These financial literacy week themes will help you keep kids, teens, and students engaged without overwhelming them with information.

I absolutely love the idea of financial literacy week themes.

That’s because I think your students, kids, and teens will get much more out of a week focused on just one part of financial literacy, than if you tried to squeeze in activities for each of these 119 money management life skills for youth.

And that makes for a solid money foundation for them to build new skills from.

So today, we’re going to go deeper, not wider, with these 9 financial literacy week themes to choose from.

Financial Literacy Week Themes

Ready to dedicate a week to teaching your kids some very valuable life skills?

Look over each of these themes, and pick the one that:

- You’re excited about teaching

- You think your students will benefit from the most

- Meets your students at the level(s) they’re at

Psst: here are personal finance basics for high school students so that you can make sure you're covering all the important topics.

Theme #1: What it Takes to Be a Car Owner

This is one of my favorite ideas for financial literacy month.

Because driving and owning a car is a big thing in a teen’s life, whether they actually can yet, or not. That makes a theme around car ownership a great anchor to teaching your students some really useful (and actionable) financial lessons.

Activity ideas:

- Car Insurance Rundown: Bring in a car insurance professional and talk about what factors go into pricing car insurance. Things like the age of the driver, the area, past accident claims, type of car, value of car, amount of insurance you want to put on a car, etc.

- Calculate Gas Costs to School: Have each student calculate how much it would cost them to commute to school and home, five days a week, with the car of their choice (if they already do this, then they can use their own car’s make/model). First, have them look up the average miles per gallon their dream car or current car gets. They can do this by looking up the number of miles roundtrip from their home to school, and then multiplying that by 5 (the number of miles they would need to drive each week to get to school and back). Calculate how many gallons they would need of gas to commute each week, and then multiply that number by the area’s average cost per gallon of gas. This is their weekly fuel costs to commute to school. (If you don’t want them to do this by hand, then use this commute cost calculator).

- Annual Costs: Go over the annual costs a car owner has to pay, like the annual inspection and car registration (here’s the requirements, broken down by state).

- Working Hours for Car Upkeep: Add up all the weekly/monthly/annual costs of owning a car, and then find out how many hours of work they’ll need to work each week/month to afford car ownership. You can also have them do this for if they have a car payment, and if they just pay cash for the car (so no monthly car payment).

- New vs. Used Car: Have your students research the cost of a car they want, both sourcing a new car price, and a used car price. Discuss the pros and cons of each option.

And, you guys can work together on building a “Dream Car” wall, where each student creates a page that highlights their work over the week. It would have an image of the car they want to purchase, the total cost if they paid in cash, the total car payment each month if not, the total monthly cost to commute to school with it, and the total monthly costs for upkeep.

This can be eye-opening not just for the students in your class, but for others who pass by the wall in the hallway!

Theme #2: The 5-Day, “I-Want Challenge”

What if you themed an entire financial literacy week around what each of your students actually wants to buy?

Well, you might have a lot higher engagement rate.

Each lesson you teach this week will be anchored by what each of your student lists as something they want to buy one day.

You’ll teach your students all different kinds of money lessons from these ideas.

Step #1 is to have your students brainstorm a big list of all the things they want, and then to narrow down to just one to focus on for the whole week.

Then, you’ll come up with activities and ideas to show them how to get what they want:

- Calculate how many hours they’ll need to work at their current job, or with the current average income for teens

- Create a savings goal (follow the detailed instructions in this article on how to save up for an iPhone as a kid), to help focus their efforts + motivate them to keep going until you can buy what you want

- Reduce the cost of what you want by using a coupon to buy it

- Reduce the cost of what you want, by waiting to shop out of season for it, or during certain seasons when there’s a discount for it

- Substitute something else to still satisfy the need or want, but in a different way

- Ask for it for your birthday or a holiday

At the end of the week, you’ll ask them to come up with a one-page plan, including backup ideas, for how to get what they want.

Psst: if they decided they no longer want what they originally thought, due to it costing too much in terms of hours worked or a substitute or another reason discovered during the week, then have them write a paragraph or two of why they changed their mind.

This will teach them so many things, like: frugality, financial resourcefulness, prioritizing money, stretching a dollar, goal-setting, etc.

Further resources to help:

- Short Term Goals for Kids (37 Ideas)

- Short Term Financial Goals for High School Students (26 to Choose From)

- 15 Intermediate Financial Goals for High School Students

- 39 Journal Topics for High School Students

- 39 Journal Topics for Kids

Theme #3: Bill Pay Your Way through the Month

Teaching kids and teens how to pay bills is actually pretty rare. Most teens enter adulthood not knowing how to do it, and they just learn as they go (that was my experience).

Imagine how far ahead of the game your own students can be if you take the time to theme a fin lit week around how to pay bills.

I created a free, 30-day bill pay simulation for classrooms to use.

Students will learn skills like:

- Looking a month ahead to plan out paychecks

- Juggling varying due dates of bills

- Being responsible enough to remember to pay bills

- How to make bill-paying easier

Some really good financial habits to develop, here!

Theme #4: Build Money Confidence

I love the idea of a fin lit week themed around growing in money confidence.

In fact, my number one goal with this site is to help kids and teens grow their money confidence, so that by the time they get their hands on a real paycheck, they’ll feel confident enough to start managing it.

This is not the experience that most people have.

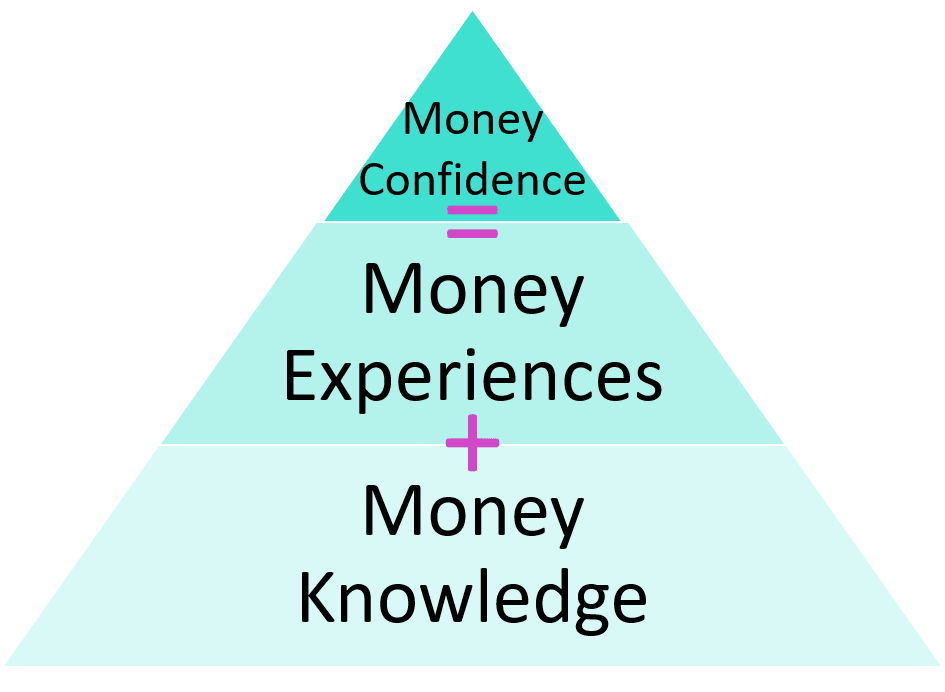

I imagine a pyramid, where the first layer is money knowledge (like learning what the different coin and money values are, all the way up to how to fill out a budget sheet), and the second layer is Money Experiences (where kids and teens actually use money in store transactions, in the way they had planned to with their budget, etc.), and then the last section is Money Confidence.

Money Confidence is gained by having a good mix of both knowledge, and experience to draw from when dealing with finances “out in the wild”.

While you could focus on the money knowledge part of this equation (with one particular category of money, such as budgeting), I would encourage you to think of ways to incorporate money experiences into this week.

Which really comes down to your kids handling money.

For example, you could base your week around creating a class store, with each student taking a turn making change, receiving payments, and each student taking turns making a purchase (could be with real or pretend money – if pretend money, try to make it look as real as possible).

And don’t forget to encourage parents to let kids and teens handle money, whenever possible (how can you become confident in something you’ve never handled, right?).

Theme #5: Budget in Someone Else’s Shoes

Perhaps your students don’t have any money to budget on their own, so introducing budgeting in the past was difficult because many of them were completely uninterested.

Don’t give up – try a budget week where students get to budget from someone else’s pay and bill responsibilities.

Here’s a free budgeting simulation (free printable with several avatars, a fortune teller, and then disaster scenarios the students will need to work through, plus a free prom budget template.

And here are some free teen budget worksheets.

Theme #6: Needs vs. Wants

Going over needs vs. wants is a great way to teach some valuable money lessons to your students.

Have your students create a Survive vs. Thrive list. Meaning, have them list out what they would need to survive (shelter, clothing, water, food, etc.), and then what they want, personally, to thrive (perhaps things like books, an education, organic foods, etc.).

Another important discussion is what I’ll call the Degree of Need. In other words, in most categories of needs, there is a continuum of products and services available. And some of them are actually wants in disguise, not needs.

For example:

- Flavored water (want) vs. plain water (need)

- $60 pair of designer jeans (want) vs. pair of jeans

- $35,000 brand new car vs. $9,000 used car

- Etc.

Here are some free needs vs. wants worksheets to help, too.

Theme #7: Dealing with Financial Hardships

Listen: I think we’ve got to be honest with ourselves. Many kids are in families who are going through tough financial times right now.

And not only that, but:

- They might be witnessing others going through tough financial times and not want to bring it up with their parents.

- They might wonder and have questions about the homeless on the street corners that they see.

- All of us, and your students, will go through tough financial times in their young and older adult lives.

All that is why I’m proposing a financial literacy week theme around how to deal with financial hardships (also, here are 9 books for kids to read about tough financial times).

You could play rounds of Monopoly Financial Hardships, with my free printables. These give kids different financial hardships that they have to work around with a normal Monopoly game.

Such as:

- Low Credit Score

- Pile of Student Loans

- Starting Up a Business

- Being in Debt to Someone You Know

- Getting Laid Off

- Past Creditors Hunting You Down

You could show kids just how well off they truly are, by comparing their allowance or what they think is a typical household income, or the national media average income to others’ incomes in different countries (using this free tool).

You could also discuss local opportunities to volunteer and donate to help those in financial need. And here are books for kids and teens that help explain financially tough times.

Hint: here are 12 activities to teach giving to students.

Theme #8: Savings Goals and Planned Spending

The three things you want to impart on your students from this themed week:

- Spend less than you earn (in that gap is where you’ll find money to save)

- Set up a savings space (savings account, money jar, etc.)

- Save towards something (i.e., have a purpose or savings goal to save money)

Theme #9: Assets Vs. Liabilities

Can I just say how I did not understand the difference between assets and liabilities until somewhere in my 20s? Seriously.

Imagine how much further ahead your students will be after a week discussing the difference between spending your money on assets, and spending less of your money on liabilities?

Total financial game-changer.

Activity Ideas:

- Discuss the difference between a liability, and an asset (the book Rich Dad, Poor Dad is a great read for this – for both you, and your students).

- Go through common, everyday household and life items, and ask students to identify whether they are a liability or an asset. For example, is a car a liability or an asset? Is a savings bond a liability or an asset? Is an education a liability or an asset? Could lead to some interesting debates.

- Have each student list out their personal net worth (does not need to be shared – you can use this free net worth sheet (PDF)).

Whether you’re celebrating Financial Literacy Month (April) by dedicating a week to teaching your kids, or your organization has created their own fin lit week, or you just are picking a week out of summer break to focus on financial education – going deeper in one particular topic by theming your week is the way to go. Next time you have another week to dedicate to this, come back and pick a new one! Your student’s and kid’s money skills will only continue to grow.

Amanda L. Grossman

Latest posts by Amanda L. Grossman (see all)

- 50 Banking Activities for Kids (Student Financial Literacy) - February 14, 2024

- 14 Christmas Activities for High School Students (they’ll Actually Find Cool) - December 1, 2023

- 3 Fun Selfie Scavenger Hunts for Teens (Christmas, Fin Lit, etc.) - November 27, 2023