Trying to teach teen students about money? Check out these free financial literacy activities for high school students (PDFs).

Teaching teen students different parts of managing money? Awesome – let’s get you some free financial literacy activities for high schools (PDFs included).

You’ll find activities and PDFs below that cover a variety of money subjects:

- Budgeting

- Money management

- Banking

- Credit cards

- Debt

- Spending plans

- Etc.

Below are PDFs, games with PDFs, PowerPoint slides, and teacher guides to help you teach your students all about managing money. Also, you might want to check out these financial literacy week themes.

Financial Literacy Activities for High School Students (PDFs included)

From learning how to rent an apartment, to learning how to decide on a big purchase decision – these lessons help prepare teens for real-life scenarios they’ll face in a few short years.

Psst: are you a homeschooler? Check out these 31 free homeschool personal finance curriculum. Includes curriculum alignments, where possible.

1. The True Cost of Renting a Place

Since your students will likely rent before owning a home, it’s vital that they learn how to actually rent an apartment (and what costs are involved).

Use this lesson plan, handouts, and slides to teach your students how to rent, the total costs involved, and how to compare rental options.

2. Put it in the Bank

Dallas Fed has a great series of resources around helping students learn how to build wealth.

This particular lesson has students compare putting money under a mattress and putting money into a savings bank account. Including a whole lesson on simple vs. compound interest.

Comes with slides, teacher’s notes, and student worksheets (hint: it’s hard to figure out how to get the materials – at least it was for me! First, click on the lesson you want, then click on the red “Procedure Documents” and “Interactive Lessons” to get the materials).

Hint: As a teacher, you can order up to 50 print copies of their 40-page booklet, Building Wealth: A Beginner’s Guide to Securing Your Financial Future, for free here! Comes in Spanish, too. Woohoo!

3. Use Credit Wisely

This set of slides, handouts, and notes takes students through how to use credit wisely.

Students will:

- Go through borrowing scenarios with specific information from fictional characters and debate whether or not they should take a loan

- Look at the impact of debt

- Learn lots of important financial words having to do with credit and debt

- Etc.

(Hint: it’s hard to figure out how to get the materials – at least it was for me! First, click on the lesson you want, then click on the red “Procedure Documents” and “Interactive Lessons” to get the materials).

Psst: Teaching students about credit? Definitely check out these credit card games for students.

4. KWHS Comparison Shopping Big-Ticket Items

So, here’s an eye-opening experience for your students – use this video and worksheet from Wharton High School to teach them about retail marketing tactics (aka, getting teens and adults to spend more money).

5. What is it Worth Saving For?

I’ve got a whole article on cool things for teens to save up for, so I’m all about financial literacy activities helping teenagers to figure out their next savings goal.

This is a daydreaming and writing exercise where teens are taken through a series of questions to get to what they really are willing to prioritize their money to save towards.

Comes with both a PDF for students to fill out, and a teacher’s guide.

Psst: you also might be interested in how much a teen should have saved by 18.

6. KWHS Organize Your Financial Records

I’m including this financial literacy activity here because I think it’s pretty interesting. This one has your students creating a Statement of Financial Position, meaning they’ll basically fill out their net worth to date.

Eye-opening, to say the least!

Also, a good financial habit to develop (here's why it's important to track your net worth).

7. Checking Account Balance Activity

This is TD Bank’s free printable resource with activities to teach teens how to balance a checkbook.

Students will complete a check register, learn how to read a checking account statement, and learn how to reconcile a checking register with a checking account.

Important stuff! And just part of the banking activities for kids and teens to learn about.

Hint: this says it’s for Grades 6-8; however, it’s a wonderful opportunity for teens who have yet to learn how to bank. Here are 11 more interactive money activities where kids and teens actually dig in and help make financial decisions around their home.

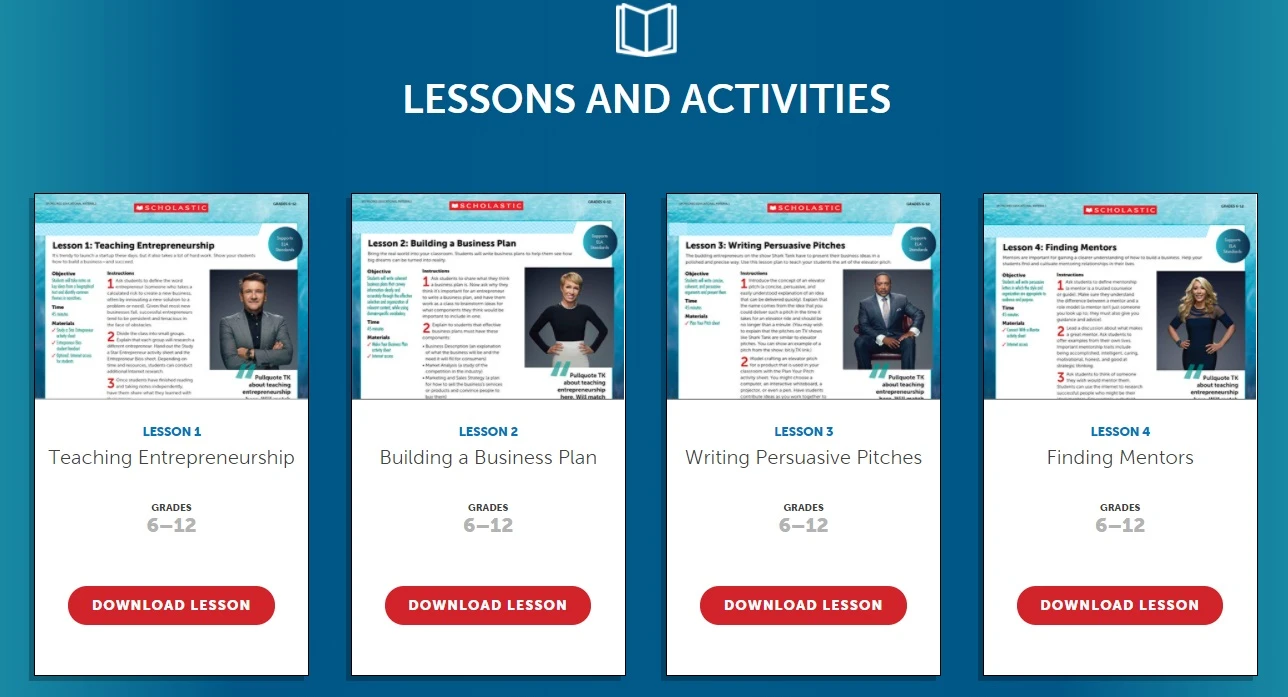

8. Shark Tank Lesson Plans

I’ve got a whole article filled with the best (free) worksheets, PDFs, and activities I could find having to do with the famous TV show, Shark Tank.

Students can use one of these worksheets to work through a business idea, product ideation, calculating profit, and much more.

For example, Scholastic has a great set of free Shark Tank PDFs and lesson plans to use in high school classrooms.

9. Create a Savings Comic Strip

Your students are tasked with writing a creative savings comic strip, all around different characters working through an important lesson about saving money.

Comes with a teacher’s guide, and student worksheet.

10. Compose a Rap Song or Poem about Paying for College

Students will review what various college payment choices are out there, and learn about each (such as scholarships, grants, loans, etc.).

Then, they’ll have to come up with a rap song or poem to talk about them!

The worksheet comes with a scoring rubric for the whole class to use in a competition.

11. Teach them How to Pay Bills

What is one financial scenarios for students to learn? How to pay bills. Everyone does it.

Paying bills is a critical adult money skill…yet I've seen hardly any lessons around this.

That's why I created a free PDF and activity that will help with how to teach kids how to pay bills. Try it out with a group!

Budgeting Worksheets Printables (PDFs)

This section is all about offering up awesome budgeting worksheet printables to go along with budgeting activities for high school teens.

Pssst: looking for more budgeting scenarios for high school students? Check out my 12 fun budgeting PDFs for students article, and these 4 budget projects for high school students.

1. Family Budget Game

Here’s a game created to help students understand not only budgeting, but budgeting for a family on a low income.

You can click on each of their “Family 1”, “Family 2”, etc. packages, and print out each of the materials. Create four envelopes (or “Family Packets”) for each family, and give each to a group of students.

Each packet includes:

- Family Scenario

- Family Budget Worksheet

- Family Crisis 1 (possible a Family Crisis 2)

- Family Good News

- Family Income

- Family Bills

- Etc.

The group is then in charge of filling out a budget and paying bills based on their family’s means.

This also makes for a good budget simulation for high school students, because it throws crisis situations (and good news situations) that change the dynamics of their “family’s” financial situation, meaning they have to think on their feet about how to move forward.

2. Budget Busters

I would call this activity a money-habits-awareness one.

Because what it focuses on is asking students whether or not they do certain money management habits/behaviors, and they have to forfeit a pretend dollar bill each time they answer “no”.

What are some of these behaviors and habits?

Things like:

- I have a spending plan for my allowance and any earnings from working for others or for myself.

- I know how much I can spend each day/week for snacks.

- I know how much I can spend on clothing each month/year.

- Etc.

Psst: you might want to check out these needs vs. wants budget worksheets, activities, and games.

3. KWHS Comment Contest

Here’s an interesting financial literacy activity – have your students register (for free) to Knowledge @ Wharton High School, read articles about personal finance, and leave a thoughtful comment on something they feel strongly about.

It’s an annual competition, and can definitely get your students interested in learning more about personal finance.

4. Making a Budget

St. Louis Fed has a set of slides, teacher guide, and worksheets to teach kids things like:

- Gross income vs. net income

- Saving money

- Spending money

- Prioritizing using a budget

Financial Literacy Games for High School Students

Financial literacy games are another great activity to guide high school students self-discover vital money life skills.

You’ll definitely want to check out my articles on:

- 19 Free Financial Literacy Games for High School Students

- 11 Budget Games

- 11 Best Business Simulation Games for Kids & Teens

And here’s one more for you:

1. Play a Budgeting Game with PDFs

Have your teens play this free online financial literacy game (Misadventures in Money Management), going through Sonya’s avatar.

Then, have them work through these worksheets to understand how to make large-purchase decisions better.

They’ll learn to:

- Think through a large purchase decision

- Plan a large purchase

- How to avoid being pressured into making a large purchase

A final idea? Is to have your teens journal about money. Here are some great journal topics for high school, including the subject of money.

Any one of these financial literacy activities for high school students pdfs will teach teens a money lesson or two that will make an impact in their young adult lives. So, just choose one to start with and go from there!

Amanda L. Grossman

Latest posts by Amanda L. Grossman (see all)

- 50 Banking Activities for Kids (Student Financial Literacy) - February 14, 2024

- 14 Christmas Activities for High School Students (they’ll Actually Find Cool) - December 1, 2023

- 3 Fun Selfie Scavenger Hunts for Teens (Christmas, Fin Lit, etc.) - November 27, 2023