Help your child set goals with these free goal-setting worksheets for kids (PDFs).

Kids have many competing desires in life (which is why they need a goal-setting worksheet for kids).

They want All. The. Things.

And they want them now, amiright?

Like…

- the newest video games

- to go to the arcade

- a snowboard like Shaun White’s

- a white guitar with a skull like Pixar’s character Coco

It’s endless (not that I have to tell YOU that!)

And that probably sounds familiar, right Mama Bear? Because you and I have endless wants as well.

How can you help your kiddo narrow down their wants and desires so that they’ll have one goal that they'll actually stick with?

These goal worksheets for kids will help.

Best Goal-Setting Worksheets for Kids

Goal-setting worksheets for kids can help your child with all kinds of goal-setting needs, like:

- Figuring out the best goal to set (here are 37 short-term goals for kids to choose from)

- Tracking their progress

- Maintaining momentum so that they have a chance of achieving it

- Helping them think through everything they'll need to achieve what they want

- etc.

Here are some of the best, free, goal-setting worksheets for kids and teens.

Psst: you'll also want to check out my article on examples of good and bad smart goals for students.

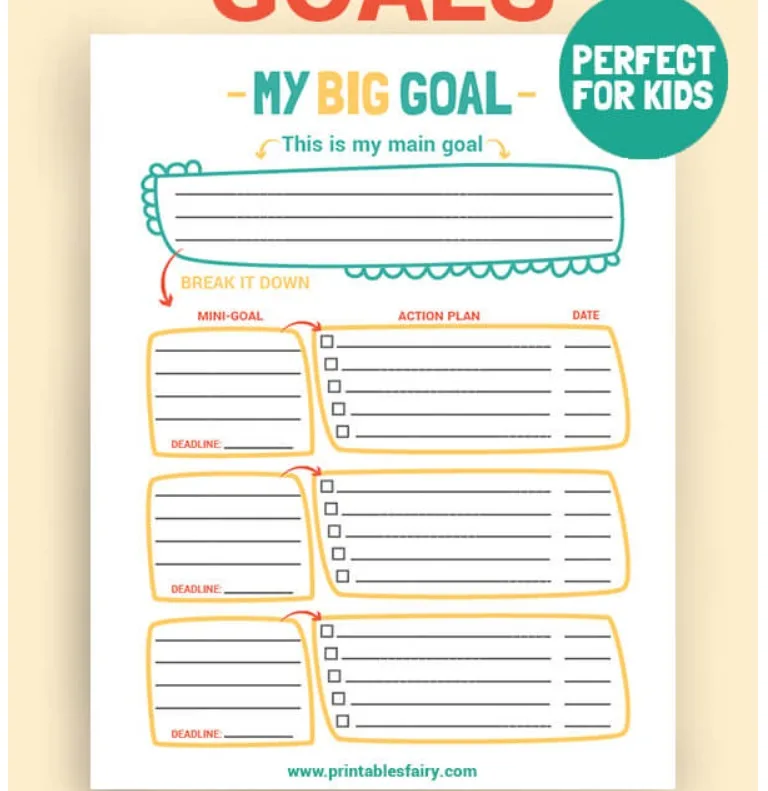

1. Goal Ladder Worksheet

Check out Printable Fairy's awesome printable goal sheets for kids. I just love how they encourage kids to take a big, main goal, and break that down into mini-goals with specific tasks.

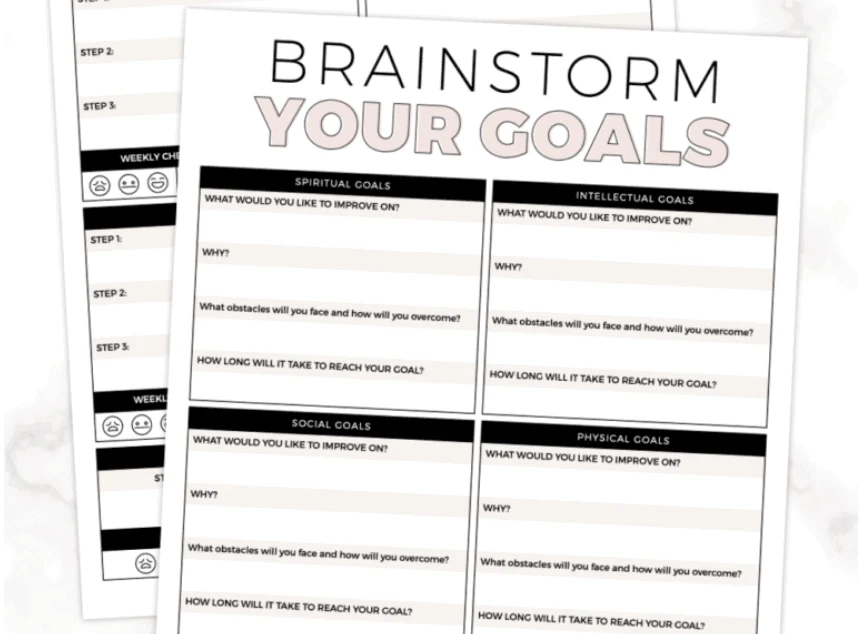

2. Simple Goal Brainstorming Worksheet for Students

Here's a simple goal-setting worksheet pdf that helps kids brainstorm what goal to set, and then brainstorm three action steps for each goal so that they know how to get started.

I like how it breaks goal setting down into categories, such as:

- Spiritual Goals

- Intellectual Goals

- Social Goals

- Physical Goals

- Financial Goals

3. Quick Win Savings Goal Worksheet

I teach kids about money, and so I love to focus on goal setting for kids. Why? Because you can anchor your entire child's money education with goal setting.

Your child needs to see that the process of setting a goal to save for and then to actually purchase – whether it’s something they want to be, do, or have – actually works.

If they see that it happens successfully one time, then they'll be more enthusiastic about trying it out again.

You'll need to eliminate as many kinks in this chain as possible for this to happen.

So, you want to steer their first savings goal towards the quickest win.

Think about it – most goals a child wants to obtain will cost them money.

Meaning, that they'll have to plan ahead and save money to be able to buy whatever resources they need or to actually buy the toy/video game/horse lessons/etc. that they want.

Psst: kid want an iPhone? Here's my article on how to save up for an iPhone as a kid.

The first step to figuring out the RIGHT savings goal for your child to use is to help them filter all of their wants/needs down to a quick-win one.

Goal Setting Action Step: To do this, use my Savings Goal Matrix. You’ll guide your child to fill in all of the wants they just wrote down according to how long each will take to save for, and how important it is for them to buy it.

Once they've gone through the goal setting for kids activity and they've got a savings goal, you'll want to check out my article on teaching kids to save money.

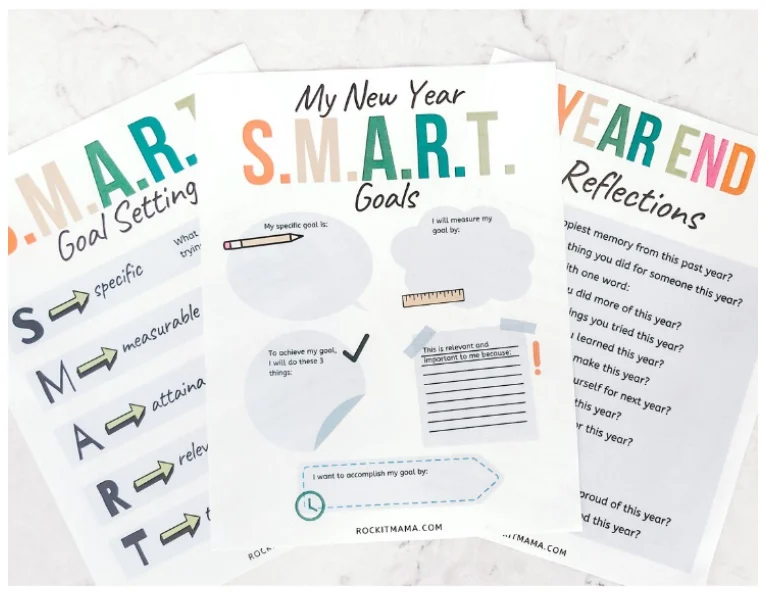

4. New Year's Reflection Goal Setting Worksheet

Rock It Mama's got an awesome SMART goal-setting worksheet for kids, centered around the New Year.

Kids are prompted to reflect on their past year, and then set SMART goals for the coming one.

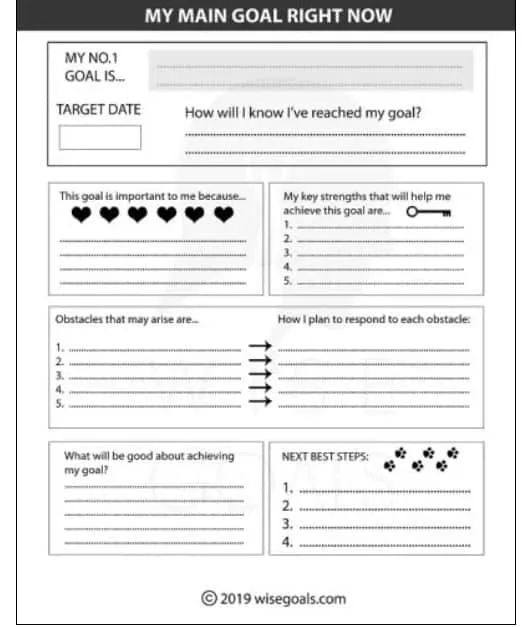

5. Simple Goal Setting Worksheet for Teens

I just love how simple this goal-setting worksheet is.

Teens and kids can use it to outline a goal, the strengths they have in achieving this goal, the obstacles they'll face and how to respond to those, and more.

6. Simple Goals Worksheet

This would be a great goal-setting worksheet for elementary students because it's simple and just helps kids write down the things in their heads that might turn into goals one day.

Let's face it: writing something down gives it power! Kids know that.

7. Goal Planner for Students

Your students can fill in daily and weekly tasks that will help them meet their goals with this set of goal planner worksheets.

Students can also use this for a New Year Resolution planner, brainstorming both goals for the New Year and actions they'll need to take to achieve them.

Psst: here's my list of 17 New Year Resolutions for Teens.

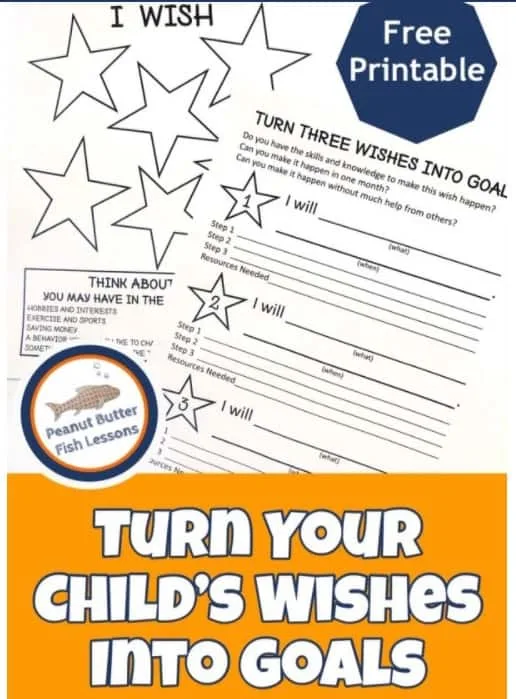

8. Wishes Into Goals Worksheet

Here's a really cute worksheet set that helps take your child's wishes, and turn them into specific goals they can work on.

I just love that, because every kid has a wish and may just not know how to turn it into reality.

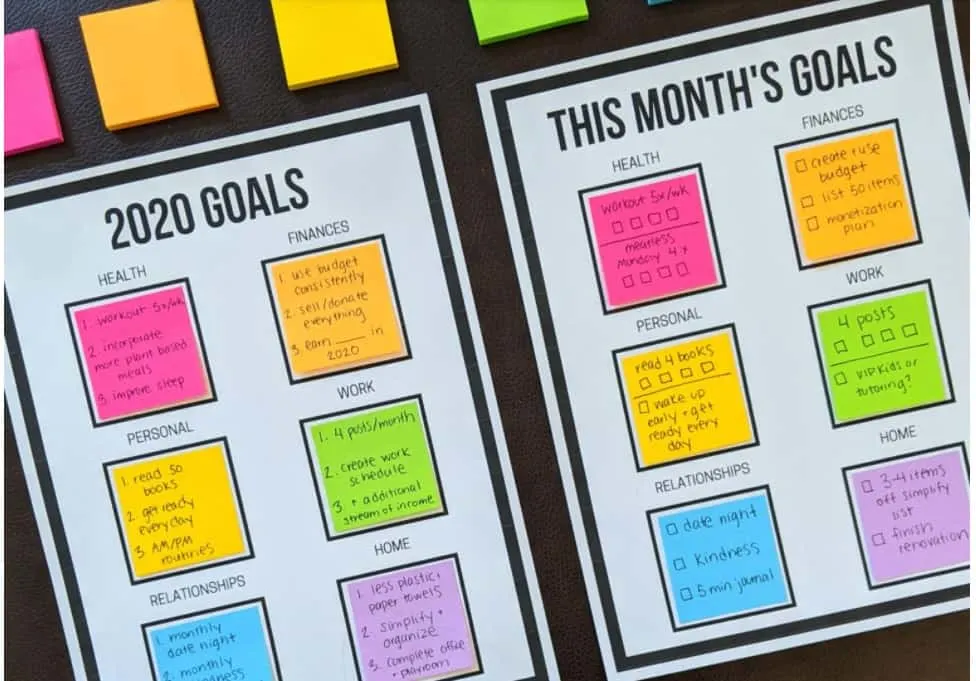

9. Post-It Note Goal Printables

I love me some Post-It Notes!

That's why I've included this free Post-It Note goal-setting worksheet in this list.

Kids can use the brainstorming worksheet that comes with this to set their goals, then print these out and write their goals down on Post-It Notes. This printable will help keep their goals front-and-center, and the Post-It Notes make it very changeable.

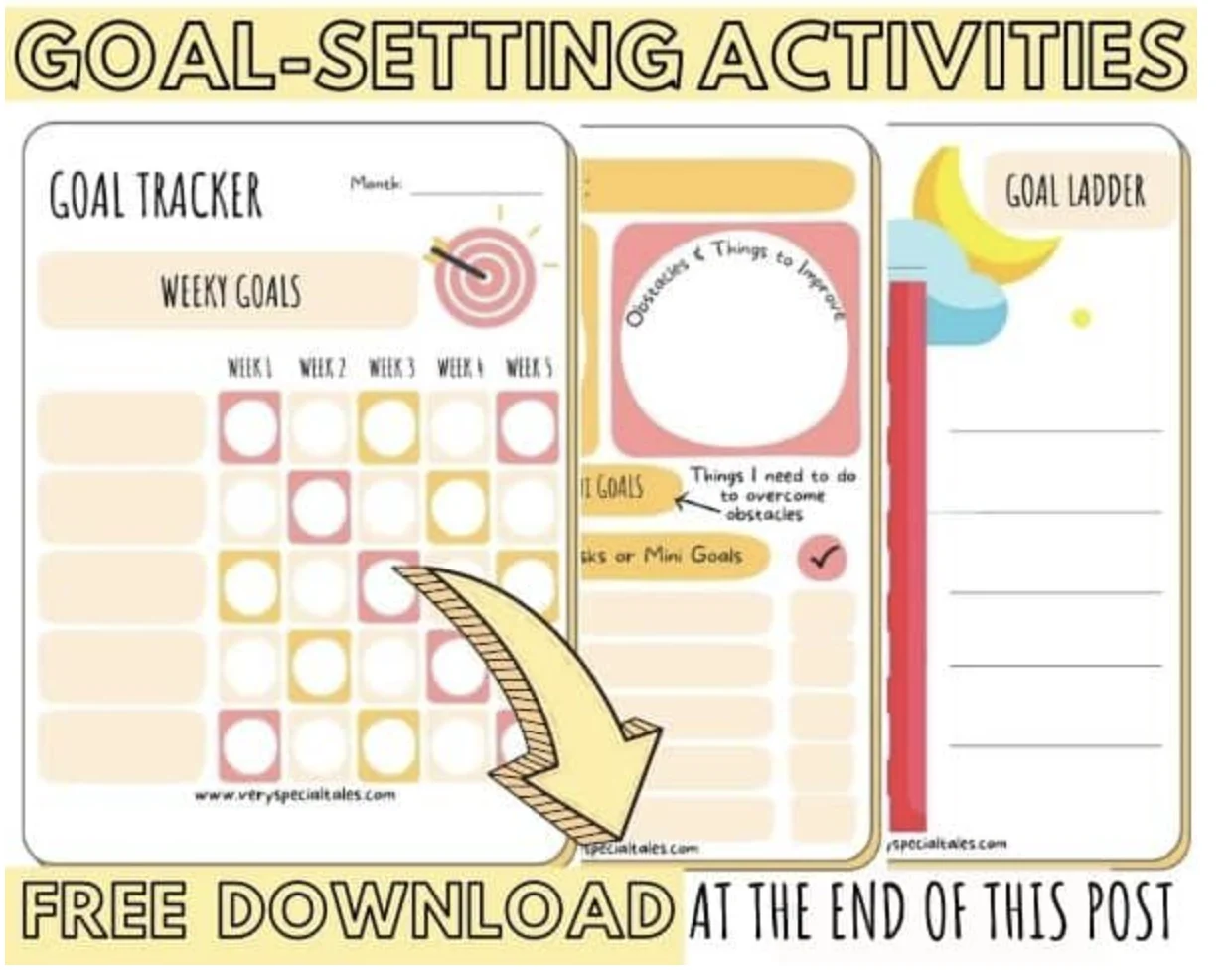

10. Kid's Free Goal-Setting Activities Pack

Included is a Goals Ladder, Goals 1-page Planner, and Goals Tracker worksheet.

11. Simple Goal Brainstorm Sheet

Can I just say how absolutely in love I am with this SUPER simple brainstorming sheet?

You could honestly use it to brainstorm anything, but its minimalist black design is very suitable for inspiring kids to brainstorm goals, too.

Amanda L. Grossman

Latest posts by Amanda L. Grossman (see all)

- 50 Banking Activities for Kids (Student Financial Literacy) - February 14, 2024

- 14 Christmas Activities for High School Students (they’ll Actually Find Cool) - December 1, 2023

- 3 Fun Selfie Scavenger Hunts for Teens (Christmas, Fin Lit, etc.) - November 27, 2023