Budget games offer students and teens the opportunity to try out spending decisions without repercussions from real life. Check these budget games for youth out!

What better way to introduce a child to budgeting than with a fun board game?

Even better – you could use one of these budget games for youth alongside them filling in their own budget sheets.

Here are:

That way, they’re self-discovering budgeting money lessons both from the budget board game AND from actually budgeting in real life.

Now, onto those budget board games – including free budget printable games, budget board games, and budgeting games for youth online.

Budget Games for Youth (Free Printables)

There are some great, free, budget games for youth out there that I’d like to highlight in this section.

Psst: you'll also want to check out my tutorial on budgeting for kids.

The Bean Game Activity

Think of beans as money, and each student gets to figure out how they’d like to spend the 20 jelly beans they start this game with.

There are “musts” that students will need to spend their beans on, and then there are other categories that they get to choose if they want, or not. Just like in real-life budgeting!

They also provide some great discussion questions, such as what tradeoffs students were willing to make to afford other things, what difficulties they felt during the process, etc.

Hint: if you want to give students a taste of joint spending decisions (like the kind they’ll encounter with a partner or spouse one day), then pair them up with another student to work on this together.

Teen Budgeting Game

Here’s a mama who took control of her fears that her teens didn’t know how to create a monthly budget…by creating her own game for it.

And, it’s now a free printable anyone can download to use!

This is a budget simulation game, where teens are given a $300/month income to use to make financial decisions.

Not only does this game care about bills being paid and savings accounts increasing in size; but you also get social well-being points depending on how a teen spends their money.

There are 9 budget categories:

- Savings

- Rent + Heat + Electricity + Internet

- Food

- Car + Gas + Insurance

- Cell Phone + Service

- Movies + Shows + Entertainment

- Eating Out + Coffee Shops

- Clothes

- Miscellaneous

Each child gets a Budget Options Sheet, which has three different options for each budget category that they can choose from. Everyone goes through 12 rounds, or 12 months, of decisions.

For example, for the Food budgeting category, they can choose to spend either $40, $60, or $80 for the month – depending on what type of food they want to eat (inexpensive, all the way up to groceries from the “luxe grocery store”).

The winner of the game is the person who ends with $450 or more in savings, AND, a social well-being score of at least 96.

The Jelly Bean Game

Another bean budgeting game!

Kids are given a 20-bean-per-month salary and need to make spending decisions using up all 20 beans.

What makes this one different from The Bean Game Activity – aside from the cute printables – are the life issues and circumstances being thrown at teen teams who are playing it.

For example, one month you might find out that someone in your family broke their leg. If you used part of your salary to pay for insurance that month, then you’re good to go. Did you skimp on insurance? You lose 3 beans.

Psst: want to take things online? Check out these free online financial literacy games for elementary students.

Don’t Bust Your Budget Game

Here’s an adorable, printable budget board that also uses jelly beans to stand in for money.

Players get to decide how they will spend their budget, though there are required categories (such as food and rent) that they have to spend some in.

Kind of like real life, right?

There are 4 rounds of play, with a specific discussion question after each round.

A scenario is thrown to the players each round as well, and depending on their choices, they’ll be in for a reward, or a penalty.

Psst: Looking for more budgeting activities? Here are 12 fun budgeting activities with PDFs.

Budget Board Games

Looking for a great budget board game to help your child self-discover some important money management life skills?

I’ve got several to check out (and I’ve personally tried each of these).

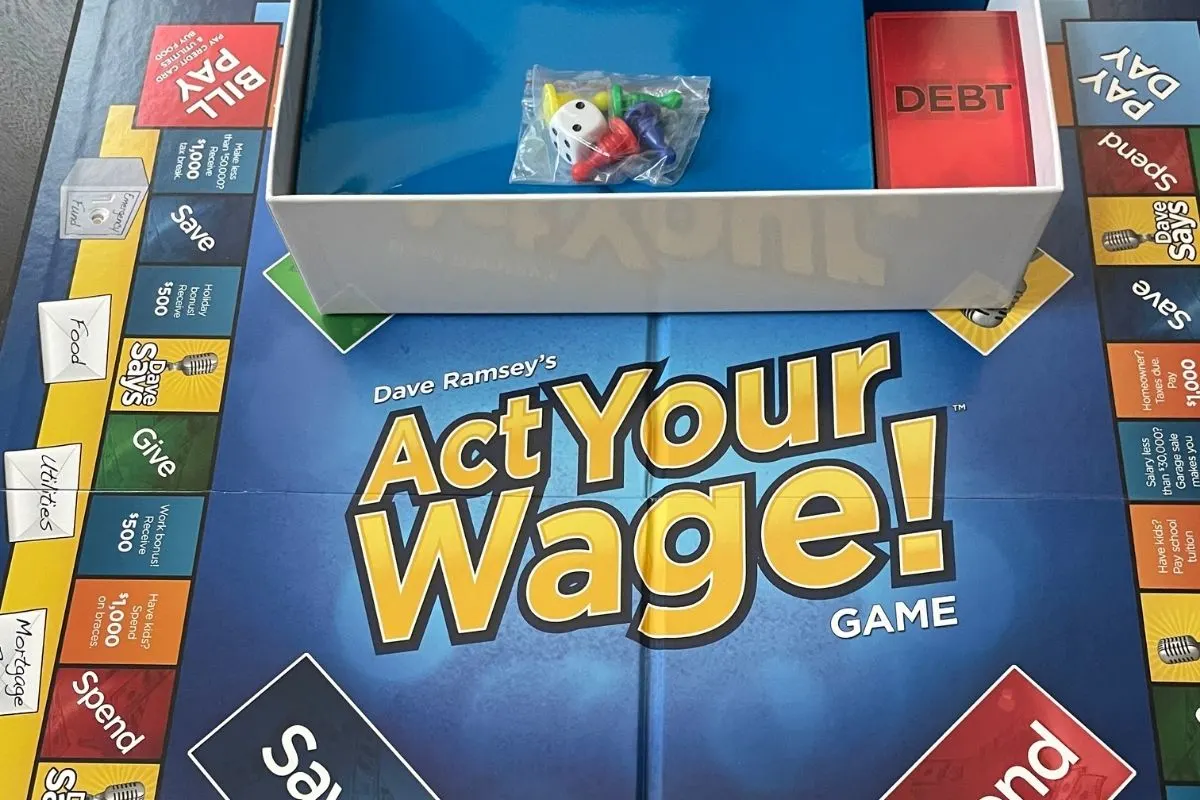

Act Your Wage!

Get ready to put your kids into debt…because everyone who plays this game starts off in debt!

You get a “Life” card that tells you how much you earn for a living, what you do, what your family life looks like, and your monthly expenses.

In typical-Dave-Ramsey-style, the focus of this game is getting gazelle-intense to pay down that debt you’re given as a new player (each player has to pick 3 debt cards).

However, just like in real life, you can’t just spend all your income on paying down debt. You must budget both for real-life monthly expenses, as well as for paying down that debt.

The first person who gets out of debt and can yell “I’m Debt Free!” wins the game.

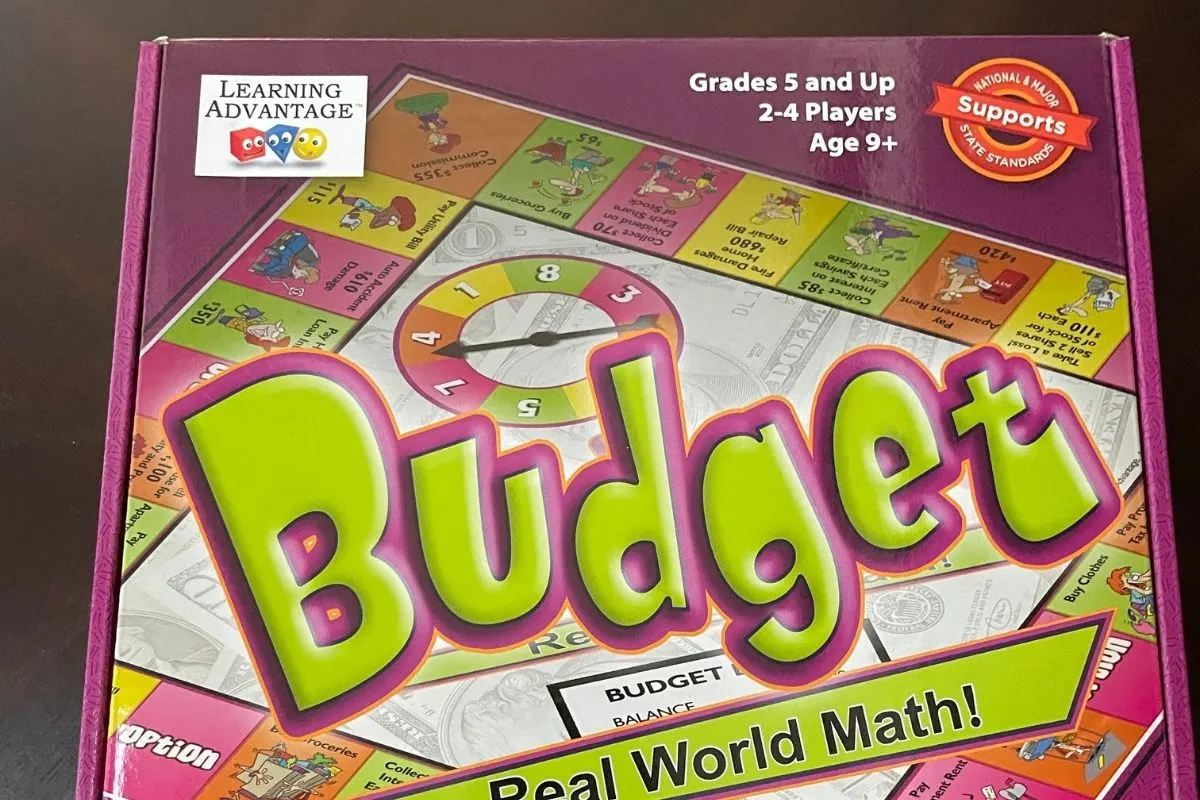

Budget – Real World Math

Here's a twist on the “traditional” budgeting games out there – in this one, kids will need to plan their budget before they actually get to Payday on the board.

They’re actually making a prediction about how much they’ll need to budget.

And if they are “reasonably accurate”, then they get a bonus on payday!

Good news is that players can adjust their budgets for each payday, meaning they can learn to get more and more accurate when it comes to estimating their spending needs.

The player who reaches $6,000 in net worth first, wins.

Next up – let’s look at free budgeting games online for kids.

Budgeting Games for Youth Online

Here you’ll find the best budgeting games for youth online, including online budget simulation for high school students and middle school students.

Lights, Camera, Budget

Here’s a great example of learning how to budget by budgeting an event.

In this case, your kid, tween, and teen get a $100,000,000 production budget to produce a five-star rated movie.

Each question that the student answers correctly gets them more of that $100,000,000 budget to produce their own movie!

Students will answer a total of 15 financial literacy questions, and make 12 movie-related decisions (like decisions on marketing, actors, etc.) that will determine if they can, in fact, produce a 5-star movie.

Tip: There’s also a teacher’s guide you can download!

Claim Your Future

Students are randomly assigned a career and salary, and must then create their own spending plan around the money they have.

For example, when I played, I was a bicycle repairer with an annual income of $26,990 (monthly take-home pay of $1,174).

I was then given the decision of different types of housing with various costs (from renting a room from my parents, all the way to owning a home), and other types of options in each of the following categories:

- Savings

- Food

- Transportation

- Communication

- Extras

I love how there’s a slider bar tracking your decisions as you make them, showing you how much of your monthly income you’ve spent and how much you have left to go. Very eye-opening!

Reality Check

This game uses national averages for salary and costs to help students determine how much their “dream” adult life will cost…and if they can actually afford it.

Budget categories kids fill in:

- Shelter

- Transportation

- Utilities

- Communications

- Cable/Internet

- Personal

- Miscellaneous

- Student Loans

Once kids make their choices for what quality they want in each category, they then fill out how much they’ll spend on that choice each month (take a guess).

Then, they hit “See Reality”, and are shown how correct, or how off, their money reality is from their life choices. In other words, it shows them how much they would have to work and how much they would need to earn in order to afford the lifestyle choices they’ve just made.

Hit the Road Financial Adventure

Kids are going on a cross-country trip with this online game, and they need to figure out how to budget for it.

In fact, they have to take out a $500 loan for the trip and make payments on this loan while playing the game.

While heading to Colorado to ski, kids will really need to focus on spending money wisely so that they can stay fed, keep gas in their car, and make it to their destination.

By the time the player gets to Colorado, they need to still have $500 left in their funds so that they can rent ski equipment and enjoy their trip.

Budget games are such a great way for kids and teens to start self-discovering important things about how to budget and manage your money as a kid (and beyond) – without risking entire paychecks if they make poor choices. So, help them get their feet wet by choosing one of the games above and going with it!

Amanda L. Grossman

Latest posts by Amanda L. Grossman (see all)

- 50 Banking Activities for Kids (Student Financial Literacy) - February 14, 2024

- 14 Christmas Activities for High School Students (they’ll Actually Find Cool) - December 1, 2023

- 3 Fun Selfie Scavenger Hunts for Teens (Christmas, Fin Lit, etc.) - November 27, 2023