Looking for fun budgeting activities PDFs? You'll love this collection of budgeting scenarios for high school students, and money management worksheets for students (PDFs).

Teaching students how to budget doesn't have to be a drag, especially if you do it through fun budgeting activities.

But, have you noticed how difficult it is to find GOOD, fun budgeting activities with PDFs?

After spending a few hours scouring the internet, searching for the best FREE options out there, I've now become aware of the problem.

Still, there are some good options you should know about (plus, I'm releasing my own — for free!).

Fun budgeting activities (with PDFs) and money management worksheets for students are two of the best ways to teach your kids and teens about money.

Budgeting Scenarios for High School Students (PDFs to Print)

I'd like to start this list off with my own budgeting scenarios I created for high school students (parents, you can use these, too!).

This budgeting worksheet for students (pdf) was originally part of my Money Prodigy Online Summer Camp, but I'm carving it out for you to use, for free.

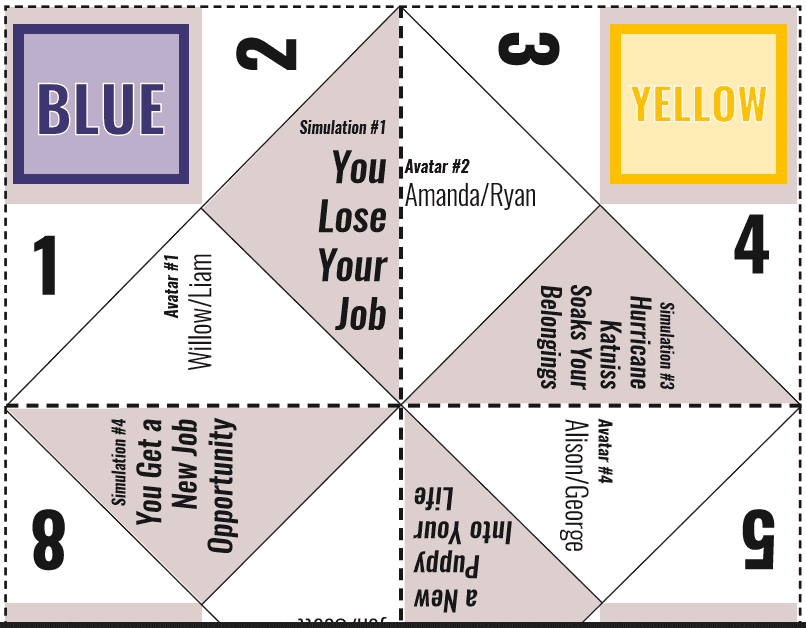

Here's how this works:

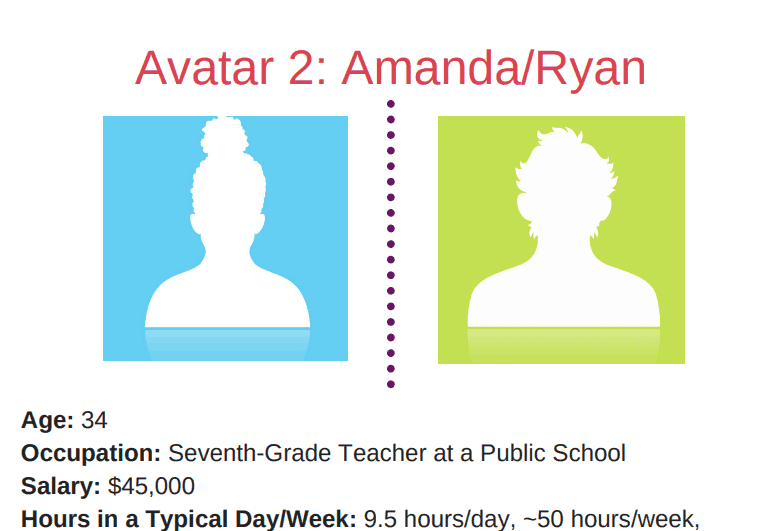

Your child uses a fortune teller (free printable) to determine which one of 4 Avatars they are. The avatars have both a female and a male name, but the information is the same — so it doesn't matter if a boy or a girl gets that avatar.

They read up on their salary information, budgeting information, and general financial information. Each avatar is at a different stage in their career, and in a different stage of life (so lots of possibilities to play several rounds of this).

They fill in a budgeting sheet based on the information they've been given.

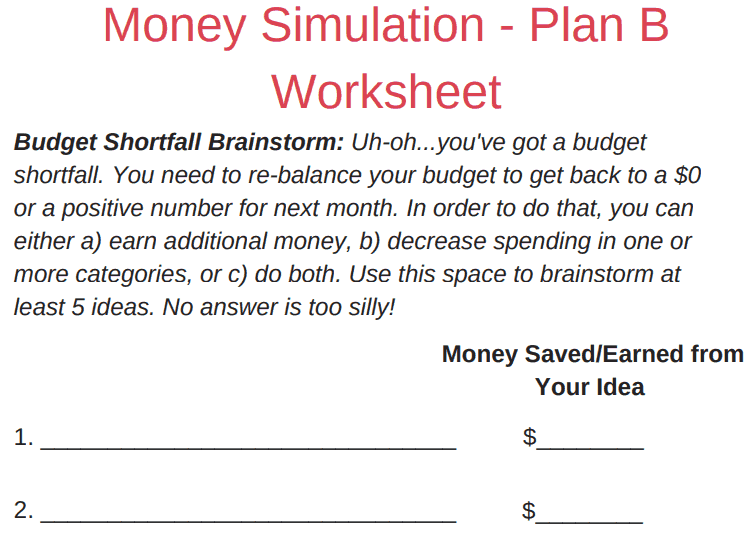

Then, the simulation really begins. They take a turn with the fortune teller again, which spits out a a real-life scenario. Once they figure out what their new situation is, they need to deal with it within their current budget constraints.

Your students then fill in follow-up questions and information about how things went for them.

Other resources for you:

- How to Teach Budgeting (from Beginner to Advanced Levels)

- 6 Budgeting Projects for Middle School Students

- 4 Budget Projects for High School Students

- 11 Teenage Budgeting Tips

- How a Teenager Can Improve their Budget

- Prom Budget Planner

Alright…let's move onto many more fun budgeting activities with PDFs and financial scenarios for students.

Fun Budgeting Activities (with PDFs)

Fun budgeting activities (PDFs you can print) will not only begin teaching your students and kids how to budget for specific events OR for life, in general, but it will make the process entertaining.

Heck, your kids might beg for more money activities after you introduce a few of these fun budgeting activities below.

Psst: you might want to check out my comprehensive article on budgeting for kids, and the best teen budget worksheets.

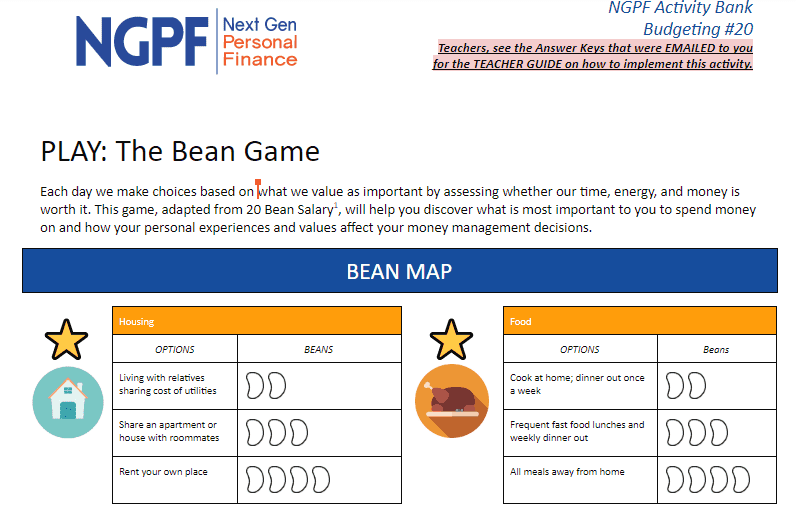

#1: Next Gen Personal Finance’s Bean Game

Suggested Age Range: Not given.

I just love this – every student receives 20 beans, as well as a game board that shows a cost (in beans) for different spending and saving categories. Students must decide how to spend their 20 beans across all categories.

What might trip your students up? There are starred categories that are “musts”, so your student has to spend some beans in those.

In midway through, if you want to really shake things up, the creators of this game suggest telling your students that they’ve been demoted or downsized at work and now only have 13 beans – they must remove 7 beans from their boards.

This is an individual activity, but can easily be used in groups of 2 as well.

#2: ConsumerFinance.gov’s Bouncing Ball Budgets

Suggested Age Range: 13-19 years

What I like about this spending activity is it has a physical component. Meaning, kids get into a group and throw a ball to one another. The number that is closest to their right index finger (the ball has numbers on it) corresponds to a question about spending habits.

The student then has 30 seconds to answer the question, which will help them analyze their own spending habits.

Example questions include:

- Give an example of a big expense you’ve had to save money for.

- Give an example of why you might call yourself a saver or a spender.

- What do you find hard to resist spending money on?

#3: Design Mom's Teen Budgeting Game

Suggested Age Range: For teenagers.

In just an hour of play, your students and teens can go through 12 months on a budget. New challenges are thrown there way for each month, such as being fined for a traffic ticket, or earning an extra $5 in interest on savings.

Teens are given $300 each (remember, this is a game, not the real world!), and must satisfy 9 different budgeting categories ranging from rent to movies.

Free printables include:

- Budget Worksheet

- Banker’s Instructions

- Explanation of “Budget Options”

The goal of the game, or how to win? Is to end the game with $450 in savings PLUS a “Well Being” Factor of 96 or higher.

Psst: Here's more budget games for kids and teens to check out. Also, here's 19 free financial literacy games for high school students.

#4: Scholastic's Trip-Planning Simulation

Suggested Age Range: Grades 6-8

Take your students through a trip-planning simulation to teach them how to budget for something. Scholastic provides free printables, including:

- Project Outline: Going On Vacation printable

- Calculating Vacation Costs Worksheet

Part of your prep is coming up with a list of 6 different resorts they can choose from. Students then must come up with both distance and costs when planning a trip to one of those locations, all while staying within the $4,500 budget they have.

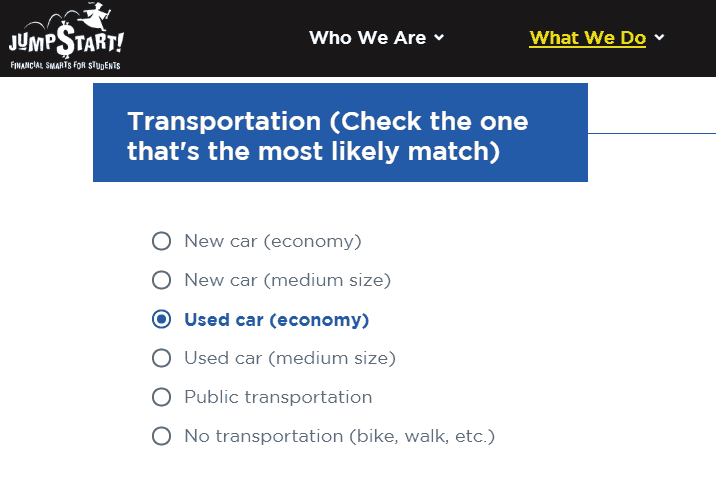

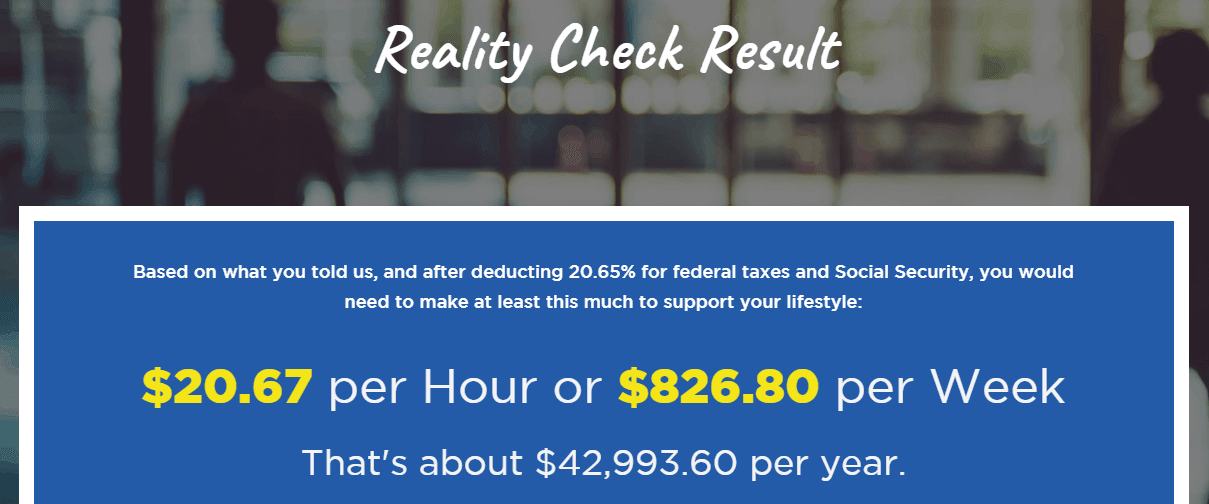

#5: Jump$tart’s Reality Check Activity

Suggested Age Range: Not given.

A fun activity to kick-off money lessons or a money unit would be to have your students go through this Reality Check calculator.

They get to answer various questions (there are only 10) about the type of lifestyle they want to live, and then fill out estimated amounts they think they’ll spend each month for specific budget categories.

Then the “reality” kicks in when they see what kind of income they’ll have to maintain in order to live that lifestyle.

Suggestion: perhaps you can set this reality check game up on computers as a transition activity for students, OR, as one of your various money centers for the day.

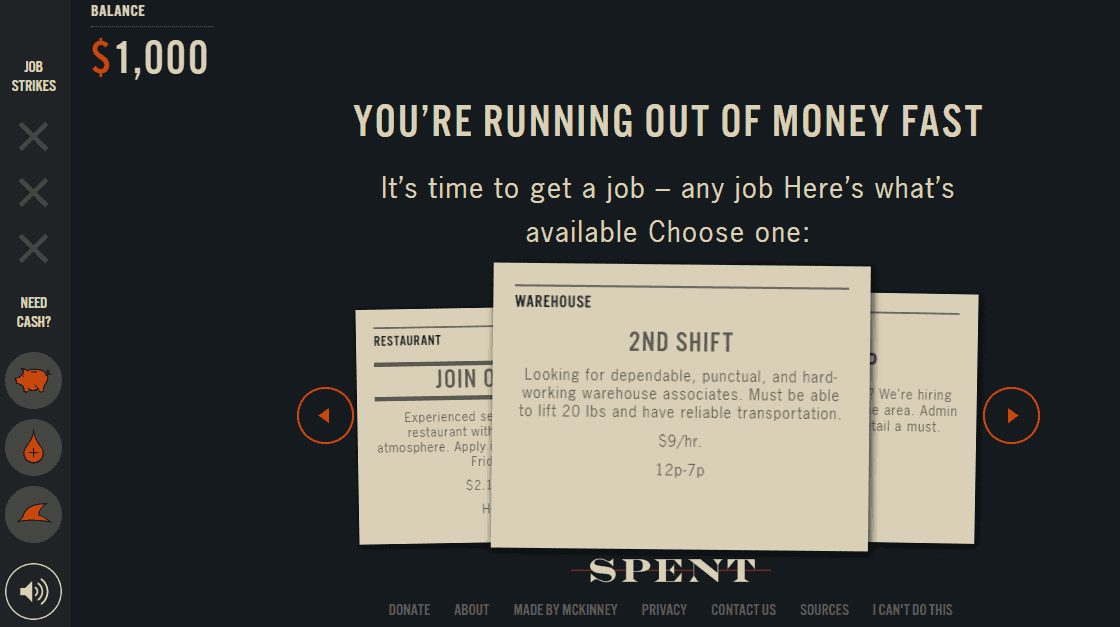

#6: McKinney’s PlaySpent.org

Suggested Age Range: Not given.

Here’s an interesting budgeting game for students to play, that will also increase their awareness of how hard it can be to survive without a job.

They are given the scenario that they are down to their last $1,000 since losing their job. The object of this game is to use that $1,000 as wisely as possible so that they can live with it over one month.

#7: FinanceintheClassroom.org’s Investigation of Regional Housing Costs

Suggested Age Range: Grades 10-12

What I love about this budgeting scenario is that they actually created it – I’ve been talking about how important it is to research cost of living before moving or accepting a job offer somewhere for years.

Mostly because, I’ve had personal experience from it! In my mid-20s, I took a job in Palm Beach Gardens, Florida. While I learned a lot at the job (I was eventually laid off from it), the fact is, I didn’t save any money (outside of retirement) during those almost two years because the cost of living was just too high.

With this budgeting scenario, students are asked to look at the finances and situation of Trish and Scott who want to move from Annapolis, MD to somewhere else for a job offer.

Students then must analyze the housing costs for one of their new job offers and see if they can or cannot afford to accept the job and move there.

Such a valuable financial lesson to learn young (especially since because young adults are least able to afford high-cost-of-living areas).

#8: Sarah and Jessica's Jelly Bean Game

Suggested Age Range: Not given.

Group students together in sizes of 2-4, and hand them 20 jelly beans in total (tell them not to eat them!). The group then collectively decides how they'd like to spend those 20 jelly beans, based on money values, spending needs vs. wants, etc.

For each round they go through, they'll deal with different scenarios, such as someone's leg breaking (did they choose to spend on insurance?), or getting a raise at work.

Now, let's move onto money management worksheets.

#9: Budgeting a Trip in Rural Setting Vs. City Setting

ConsumerFinance.gov has these two lesson plans that are exactly the same…except where the students plan a trip to: rural or a city location.

I say, why not take this a step further and show your students one aspect of cost-of-living by having them budget out BOTH a trip to a rural setting AND a trip to a city setting?

Then, they can compare the costs of each and discuss why one is (most likely) costlier than the other.

Money Management Worksheets for Students (with PDFs)

I love that you're looking for money management worksheets for your students — it means you care about their money future!

After hours of research, I've curated a list of free printable money management worksheets (available in PDF format, so you can easily print them out), that, in my opinion, are the best available.

#1: Practical Money Skill’s The Art of Budgeting

Suggested Age Range: 14-18 years

What I specifically like about this lesson is the “Rework a Budget” section, found on Page 11.

Students are given the chance to budget for a girl named Gabrielle. And then, they’re asked to rework the budget once her month actually played out – which is such a great lesson because, let’s face it, planned budgets and planned spending is often not what happens in real life.

Yet, you want to teach students to learn early on that just because your planned spending and your actual spending aren’t the same, doesn’t mean you should give up on budgeting.

Instead, rework it! They’ll get better and better with doing that, the more they budget.

#2: Second Harvest Food Bank’s Shopping on a Budget Activity

Suggested Age Range: Not given.

I don’t know that I would call this budgeting activity fun, but eye-opening? For sure.

This budgeting activity for students attempts to bring awareness to how difficult it can be to feed your family nutritious food on a low budget.

#3: ConsumerFinance.gov’s Create a Savings First Aid Kit

Suggested Age Range: 13-19 years

One of the most valuable parts of this activity is having students complete the simple acts of:

- Brainstorming possible unexpected expenses that pop up in life

- Determine if those expenses are an emergency, or not

Simple, but effective.

I hope you've found some awesome fun budgeting activities, budgeting worksheets for students, and budget scenario activities you're going to give a try with your own students and kids. Let me know how it goes in the comments below!

Amanda L. Grossman

Latest posts by Amanda L. Grossman (see all)

- 50 Banking Activities for Kids (Student Financial Literacy) - February 14, 2024

- 14 Christmas Activities for High School Students (they’ll Actually Find Cool) - December 1, 2023

- 3 Fun Selfie Scavenger Hunts for Teens (Christmas, Fin Lit, etc.) - November 27, 2023