Stock apps for kids that will help teach them how the stock market works, PLUS, let them make parent-approved trades.

Most parents understand the need for their kids to learn how to invest – they just don’t quite know how.

Or they have an idea of how, but taking action on it seems completely overwhelming.

That’s where these stock apps for kids come in.

Stock apps for kids:

- Give your child a platform to make parent-approved stock trades

- Teach your child how the stock market works

- Give your child practice before they start investing at all

Whether you’re looking for stock trading for kids, or apps that help teach your child about using the stock market, there’s an app for that!

Apps that Allow Kids to Buy Stocks (with Parent Approval)

What app can kids use to invest? You can use Greenlight, BusyKid, Acorns, or Stockpile.

We’ll go over the features of each, the cost, and what you can expect.

Also, each of these apps allow kids to buy fractional shares. This means they can buy part or a fraction of a share (without needing to save up enough to buy one whole share).

It also means they can choose a dollar amount to invest, and not have to calculate out the number of whole shares they can afford.

Greenlight App

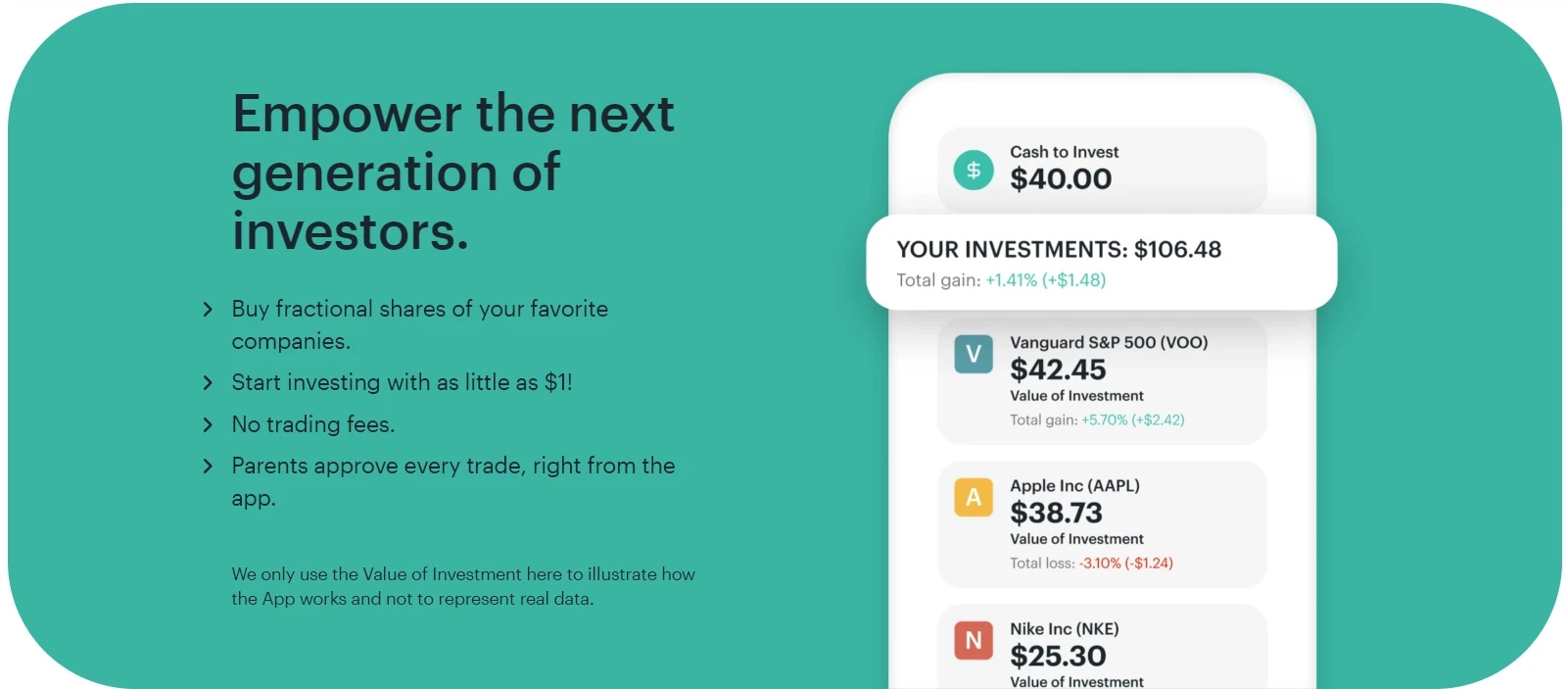

Kids can use the Greenlight app (with the Greenlight + Invest, or Greenlight Max plans) to research stocks, invest an amount of their choice, and track progress over time.

There are no trading fees, and parents must approve each stock purchase or trade before it actually happens (you’ll receive real-time notifications when your child is ready to buy or trade a stock).

There’s also an educational component to this investing app for kids – quizzes, and articles from investor pros that kids can read.

Updates to the stock values plus investment gains happen right on the app.

The Price: You’ll pay $7.98/plan, and kids can start investing with as little as $1.

Here's how you can get started.

Acorns Early

Acorns Early is a UTMA/UGMA account that’s built into the Acorn Family plan.

A few things make this stock app for kids different:

- All engagement with this app happens through the parent, not through the child.

- You cannot choose specific stocks to buy with this app – it’s 5 managed portfolios with various risk levels that you can choose from (aggressive to less aggressive). Stocks in Early accounts are automatically in their “aggressive portfolio”, FYI, and in order to change that, your ETFs would be sold and new ones purchased (a taxable event).

Contributions can be one-time, or set up as a recurring amount. Also, you can set it so that your spending round-ups are invested, too (once the round-ups amount to at least $5).

Children take over the account when they reach the “age of majority”, which is between 18 and 25 (depending on your state). Unlike a 529 education investment account where funds can only be used for educational expenses, a UTMA/UGMA account allows you and your kids to use the funds in any way that benefits them.

You cannot just open an Acorns Early account – you need to be an Acorns customer.

The regular account also includes:

- Access to Acorns Checking account with a debit card

- Access to Acorns Later accounts for retirement investing

- Access to Acorns Early accounts

- Etc.

The Price: The family plan with the Early account is $5/month, and it lets you open accounts for unlimited kids in your family. You can invest when you have at least $5.

Stockpile

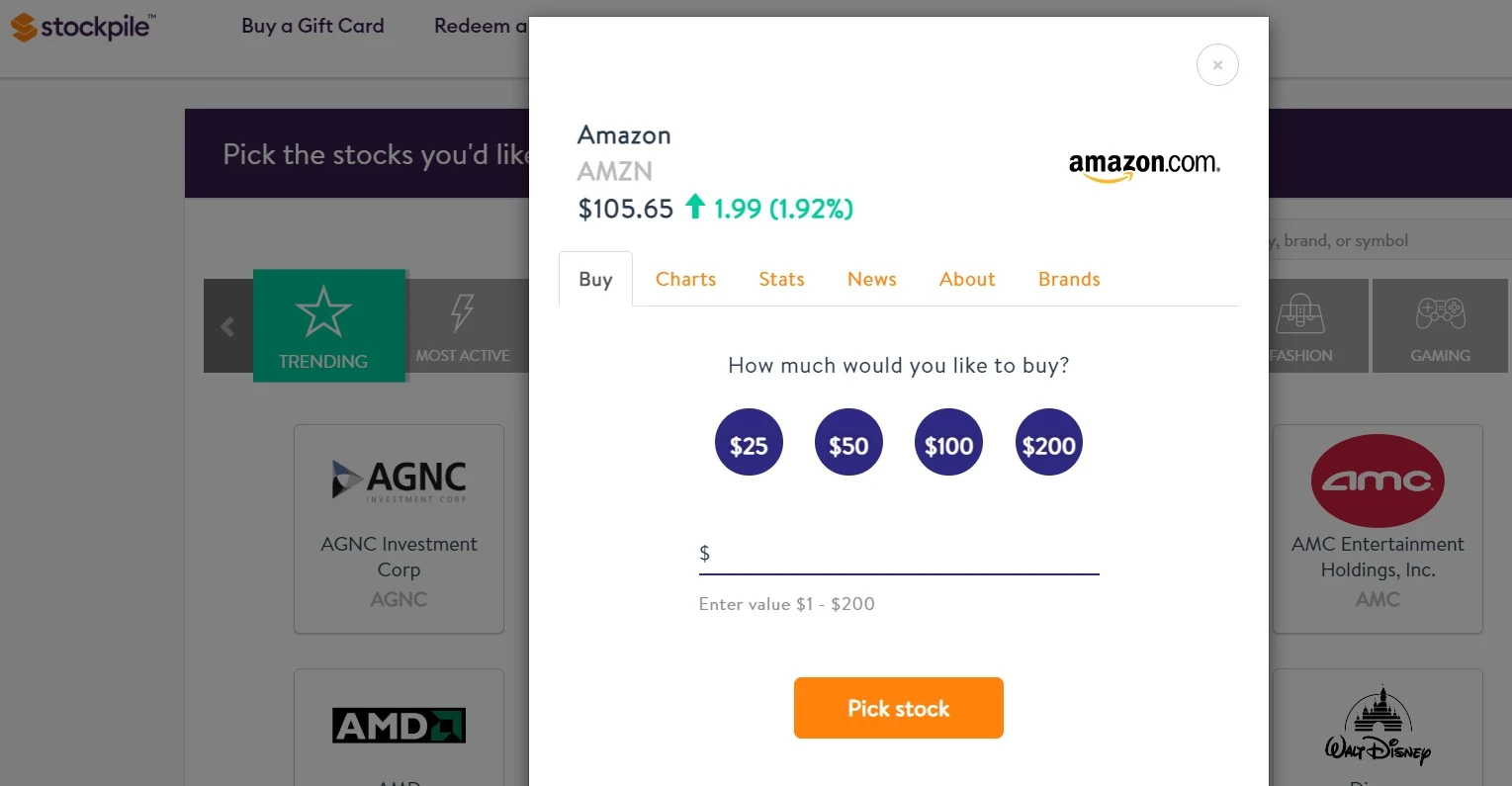

Stockpile is an online digital brokerage with custodial accounts you can open for kids and teens under 18.

Stockpile’s supervised custodial accounts allow your child to choose stocks they want to invest in, and then gain your approval before they’re allowed to do so.

Kids own the stocks and ETFs, but adults have control over (and legal responsibility for) the account until your child reaches the age of majority (between 18 and 25, depending on what state you live in).

I love that you can help kids expand or start their portfolio by buying them gift cards between $1 and $500 they can redeem for stocks (not available in Connecticut, FYI).

Know that fractional shares are bundled together until Stockpile executes the order at pre-set times, fyi.

The Price: $4.95/month, plus a $5 quarterly inactivity fee for accounts worth $20 or less. Kids can start investing with as little as $1.

Here’s the Stockpile App for iOS, and for Android.

BusyKid

BusyKid is a robust allowance and chore commissions tracking app, with a prepaid debit card and a money management dashboard.

They also offer unlimited investing with more than 4,000 companies and ETFs available, starting with just $10.

The cost is just $4.00/month when paid annually.

Stock Game Simulation Apps for Kids

You can read all about free stock market simulation games, here – they’re a great way to get your kid’s feet wet with the stock market, without the chance of losing heaps of money.

I’ll highlight the ones that come with an app, below.

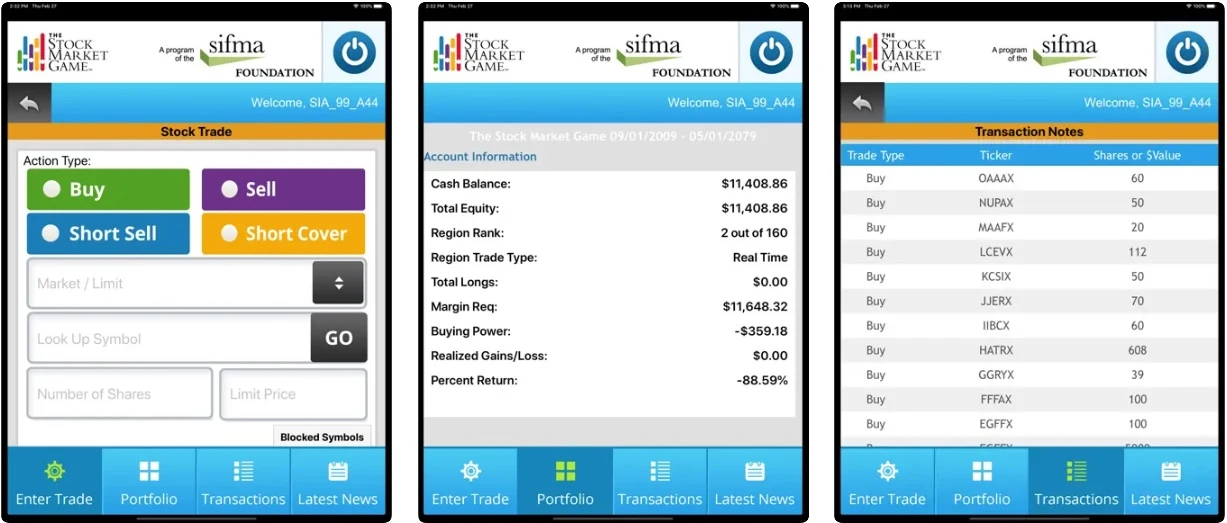

The Stock Market Game

Ages: Elementary+

The Securities Industry and Financial Markets Association (SIFMA) Foundation created this app to give kids and students $100,000 in virtual money to manage.

Students can compete as individuals, or in teams of 2-5 people. Only adults or educators can register, FYI, so if you’re doing this with your child at home, they would need to use your account.

Here’s The Stock Market Game app for iOS, and for Android.

Trading Game: Stocks & Forex

Ages: Not given. Definitely more advanced, so I’d suggest for teens.

I haven’t personally played this stock trade simulator, but it’s got impressive reviews that make me want to share it with you.

Students will learn all about the:

- Forex (Foreign Exchange)

- the stock market

- cryptocurrency

- commodities

- ETF trading

They’ll be given $10,000 in virtual play money to invest, and will work towards doubling it (or beyond).

Here’s the Trading Game: Stocks & Forex for iOS, and for Android.

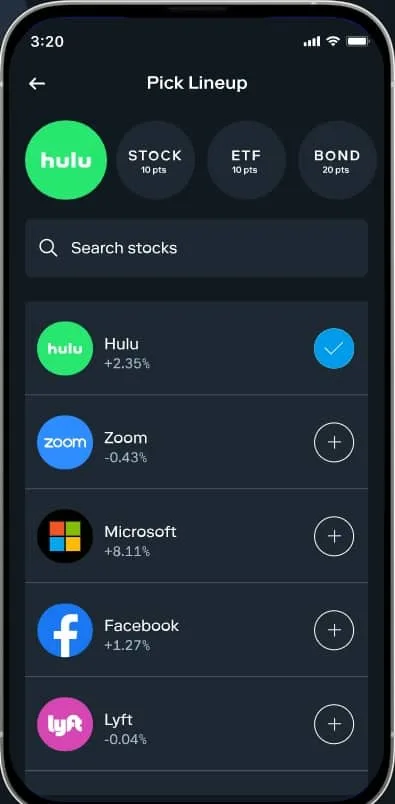

Stash101 Fantasy Investing

Age: 13+ years

There is one game per week, and it officially starts every Monday at 9.30am EST when the stock market opens and concludes on Friday at 4pm EST.

After your child downloads the app and registers, they are asked to draft a lineup of three stocks, one bond and one ETF into the game.

Game points are calculated based on the performance of your child’s lineup.

Hint: While cash prizes are given (by gift card) to the top 10 players at the conclusion of each week's game, you can only collect your prize if you’re 18 or older.

Here’s Stash101 Fantasy Investing for iOS, and for Android.

Apps that Teach Kids about Stocks and Investing

Do you want your child to get educated about the stock market (but not to actually start investing)?

Well, this is your section.

Hint: pair one of these apps with a stock app for kids that allows them to buy parent-approved stocks for to give them educational background on what they’re doing.

Learn Stocks: Investor’s Guide

Get 40 bite-sized lessons about how the stock market works, and how to invest in it from Emmet Savage.

Lessons are based on the following investment philosophies:

You’ll also want to check out these resources:

- How to Teach Kids about Investing (Tools & Resources)

- 9 Investing Books for Kids

- Stock Market Worksheets for Students

- 9 Investment Board Games for Kids & Teens

Stock apps for kids can do several things: allow them to make parent-approved trades and buys, educate them about the stock market, allow them to participate in a live stock market simulation game. Any of these avenues will help your child start to understand investing, so just get started!

Amanda L. Grossman

Latest posts by Amanda L. Grossman (see all)

- 50 Banking Activities for Kids (Student Financial Literacy) - February 14, 2024

- 14 Christmas Activities for High School Students (they’ll Actually Find Cool) - December 1, 2023

- 3 Fun Selfie Scavenger Hunts for Teens (Christmas, Fin Lit, etc.) - November 27, 2023

Yvonne

Friday 24th of June 2022

What about Robinhood?

Amanda L. Grossman

Friday 1st of July 2022

Just received their reply! They confirmed that "Robinhood Financial only supports individual brokerage accounts. At the moment, we don’t offer joint accounts, trusts, or custodial accounts but we hope to in the future". I hope that helps.

Amanda L. Grossman

Friday 1st of July 2022

Hi Yvonne! Thanks for reaching out. Most of the research I did showed that Robinhood does not have custodial accounts (and you have to be 18 or older to use their platform); however, I've got an email in with their customer service and will update after I hear for sure.