How can a teenager improve their budgeting skills? Common teen budgeting problems, and some solutions to help.

How can a teenager improve their budget? By taking their teen budgeting problems, and turning them around.

I can guarantee you that any teenager is going to come up against at least one (and usually many) of these teen budgeting problems.

So instead of seeing them as insurmountable obstacles – or worse, as a reason to stop budgeting altogether – I want to show you how to use them to help a teenager improve their budget skills.

Common Teen Budget Problems

How can a teenager improve their budget?

I’m about to list lots of teen budget problems your own teenager may be grappling with either now, or will grapple with in the future.

But don’t let these discourage you – budgeting is a learned skill. And I’m going to show you how to take some of the worst budgeting problems, and turn them into new budgeting skills.

Hint: you'll also want to check out my article on how to teach budgeting, from beginner to more advanced skill levels.

1. They Look at Budgeting as a One-Time Thing

Your teen filled out their budget worksheet. Hurrah!

That’s it…right?

Totally not.

In fact, the learning is really is in the follow-up, when they come back to that worksheet at the end of the budgeting cycle (hopefully, just one week – we’ll discuss this soon), and then figure out their leaks, leftovers, etc.

And then create their new budget based off of their learnings.

If they see their teen budget worksheet as more of a fixture then a working, living, document, then they’re going to miss a lot.

Budget Skill they Need to Work On: Budget Tracking/Tracking Spending

Try this: You want your teen to see the budget worksheet as a starting point, and to refer to it after they fill it out. At the end of their budget cycle (1 week, bi-weekly/by paycheck, monthly), have them come back and fill in how they actually used their money. Then, they need to do a few calculations to see how this compares to how they planned to use their money. How much do they have leftover to put into their budget worksheet for their next budget cycle?

This is so important to your teen improving their budget skills, that you’ll find columns for each of these follow-up questions in my free teen budget worksheet (actuals vs. planned):

2. Don’t Know how to Deal with Inconsistent Income Sources

Have you ever tried to budget with inconsistent money coming in? It’s challenging.

Many times, kids have an inconsistent “income” source. This could be from an inconsistent allowance, earning various amounts on chore commissions, only getting money for special occasions (such as a birthday, Christmas, graduation, etc.), etc.

It might be enough to discourage them from even trying to budget…because they think “why bother?” Especially if they didn’t receive the income they thought they would, after spending time filling in a budget.

Budget Skill they Need to Work On: Estimating income to come in

Try This: You want them to create a baseline budget to work from for the week. This means, help them to average together what they usually have each week to spend, given the last 4 weeks or so. Is it around $20 a week? $50/week? $150/week from tips? Use this number. It won’t be perfect, but it’s a way for them to be able to move forward with learning important budgeting skills.

3. Trouble Translating their Budget to Real Life Money Management

A budget is only as good as how it helps someone out in real life. In other words, if you fill in a budget sheet but you don’t actually do what you say you will do, or use it as guidance, then it doesn’t do a whole lot of good.

Budget Skill they Need to Work On: Handling and managing money from a plan

Try This: If your teen is dealing with going over budget in several categories, then have them use money envelopes with clearly marked spending categories on the outside. They’ll fill these envelopes each week after writing up their budget, and then try to stick with the rule that once the money in that envelope is done, the spending in that category is done.

Psst: curious about common adult budgeting problems? Here's an adult list of common budgeting mistakes.

4. Failing to Look Past this Week, or this Allowance

Your teenager may be budgeting for one week at a time, but they need to think beyond just this week’s budget.

That’s because stuff that’s coming down the pipeline over the next month – cell phone bill that’s due, babysitting opportunity, class trip, etc. – will affect this week’s budget. And this week’s budget, will affect the next several weeks.

Doing this is really ground zero for them learning how to plan spending.

Budget Skill they Need to Work On: Planning Ahead

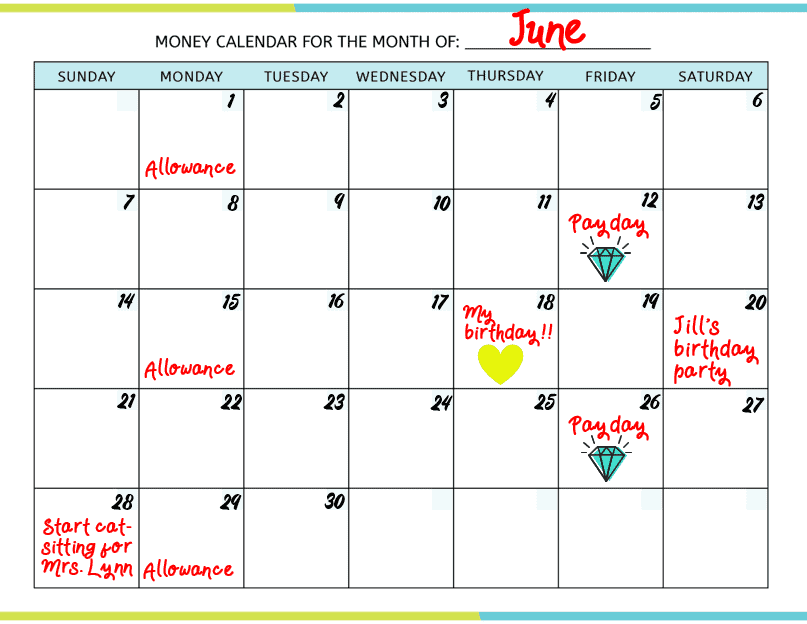

Try This: Download my free teen budget worksheet, which comes with a monthly money calendar. Each time your teen budgets, have them fill in the calendar first – they’ll need to know when they expect money to come in, when bills are due, when they have specific purchase occasions, etc.

5. Not Budgeting at all Because they have Little or No Income Coming in

Budgeting skills are scalable (OR budgeting is a scalable money skill).

If you learn to budget with a small amount, then you’ll know how to budget when you have a large amount. The amount is irrelevant – it’s all about learning the money skill as soon as you can.

Budget Skill they Need to Work On: Consistent “income”.

Try This: Have you figured out a kid money system, where your teen is getting consistent income into their hands (either through an allowance, chore commissions, etc.)? OR, is it time for your teenager to get a job and earn their own pay? Either of these can lead to you introducing a new rule that they need to budget for this new money coming in.

6. They Messed it Up, and Never Turned to Budgeting Again

They tried once (or twice), messed things up pretty good and got nowhere near the amount they allocated for savings actually TO their savings account, or overspent all over the place…so they’ve written off budgeting all together.

Budget Skill they Need to Work On: Building their money confidence

Try This: This one’s a tough one – because at the end of the day, you have to convince your teen to try again. First of all, you could start with a money mistake story of your own. How you gaffed something up when you were their age, or a little older. Then, you can start them budgeting again, but with the end goal of budgeting FOR something they want. Something specifically – use the savings goal tactic from #9 to do this. See if that piques their interest enough to try again.

7. Making their Budget Cycle Too Long

Trying to budget money for two weeks or a month at a time, and giving up because they run out of money wayyyy before the budget cycle renews.

Who hates sweatin’ it until payday?

Budget Skill they Need to Work On: Choosing a budget cycle duration

Try This: They need to be able to refill their budget categories and spending ability sooner rather than two weeks or a month from now. SO, have them fill out a weekly budget next, and refill their money envelopes or whatever else they use for spending.

8. Feeling No Purpose with Money, and No Enthusiasm for Budgeting

Are you more excited about your teen budgeting than they are?

Some teens feel no sense of purpose with their money, no excitement for budgeting, and spending is just willy-nilly.

This is mostly because:

- Budget doesn’t reflect their money values or priorities

- they’re brand new at this and don’t have money obligations to prioritize

Budget Skill they Need to Work On: Creating a spending plan and uncovering their money values

Try This: Go through a spending plan with them. How much should they be spending, how much should they be saving, how much should they be investing, and how much should they be donating? Now, have them go through their filled-out budget sheet and figure out what percentages their money is allocated to. Does it come close to the spending plan priorities? Hint: you’ll also want to check out #9 to get them more excited.

9. Not Budgeting Anything for Savings

Your teen is not likely to get excited about saving money for savings’ sake – most of us aren’t, except for a few money nerds I happen to know (*ahem*).

SO, you need to get them excited about saving money through a savings goal project.

Budget Skill they Need to Work On: Setting a savings goal

Try This: Have them brainstorm a savings goal, then narrow that down to a short-term one that will give them the quickest win. Short-term savings goals take more than one allowance/payday cycle, but less than one month to save up for. When they fill in the “savings” part of their budget worksheet, they’ll want to specifically list this goal so that they know what they’re sacrificing for.

10. Their Social Life is Too Expensive

Are all the weekend invites your teen is receiving more than their money can handle?

Budget Skill they Need to Work On: Prioritize spending, boosting income, finding frugal alternatives to stretch income

Try This: Your teen can attack this problem in a few different ways. For starters, they can figure out what percentage of their money they’re spending on wants (going out with friends) each week. Does that surprise them? Secondly, they can come up with frugal things to do with teenage friends when bored. Such as these 100 things to do at a sleepover. Finally, they can look at ways to boost their income, such as initiate and negotiate a household project their parents are willing to pay for, or getting their first teen job.

11. Forgetting to Pay Back a Family or Friend

Are they failing to budget for money they need to pay back a family or friend?

Budget Skill they Need to Work On: Prioritizing needs over wants, and gathering all of their expenses/money obligations

Try This: While paying someone back is not always a “need” in the adult world (for example, it isn’t more urgent than paying for food from a grocery store), in your teen’s world, it’s more of a need since they have very few obligations to pay for. Let your teenager know that a need gets priority over a want, and that you consider them paying this person back to be a “need”. Another reason they might not be paying them back is because they simply forget. Help them look over their total finances and fill in their monthly money calendar, so that they can list out everything they need to plan for in the coming weeks – including paying back this loan. Either in full, or with planned installments.

12. Being Afraid to Tweak and Change Budget Categories

Teen’s lives? Well, they can change from week to week.

Your teen needs to stop seeing a budget as a one-time thing they fill out and periodically look at, and instead as a living, breathing document that changes as their needs change.

Budget Skill they Need to Work On: Making a budget that works for them, practically, and not just a budget they'll put on their bookshelf museum and never turn to again

Try This: Each week that they fill out a new budget, have them go through the categories. Cross off any that they don't need for that week, and add in any new ones they will need. This will help them to see they have power to change their budget to work for them, and to gain confidence in handling their money.

13. Having no Place to Store Money for Planned Spending Later in the Month

Has your teen figured out that they need to save some money from one week to the next so that they can pay a bill or have more money later in the month for some planned spending?

That’s awesome. Seriously – great progress.

But after they account for this planned spending money on their weekly budget, where will they keep that money (hint: this is NOT one of the things teenagers should keep in their wallet)?

Budget Skill they Need to Work On: Handling money and money management, delayed gratification

Try This: Set up a teen budget binder for them, with those 6 (at least) teen budget worksheets. Then, get a binder pouch with several pockets in it for the front. Put the planned spending each week into these pockets. When the week comes that they need the money, it should be waiting for them.

14. Failing to Count all Forms of Income

When I teach teens to budget, some of their eyes go blank when I use the word “income”.

I mean, some teens have jobs, and some don’t.

But “income” for kids and teens can mean any money that comes in, whether it be:

- gift cards

- birthday money

- paycheck

- allowance

- babysitting job money

- etc.

Budget Skill they Need to Work On: Work with what you’ve got

Try This: Use the money monthly calendar and a conversation to job your teen’s memory about what money they think they’ll have coming in. ALL kinds of money – anything that can be used to pay for something. Doesn’t matter if it comes from a job or a gift card. Heck, they could even include a coupon, so long as it’s for something they were planning on spending money on anyway!

15. Forgetting when a Bill is Due

Maybe you’ve given a bill over to your teenager as a money responsibility, and they keep forgetting either when the bill is due, or when the deadline is to reimburse you for paying their bill.

Budget Skill they Need to Work On: Meeting money deadlines

Try This: First of all, do they have a hard deadline for the due date? If you haven’t given them a firm deadline for when to reimburse you, then go ahead and do that. Now, have them fill in a monthly money calendar with their bill due date (before they do their budgeting). Then they’ll be able to clearly see which week they need to allocate money in their budget for it, and whether or not they’ll need to “save up” a little from this week to be able to do that (say, if the bill is due in like two weeks from now or so).

Now that we’ve gone over 15 teen budget problems, let’s go over one more thing: how much teens actually spend each month.

How Much Do Teens Spend a Month?

Lots of teen budgeting problems come from their spending, so it’s helping to quickly go over how much teens spend a month. For a baseline comparison.

According to the Piper Sandler survey of 10,000 teens (average age is 15.8 years), teens self-reported spending $2,274 per year (with 61% coming from parents).

The following are the most common spending habits teens have:

- Clothing (22% of spending)

- Food (21% of spending)

- Video Games

- Personal care/beauty

- Entertainment

If the average spent per year is $2,274, then that comes out to about $189.50/month, or about $47.38/week.

How does your teen stack up with this? Is their spending at the root of some of their budgeting problems?

I hope I’ve shown you the opportunities and, at least, first step forward in turning these common teen budget problems into budget skills. How can a teenager improve their budget? By making mistakes, and turning them around. Just know that they might not get it right away. Budgeting and learning how to budget is a process, not a one-time activity.

Amanda L. Grossman

Latest posts by Amanda L. Grossman (see all)

- 50 Banking Activities for Kids (Student Financial Literacy) - February 14, 2024

- 14 Christmas Activities for High School Students (they’ll Actually Find Cool) - December 1, 2023

- 3 Fun Selfie Scavenger Hunts for Teens (Christmas, Fin Lit, etc.) - November 27, 2023