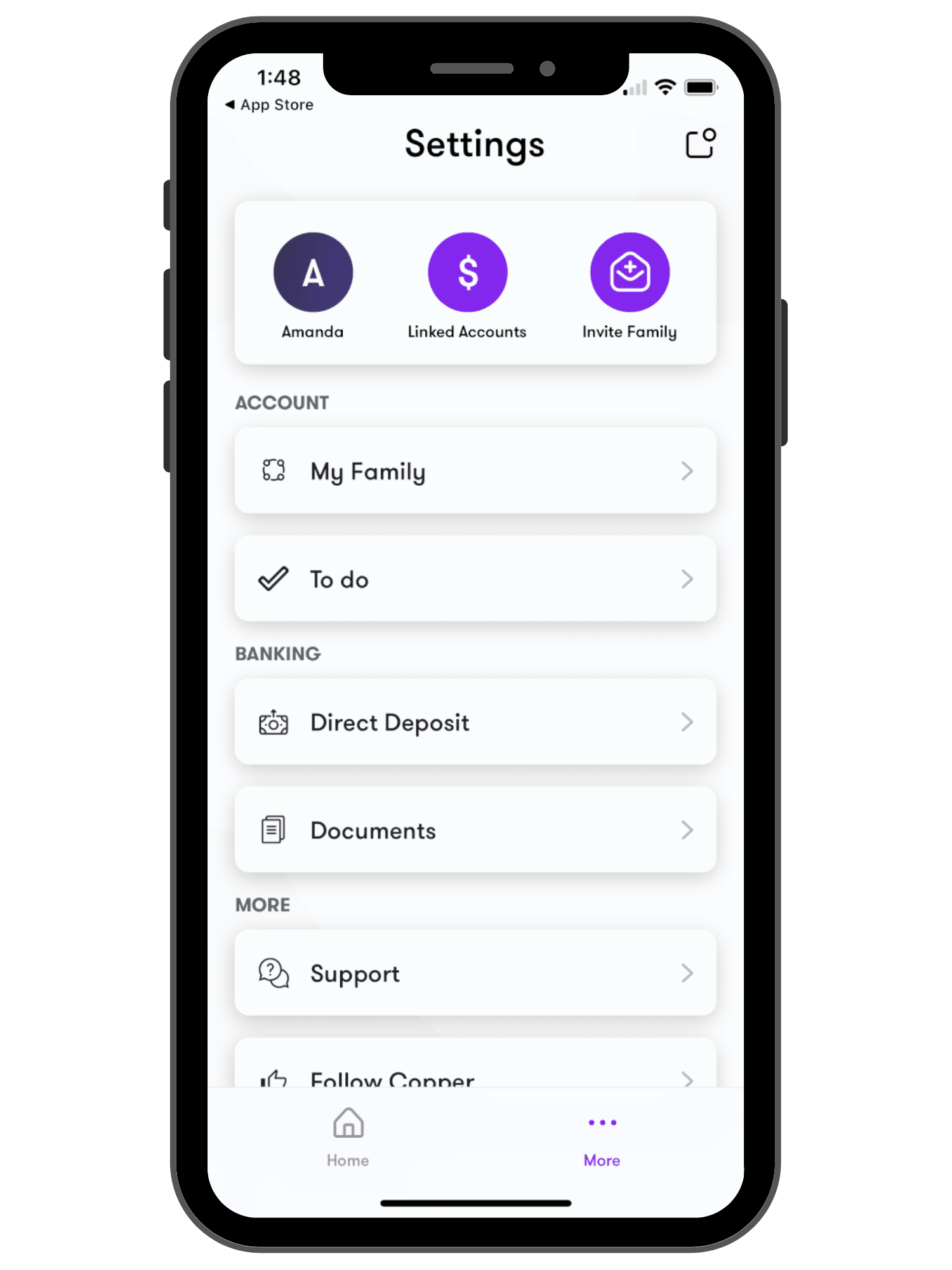

5. Allowance App Name: Copper

Allowance Functionality: Parents can set up recurring transfers to their linked teen(s), or one-time payments. There is no chore tracking available.

- Age Range: 6-18 years (but more for teens)

- Cost: $0/month (instant transfers from a linked debit card costs 2.5% of the total amount + $0.30 per transaction).

- Parent Spending Controls: View transactions, enable notifications when they make a purchase, and send and request funds between accounts.

- Saving Incentives: Teens can earn a small 0.01% APY savings reward. Parents can incentivize child to save more with a "bonus deposit" for hitting their savings goal.

- Investing Capabilities: Copper Investing offers automated investing portfolios for teens, as well as in-app investing education.

- Charitable Giving: Not available.

- In-App Learning: Financial tips are built throughout the app experience.

- Digital Wallet Access: Apple Pay, Google Pay, Samsung Pay, Venmo, and Cash App (kids must meet minimum age requirements).

- Cash Back on Purchases: Not available.

- Teen Paycheck Direct Deposit: Teens can direct deposit their paychecks to their Copper account.

- Reload Sources: Parents can reload by direct deposit, debit card transfer, or bank transfer.

- Mobile/Web Dashboard: Mobile app access only.

6. Allowance App Name: Homey

Allowance Functionality: You can take pictures of the messes in your home, and assign the work with a visual to individual family members. Chores are divided into two categories: responsibilities ($0 earned, but can be required to unlock weekly allowance) and jobs (have a monetary value, but you can also set them to $0). Detailed chore settings include due dates, recurrence vs. one-time, availability, photo completions, completion confirmation requirement, and difficulty.

- Age Range: Families (all ages)

- Cost: $4.99/month (or $49.99 if paid annually, unlimited users)

- Parent Controls: Parents can accept or reject chore completions, and take money out of a kid's wallet through the app.

- Saving Incentives: Kids can set and track savings goals through this app, with a progress bar that visually shows them how far or close they are to being able to purchase what they’re saving and earning money for.

- Investing Capabilities: Not available.

- Charitable Giving: Not available.

- Digital Wallet Access: Not available.

- Reload Sources: This app connects to your bank account, and you transfer allowance to a bank account (US only), or mark it as payed out in cash.

On the free forever tier, you can use the app as a money tracker for up to 3 accounts. If it's used this way, parents can choose the “cash” pay option, instead of the bank option (since you cannot connect any bank accounts).

Pro Tip: In addition to weekly allowance, responsibilities can also be connected to the daily goal. This allows parents to require a percentage of daily responsibilities to be completed for the daily goal to unlock. Daily goal is usually screen time or similar non-monetary rewards.

What Makes it Different: You can actually take pictures of messes in your home, or areas in your home where attention needs to be paid, then send those pictures + an assigned task to individual family members. This is a two-way feature; kids can take a photo to mark the chore as done. Additionally, you can also toggle on “parental approval”, which will require parents to approve a chore completion before it counts.

Available On: iOS, Google Play (Mobile-only)

Best App for Tracking Chores (Chores for Money App)

If you’re giving chore commissions (i.e. paying for chores), then you might want to check out one of these chores for money apps below, which are set up to pay and otherwise reward your kids for chores.

Psst: here are 100 chores to do around the house for money, and teenage chore chart ideas.

1. Chore Tracker App Name: Bankaroo (All accounts will be sunset by Oct. 2023)

Geared For: Children ages 4 years and up.

How It Works: Created by an 11-year old kid named Dani, Bankaroo allows you to set up deposits into an account your child can track. You can also set up goals and badges for your children to earn based on chores around the house for extra cash. Children are able to see how money goes in and out in an easy to understand way while holding them accountable for their spending.

With the pro version, you can transfer money between sibling accounts and checking and saving accounts.

Something nice about this one? You don’t need a smartphone to use it. It has both a web interface and a smartphone app to go with it, and you can use both, or either.

What Makes It Different: Bankaroo allows you to match funds to incentivize your child to save even more. It also allows you to make deductions to mimic real world scenarios.

Available On: iOS, Google Play, Amazon

Price: Free, with a one-time $4.99 fee for the pro version.

2. Chore Tracking App Name: Rooster Money (Only for UK customers)

Geared For: Ages 4-14

How It Works: Money Rooster keeps a running bank balance of money that children earn via chores, gifts, or a weekly allowance allotment. With an easy to read ledger, children can easily know if they have money saved up for what they want at the store which relieves the pressure off of mom and dad. This also gives children control over their own spending power.

Core features of tracking allowance, goals and savings are available with the free version. Parents can sign up, create accounts for their children, and set a regular allowance using this. Children can also log into their accounts to view their funds and move it between the difference pots.

You should note that this app does not integrate with banks — it's a money tracker system, letting parents and children keep track of the pocket money they've earned and saved.

When you upgrade to the paid plan, you get additional features:

- Chore tracking

- Ability to set interest rates (so that you can give kids a bigger incentive than current bank interest rates to save their money)

- Ability for kids to set regular “outgoings” (such as a bill for a magazine subscription)

- Ability to add unlimited guardians

What Makes It Different: Something that makes this app stand out is, it's international! There are 150 currencies you get to choose from in the app, and they've got users from lots of international countries. However, at the moment, the app is only available in English.

Available On: iOS, Google Play, Amazon

Price: Lite version is free, Pro is $2.99 a month.

Best Chore Apps for Family – Not Necessarily Tied to Allowance or Chore Commissions

Perhaps you’re not looking for an allowance app, per se, but an app that will both manage and track all of your household chores (with OR without paying for those chores).

Let me give you some really great options for best chore apps for your family.

Psst: you probably want to check out my article on age appropriate chores for kids that I put together after surveying 179 Mamas about the chores they’re giving their kids. Use the lists to fill up your chore slots for each family member!

Allowance App Name: Our Home

Geared For: Families with children ages 8 and up due to smart phone capability.

How it Works: Parents can assign recurring chores (meaning you don’t have to continually write down the same chores – they automatically renew after a certain period of time that you set), reminders, and one-time tasks for children to complete, with assigned points. Points can be collected towards a goal that parents decide, such as different amounts of money or screen time.

You can decide on the rewards (money, a trip, lunch with Mom, etc.), and you actually put that into the app so that kids can see what they’re working for, and how much each reward will cost in points. Goals are usually the rewards, but they can also be expressed as a weekly or monthly points target.

You can use OurHome to pay kids for chores, but the app does not currently integrate with any banks or do any financial payments. You just enter how many points are required for a set amount of pocket money and then the kids only get the pocket money when they've earned that many points. Once the pocket money has been claimed by the kid then the parent needs to give them that money separately.

You can also use this app as a communication tool for everyone in the family – you can set up events that the whole family needs to know about, and at any time, they can access their calendar on their phones and know who is going where, when.

What Makes It Different: With this app you can apply late penalties and fees if tasks are not completed within a set time frame (such as losing 25% of earned points for each day the task is late). You can also set approval needed to tasks that require a little more guidance before points are earned. It also serves as a social network hub with direct and group message capability. You can use this as your grocery store list as well, and your past items are saved so making new lists can be even easier.

Available On: iOS, Google Play & Webapp (Desktop)

Price: Free

I hope I've given you helpful info to figure out which allowance tracking app is best for you. And if you want to track your kid's money but not use an app? I've got some alternatives in this how can I keep track of my kid's money article.

Amanda L. Grossman

Latest posts by Amanda L. Grossman (see all)

- 50 Banking Activities for Kids (Student Financial Literacy) - February 14, 2024

- 14 Christmas Activities for High School Students (they’ll Actually Find Cool) - December 1, 2023

- 3 Fun Selfie Scavenger Hunts for Teens (Christmas, Fin Lit, etc.) - November 27, 2023

Grace Henderson

Tuesday 23rd of July 2019

Busy kid says it’s $14.95 per year for the family, however when you sign up it is $24.95. This alone makes me not want to use it.

Amanda L. Grossman

Monday 5th of August 2019

Thanks, Grace! I'll look into this and see what they say.