Does your child always want something new — and they think you should buy them something every time you to go to the store? Here are 2 strategies to stop this.

I hear complaints from many parents about taking their kids to stores.

Like:”

- my child always wants to buy something”

- “my child always asks for more”

- “my child always wants something new”.

Honestly, they're worried they are raising a greedy, entitled child who doesn't hold similar money values to their family. And, they're wondering how to stop the behavior (not to mention end the begging and whining).

You might even fear YOUR child thinks money grows on trees — I mean, what's the other logical explanation for why they want you to spend money on them all. the. time.?

You're probably getting sick of saying, “it's not on the list” every time you go to Target.

Don't worry, you're not alone. If you're asking yourself, “why is my child never satisfied?”, then you're in the right place.

Let's look at 2 strategies you need to use TODAY that will not only redirect this behavior to give you some peace of mind in the store, but that will also help your child's money education.

Here's how to deal with a child who wants everything:

How to Get Kids to Stop Asking for Things

Strategy #1: Update Your Allowance System

It's possible that you are unknowingly reinforcing your child's belief that money grows on trees and that you can just buy them whatever they want.

Don't fret — we can turn this around by upgrading your allowance system from one where your kid asks you for things and money on demand, to one where they're in control of a little bit of their own money and are expected to pay for some of their “wants”.

We do this by going from the Dole Method to a proper Allowance Plan.

Psst: here's my take on how much allowance by age.

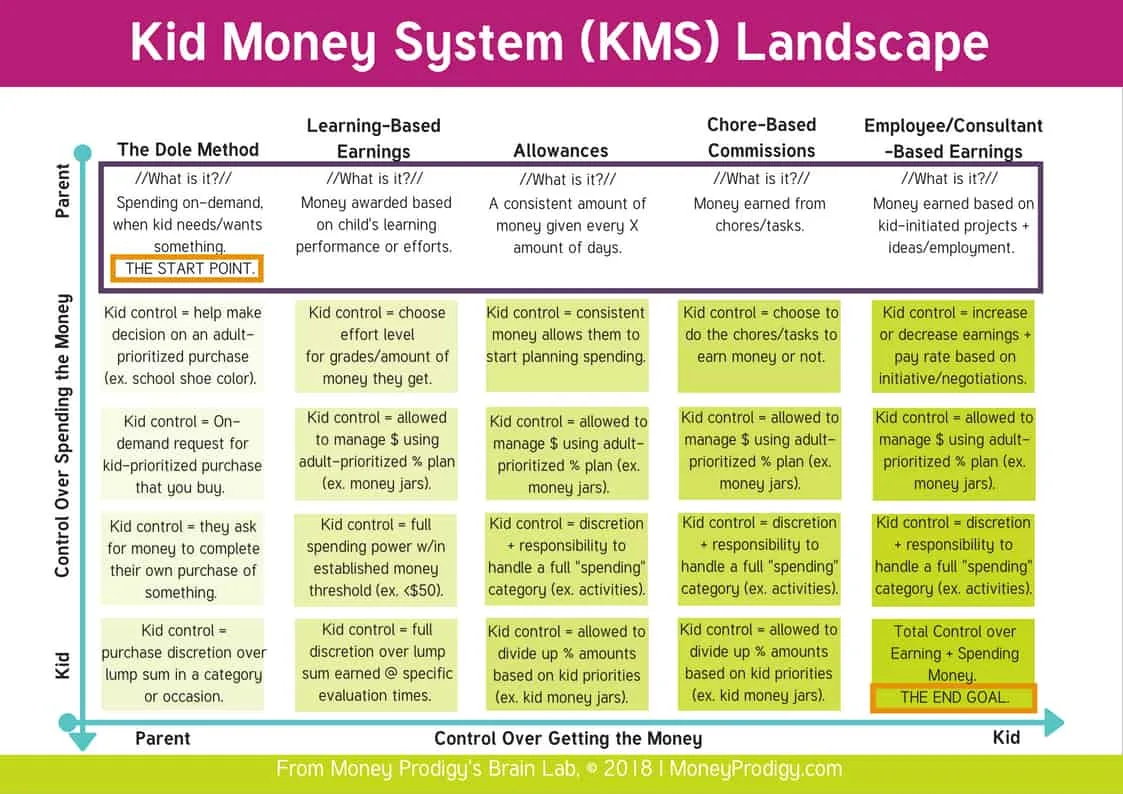

I’ve taken the last six months to study the allowance landscape, and to read up on the various systems out there. And I created something called the Kid Money System Landscape from what I found.

Share this Image On Your Site

I categorized each of the allowance systems out there (such as chore commissions, paying for grades, giving an allowance, etc.) along a plot based on how much control they gave the parents versus how much control they gave the kids over both the spending and the getting of money.

All this to say that the allowance method that gives kids the least control, and parents the most control, is called the Dole Method.

It’s basically an on-demand money system where your kid asks for money as THEY see fit, and you give them money as YOU see fit (depending on your mood, the amount you’ve got in your wallet, and any other number of reasons).

The Dole Method is basically where every family starts with allowance systems.

But if you’re still using the Dole Method, versus setting up a consistent Kid Money System of some sort, then you may be unknowingly reinforcing your kid’s idea that money is a never-ending resource (hence why we say, ‘they think money grows on trees’).

And if it's a never-ending resource, then why SHOULDN'T they ask you for anything and everything they want?

Why the Dole Method Reinforces the Idea that Money Grows on Trees

Think about it this way: you and your child are at the store, grocery shopping. You’re at the cash register, waiting patiently (or not so patiently) for your turn in line. And your kid spots some candy that is cleverly packaged to also look like a toy.

*sigh*. You know this is going to be a battle. Honestly, it’s only $1.25, so you say “yes” when they plead you for the item (plus you're worn down from making it through the last 25 aisles with them).

The next day, you head to your local library to pick up some books you’ve got on hold, and there’s a table of Girl Scouts selling cookies. Of course, you can’t pass that up (I’ll take a box of peppermint patties, thank you very much)!

Later in the week, you head through the Starbucks drive-thru, and get an after-school snack for your kiddo after ordering your own beverage of choice – just enough caffeine to get you through the evening routine.

Your experience of these transactions is that you’ve worked for the money, you have prioritized these spending occasions (even if that means they’re a priority just to stop the nagging from your child about the candy), and you know that these are getting subtracted from the bottom line in your wallet or your checking account.

But your child? Well, they’ve observed all of these transactions as well, but without any of the context involved. They just know that they wanted something, or Mommy wanted something, and she pulled out the cash (or plastic) to buy it. End of story.

Seems kind of magical, right?

What to do Instead of the Dole Method — Set Up an Allowance Plan

If you want your child to understand that money does not grow on trees, and that money is not spent in some sort of magical vacuum where there are no consequences or prioritization of resources, then you’ve got to put them in control of both some of the supply of money, and in some of the decision-making in spending it.

This is how they’ll begin to express priorities, to learn the “value” of money in context to having to work for it, or only being given a certain amount each allowance period (or however else they get money into their hands) and that once the money is gone, they’ll need to wait until next “payday” or earn extra to get more.

Suddenly, money doesn’t appear to grow on trees anymore! And then they’ll be able to make the connection that you work for your money, and that money does not grow on trees for YOU, either.

It’s a beautiful thing.

This will also set your child up for Strategy #2 below so that they stop asking for things at the store.

Strategy #2: Put their Wants into Their Own Lap, with a Wish List

I want you to stop telling your kids “no” at the store. Yes, even if your child is obsessed with buying things.

Do you think I’m CRAZY for saying that you should quit telling your child “no” at the store, especially since they seem to do it ALL the time?

I’m a mother, too. The amount of “no’s” that we get to dish out each day is unreal. It gets tiring, and honestly, sometimes I feel bad about saying “no” all the time!

So, if “no” has become your store mantra, I want you to try this method — not only will it help your child come up with a pre-made list of things to save up for as a kid…but it also will help you to stop saying “no” over and over again at the store. #MamaWin

Pssst: Stick around. I promise there really is a money lesson in this for your little one.

The Wish List Puts the Responsibility of Purchasing Wants into their Lap, Plus Teaches Delayed Gratification

You see, if you do Strategy #1 from above and get your allowance plan in check, then your child will now have a consistent source of money. That, paired with the Wish List, puts at least part of the responsibility of buying “wants” into your child's own hands.

Does this mean they'll be able to buy everything they want? Absolutely not (which is a great precursor to teaching them how to save up for a money goal).

That's why this strategy also helps to teach kids delayed gratification.

Wish List Strategy steps to follow the next time your child asks you for something at the store:

Every time your kiddo has his mind fixated on something on the shelf – something that surely will change his entire existence, and be the bee’s knees, and he’ll be sure to play with it for umpteen years and take care of it, and, and, and… – you are going to ask them to write the item down on their Wish List.

But, there's a bit more to this strategy than that.

Step #1: Give Them Control

Have them carry around a notepad/pencil, or you keeping them in your purse, each time you go to the store. When they ask for something, tell them that they can have it, and will need to pay for it themselves.

Offer to help them in making their final decision using the next steps.

Step #2: Help them Research the Cost of the Item

Help your child research how much the item they want costs. You could use Amazon.com, go to a physical store, or peruse a catalogue of some sort. This is a good financial habit to develop in them.

Step #3: Help them Calculate How Long it Will Take to Pay for It

Your child needs to understand how long they must work to get this item, or how many allowance cycles they need to wait to get it.

Whichever one you use all depends on how you give them money – either through an allowance, chore commissions, etc.

Help them calculate how many chores they’ll need to complete in order to pay for this item. Is it two weeks of vacuuming and emptying the dishwasher? Is that emptying the trash out 8 times, or 15? How many floors do they need to mop?

They need to see the work value of this item they’re considering, and whether or not they still consider it to be worth it after figuring this out.

Pssst: Don’t give them an allowance? That’s fine. You’ll want to use Step #4 below.

Step #4: Help them Answer the Question, “What Else Could I Buy with That?”

By your child purchasing this item, they’re giving up purchasing other items. This is called a trade-off. But they might not know that they’re doing that, so this exercise is going to help them identify trade-offs to give new value to their money.

Go back to how much this item is going to cost. Have your child list out 5-10 things they can purchase with this money instead.

Hint: the idea here is that, they can't have everything on this list. They can only pick and choose what's best for them. This is called a trade-off, and they're making one every time they buy something (they just probably don't know it).

If they’re still willing to use their money for this item after figuring out how much they have to work for it, or how long they have to wait for it, then so be it. They must really want it, and going through this exercise makes that purchase non-frivolous now, anyway, as it’s passing on a valuable money lesson! Either way, spending money wisely will easier for your child once they go through this process a few times.

Bonus Tips: how can the two of you use this Wish List?

You could:

:: Save it for Christmas/holiday times and give your child a head start on their wish list.

:: Use it when relatives ask what they should get your kiddo for their birthday.

:: Use it as a cooling off period. Set up the expectation that any thing they write on the wish list is sealed for 48 hours, a week, or a month. After that time, you’ll both assess whether or not to actually buy the item.

:: Use it to help your child create their first savings goal.

Now the True Money Education Can Begin

This Wish List is the perfect fodder to capture your kid’s interest in learning about money. And more importantly, in learning about how to save money.

That's because their Wish List can be the first step in going through a savings goal setting exercise for your kiddo.

Now that they’ve got a bunch of ideas for things that they want, you can take them through this 1-page guide below to narrow down their savings goal to the one that will yield the quick win. Because right now, they need quick-win savings goals to keep them interested in the process of setting a target savings goal and giving them some confidence in actually reaching it.

Bonus Tip: Instill this Rule

Emma from Tuppennysfireplace.com told me about her really interesting way to get her grandkids to think about their purchases before buying them…while also cutting down on impulse buys they'd later regret.

She says,

“When I take my grandkids shopping…they are not allowed to spend any money in the first shop we visit. If they really like something there, they can ask for it to be put aside and we will revisit. This way, their money lasts longer and they focus much more on getting the best toy for their small budget. It's never the first thing they see and we rarely backtrack to that first shop.”

Use these three strategies from above — setting up a proper Allowance Plan that gets money and responsibilities into your child's hands, having them keep a Wish List during your shopping trips, and not letting them impulse-buy at the first shop they visit — will be just the thing to start your child's money education. Talk about turning a negative into a real positive!

Amanda L. Grossman

Latest posts by Amanda L. Grossman (see all)

- 50 Banking Activities for Kids (Student Financial Literacy) - February 14, 2024

- 14 Christmas Activities for High School Students (they’ll Actually Find Cool) - December 1, 2023

- 3 Fun Selfie Scavenger Hunts for Teens (Christmas, Fin Lit, etc.) - November 27, 2023