Your 18-year-old doesn’t exactly know how life looks like next? No worries – here’s 3 sample budgets for 18-year-olds to help.

Around the time my youngest brother was 18 (I’m his much older sibling), he asked me to help him create a sample budget for an 18-year-old.

You can imagine how much my eyes lit up! I was super happy to sit down with him and show him what a typical 18-year-old budget looks like.

Not only was I able to help him that day, but I saved the exact scratch paper we used so that I could create an article to help you and YOUR 18-year-old with this task.

So, let’s get started!

How Should an 18 Year-Old-Budget?

First up, how should an 18-year-old budget?

I mean, let’s face it: things change quickly at this age.

- Your young-adult-still-teen may only have steady income seasonally, like in the summer (here are sources of income for 18-year-olds).

- They may not know what they’re going to do with their lives yet (apartment? College? Living at home longer? Gap year?).

- They may not even be graduating high school for another year, depending on when their birthday falls (here are smart ways to spend your graduation money).

All of these reasons are why I urge you to create several different budgets – they’ll give you an idea of what you’re looking at, and what could be.

You’ll want to create:

- A budget for where they are right now

- A budget for their ideal scenario for their next step in life

- A budget for a back-up scenario for their next step in life

It'll help with a teen improving their budgeting skills. I’ll show you samples of each of these types of budgets, plus give you a budget sheet to help them create each.

1. Sample Budget for 18-Year-Old – Where They’re at Now

You want your 18-year-old to not only budget sometime in the future, but to get on top of their budgeting right where they are. No matter what that looks like.

That’s why we’re starting with a sample budget for 18-year-olds for where they are right now.

When my brother and I sat down, he just could not understand where all his money was going to.

We first worked on his actual budget – what he was actually earning and spending right now. Then, we worked on a sample 18-year-old budget so that he could see what his COULD look like.

Fortunately, I saved this information as well!

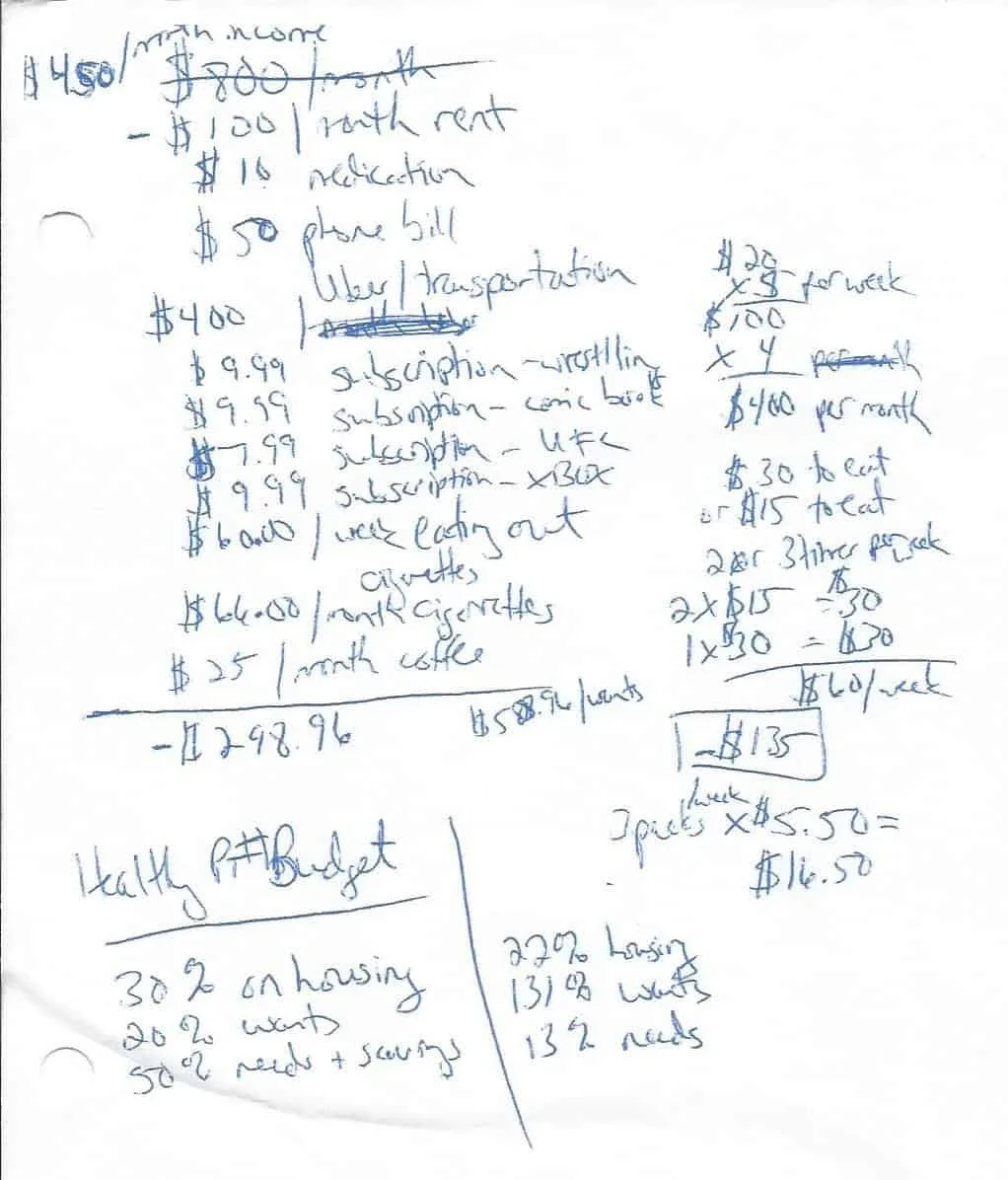

Here’s the scrap of paper we used, showing his actual budget on a monthly income of around $450:

Aside from my chicken-scratch handwriting…can you notice a few things?

For example, he:

- Is spending approximately $258.96 each month MORE than what he earns

- His transportation costs of using Uber were eating up $400 of his $450 in income each month…meaning it almost wasn’t worth it for him to work until he got his license (though gaining work experience is valuable, too)

- His cigarette habit was costing him almost 14.7% of his entire budget

- He was spending 131% of his income on wants

- His real-world expenses (such as $100 in rent) were completely unrealistic because he was still living at home

This is where this 18-year-old was at with teenage money management, at the time we sat down to do this. It was an extremely eye-opening experience for him.

Next up, we looked at what a typical 18-year-old budget COULD look like for someone still living at home.

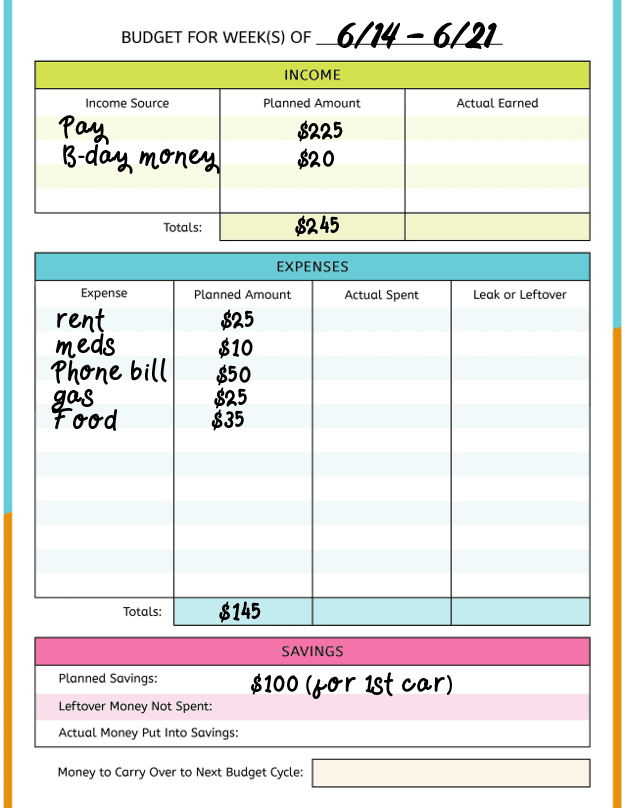

In this example, the 18-year-old makes $900/month, with a bi-weekly paycheck of $450.

That means that each week, they have atleast $225 to budget with from their paycheck.

Other things to note:

- This is a weekly budget, so monthly costs like rent are divided by 4 ($100/4) to show how much money they need to set aside each week to be able to pay it for the month.

- They’re paying $25 to their parents for gas, and using their parent’s car.

- They’re saving up for their first car.

There’s not much wiggle room with this budget. However, they are both paying rent and their gas costs – keeping their parents happy – and will be looking at a better tomorrow (since they’re saving as aggressively as they can for a car).

Next up, a sample budget for teens that will be getting their own apartment.

Psst: wondering how much money an 18-year-old should have saved?

2. Sample Budget for 18-Year-Old – Who Will be Getting an Apartment

This is the sample budget I created with my own 18-year-old brother several years ago. He was having trouble visualizing what his next step in life would look like – moving out into an apartment as an older teen.

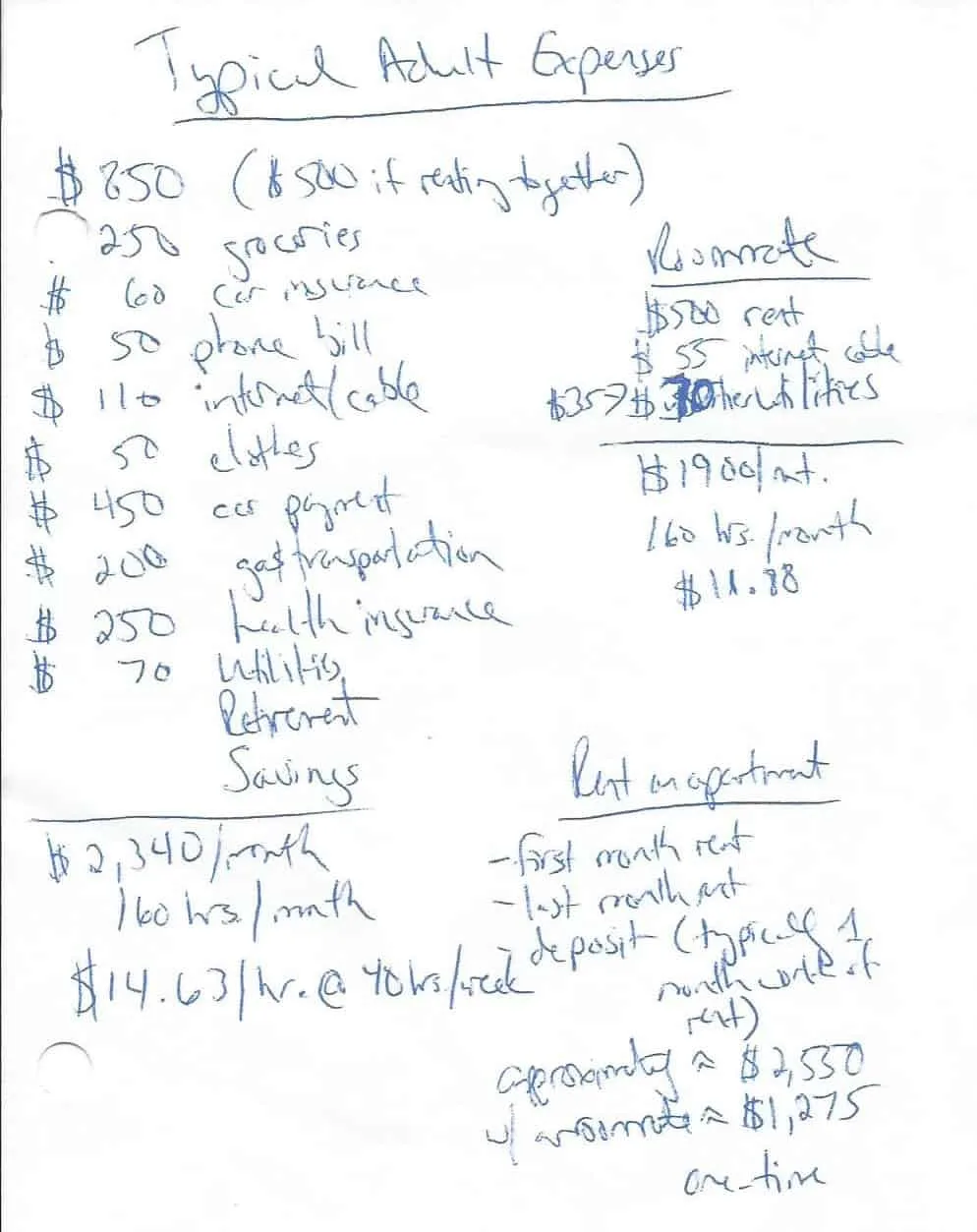

We sat down, and created what a typical young adult’s budget might look like.

Note: this is “typical”, but the numbers may vary wildly depending on where your teen is going to live. The cost of living in NYC, for example, is going to be wayyyyy more than in the middle of Texas.

I wanted to show my brother how much of a difference it could make if he lived with a roommate – at the time he had a one-bedroom apartment, and so he’d have to move to make that happen.

We also discussed how much he would need to save up for that first apartment, including first month’s rent, last month’s rent, and a deposit (equaling one month’s rent).

Finally, I broke down approximately how much it would cost to afford this lifestyle of moving out on your own or with a roommate.

Without a roommate, you’d have to work full-time (160 hours) earning around $19.00/hour to afford this budget (this takes taxes into consideration for a person with single filing status).

With a roommate paying half of the rent, utilities, and internet/cable, you’d need to work full time earning around $15.00/hour.

Pssst: if your teen is in search of extra income on the side, they can look into these 25 online jobs for teens that pay, or these 11 teen job apps.

Note: this budget and income amount does not allow for savings or retirement, which is definitely something to think about. Those are two very important things to start doing as early as possible! Here’s 41 things for teenagers to save up for.

3. Sample Budget for 18-Year-Old – Who Will be Going to College

When a teen is prepping then attending college, their earning ability is typically going to be much lower than if they got a full-time job.

Focusing more on their studies is made possible by many college plans including both tuition and board (a place to sleep, food to eat, etc.) in their college costs.

Their budget for the college years is going to look quite different than if they were living at home or were working full-time and had their own apartment.

For example, when I was in college, I earned much more money during the summer months than during the college year (when I worked a minimum-wage job at the library).

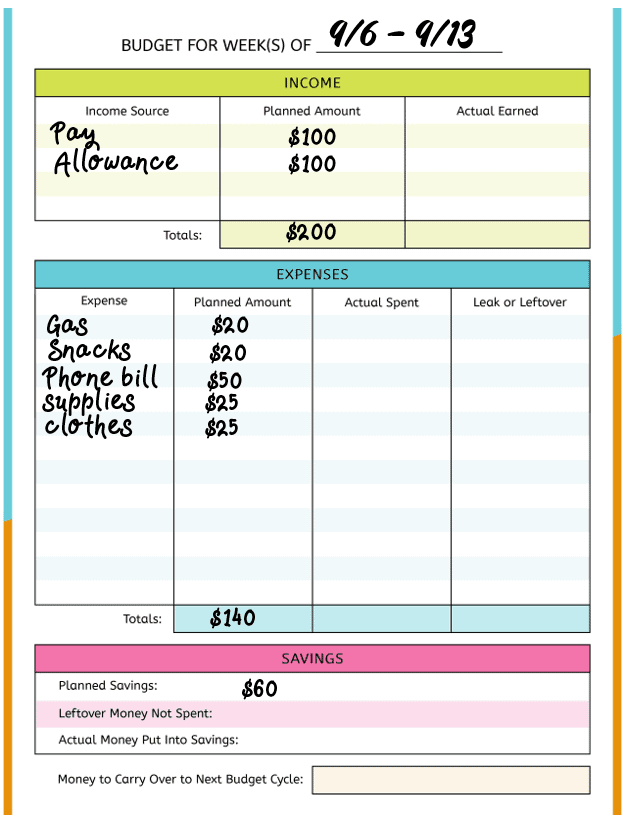

In this example, the student has a minimum wage job, working around 15 hours/week, with income of approximately $200 every other week. They also get an allowance (either a stipend from a scholarship, or from parents) of $400/month, so $100/week.

They are also setting aside $60 for the week into savings, which is really important for any number of reasons. For example, when I graduated college, I had a little over $2,500 in savings. This was enough to pay for my first month’s rent, last month’s rent, and a deposit on my first apartment (I got a job right out of college, and had to move a week after graduation).

Next up, let’s talk about one of the elephants in the room.

What Should an 18-Year-Old Pay For?

Figuring out what an 18-year-old should pay for will really dictate lots of things.

Like, how much they’ll need to earn, whether or not they’ll need a part-time or full-time job, whether or not they can afford college, etc.

So, let’s take a minute to talk about this.

“Should” is very subjective. What one family feels an 18-year-old should pay for, is going to look different from another family.

Coming to the answer that’s right for your particular situation boils down to:

- Your personal financial situation

- Getting clear on your money values

- Getting clear on your money boundaries

- How much prep you’ve given your teenager in teaching them about money

- Your 18-year-old’s maturity level

If you’ve been slowly changing your role from a manager to a mentor with your child as they’ve grown, and given them ever-increasing money responsibilities to pay for and decide on, then you’ve got more of a greenlight to handing them over the bulk of money responsibilities as an 18-year-old.

If you’re in the beginning stages of teaching your teen money, or if they don’t have a steady job, or if they’re going to college, then they likely will take over less money responsibilities for now.

You’ll definitely want to check out my article on how to teach teens financial responsibility, and a robust discussion of money boundaries in my article about how to raise financially responsibly kids.

Find specific teenage expenses here.

I hope I’ve shown you how creating three sample budgets for 18-year-olds is the way to go, plus given you and your teenager plenty of examples to show you how to do it. Remember that budgets are all about tweaking – they’re going to change and grow and shrink as your teen’s financial situation changes. Still, they provide an excellent foundation for some serious “aha” moments that will teach your teen how to budget right now and into adulthood.

Amanda L. Grossman

Latest posts by Amanda L. Grossman (see all)

- 50 Banking Activities for Kids (Student Financial Literacy) - February 14, 2024

- 14 Christmas Activities for High School Students (they’ll Actually Find Cool) - December 1, 2023

- 3 Fun Selfie Scavenger Hunts for Teens (Christmas, Fin Lit, etc.) - November 27, 2023