An age-by-age guide to teaching kids about money. Includes the most important money lessons to focus on, and what you need to feel confident teaching them.

Teaching kids about money is one of the most important things you can do as a parent and educator.

And yet it’s one of the most intimidating.

I run across people all the time who confess that they're not very confident in their own money skills…so they feel completely unqualified to teach their kids and teens to manage money.

And if they feel qualified? They're terribly confused over where to start (saving money, spending money, earning it, etc.).

Like, what does their child already know, and not know, and how do they pick up from there?

If this describes you, too, then I'm so glad you're here. You're not alone.

You ARE qualified to do this. And I'm going to help make your task a bit easier.

Before we get into the very specifics of teaching kids about money, I want to touch on a really important thing you’ve got to do first: get clear on WHAT you want your child and your students to learn about money.

Step One When Teaching Kids about Money

You're probably here because you're hoping for a list of what lessons to teach your child, and when to teach them (stick around – we'll go into specifics for both of these).

But first, before we dive into expert findings, state requirements, and other expectations for what your child should know about money at their age?

You need to get clear on what YOU want to pass onto your child.

Because at the end of the day – when your child has graduated and moved off – the buck stops with you. And you want to feel GOOD about what you taught your child, right?

Figuring out how to teach kids about money is only half the equation. The other half is knowing what to teach them.

A full money education isn't only about reaching the minimum requirements around teaching kids and students about money. It's about marrying those with the lessons that you want to personally pass down to your kid(dos).

Money Mission Statement Exercise

This exercise is going to guide you through getting clarity around the lessons you want to pass onto your child.

I want you to think back. Waaaayyyy back, to before you carried your money hang-ups around with you.

When money didn't feel like a limiting factor. Wasn't a limited resource. Wasn't a stressor.

When money was shiny, and new, and something you were highly fascinated with.

What did you want for yourself in terms of money at this point in your life?

That's how deep I want you to dig to create a money mission statement for your own child.

- What do you want them to know about money?

- How do you want them to feel about money?

- What do you want them to be able to do with money?

Hint: Scroll all the way to the bottom of this article to read my own money mission statement letter I wrote to my child. Are there things in my letter to my child that really resonate with you? Go ahead and use 'em for your own money mission statement.

Take 20 minutes or a lunchbreak to brainstorm your money mission statement.

These questions will help:

- How do I want my child to feel about money?

- What are the ways in which I want my child to be able to use money?

- What money values do I want to pass onto my child, and which ones do I hope don't get passed on?

- Where do I want them to financially be at different stages of their lives (teenager, high school graduate, college graduate, first job, etc.)?

- How dependent or not dependent do I want them to be on me financially and otherwise? How can I ensure I do my best to facilitate that level of independence that's right for our family?

Talk to them from the heart, and be specific about what you want to pass onto them.

Don't worry, you can choose to save this letter in the pile of sentimental goodies you'll give to them when they're an adult, or you can just keep it for yourself and periodically look back at it to determine if your money education is on track or not. It's completely up to you.

Next up, let’s outline the money-teaching-process with an age-by-age guide for what to teach kids about money.

Teaching Kids About Money – An Age-by-Age Guide

One of the most common questions I get about teaching kids about money is what lessons should be taught, by age.

I mean, an age-by-age guide would be nice, right?

Well, one actually exists.

Pssst: please read the end of this section as well, because you need to know a few things before merrily checking off these money lessons.

Before I give it to you, I want to share with you my take on how kids develop money skills and how they interact with money.

I'll be the first to say: kids are SO different.

However, the *rough* money development path they follow typically looks like this:

1. Become Fascinated with the Power of Money

Your kid thinks money grows on trees – it’s limitless. Kids make some decisions about how they spend any money they can get, and they want to make ALL the decisions about it.

2. Start Building Delayed Gratification

Your child begins to understand that if they don't spend all their money each allowance/chore commission payday, then it starts to grow to an amount that's bigger than one allowance/chore commission cycle.

3. Express their Own Priorities Using Money

Kids/teens see money (specifically, spending) as a tool to help them express themselves.

4. Question Money Boundaries

As with all boundaries, kids/teens question money boundaries as well.

What money is theirs? How much of their parent's money do they have access to? What decisions do they get to make? What are they responsible to pay for now that they're a bit older?

5. Desire Financial Independence

Kids/teens want to, and need to, earn their own money, make decisions about their money, and manage their financial lives.

Now that we have those money development stages out of the way, I next want to share with you the age-by-age guide to teaching kids about money that was created by the President's Advisory Council on Financial Capabilities.

You'll also want to grab a copy of my extensive checklist of money life skills.

Hint: another way to figure out what your kids do/do not know about money? Is to have them journal about it. Here are 39 journal topics for kids, with lots of money ones.

Teaching Kids about Money – Money Skills for Ages 3-5

Teaching preschoolers about money?

You might be surprised I'm starting at the age of 3-5, but it turns out that a money education is supposed to start a lot earlier than what most of us think, backed up by studies that show kids are set in their money habits as early as 7!).

In fact, it's highly likely your Pre-K kiddo has already started asking questions about money (and if they haven't, then they're holding them in…then again, when have you known ANY Pre-K kid to hold ANYTHING in?).

Maybe they don't know exactly how to describe it, but they've figured out a thing or two.

Like when Mommy and Daddy go to the store, they hand over something green or plastic to the cashier before taking items home.

Or sometimes they don't get to have the things that they want in a store, even though they appear to be there for the taking.

Or that Mommy and/or Daddy leaves most days to go to a job to make money.

According to the President's Advisory Council, by the age of 5, your child needs to know the following four things to be on track to living a “financially smart” life:

- You need money to buy things.

- You earn money by working.

- You may have to wait before you can buy something you want.

- There's a difference between things you want and things you need.

Money management activities for preschoolers to help with these lessons:

- Coin Recognition Games

- Best cash register games for kids

- Best money coloring pages

- Best read aloud books for preschoolers

- 17 Best Money Toys for Kids

- Grocery store games for kids

- Career exploration books for kids

- Teaching Preschoolers about Money

Teaching Kids about Money – Money Skills for Ages 6-10

Kids need to regularly be handling money at this point, and be put in charge of money management decisions.

That means if you haven't already stepped into the world of allowances and/or chore commissions? Now is definitely the age to do that (the sooner, the better!).

According to the President (or at least his advisory council), from the age of 6 to 10 years, your child needs to know the following four things to live a “financially smart” life:

- You need to make choices about how to spend your money.

- It's good to shop around and compare prices before you buy.

- It can be costly and dangerous to share information online.

- Putting your money in a savings account will protect it and pay you interest.

Money management activities for kids to help with these lessons:

- Allowance for Kids — the Ultimate Guide

- Should Kids Get Paid to Do Chore? Pros and Cons.

- 119 Money Management Skills for Youth to Learn

- Money Management for Kids

- Budgeting for Kids Tutorial (plus Free Kid Budget Worksheets)

- 50+ Banking Activities for Kids

- How to Teach Kids How to Pay Bills

Teaching Kids about Money – Money Skills for Ages 11-13

We're moving onto the Tween age group (11ish – 13ish).

Kids really want to start expressing themselves in this age-set, and money is one of the best ways to allow them to do this. WELLLLL…with some money boundaries, that is.

Not only that, but outside friends and social groups are only going to get more and more important to your child's development. Meaning, they might be spending more time away from home as the years drag on.

You'll want to readdress the money responsibilities and money boundaries that you've given your child. Haven't looked into these? No worries – I've got you covered in the activities resource section below.

Your child is likely to also be wanting to start earning extra money around the house and outside of the house (if they haven't started already). Once that happens, it might be time to recalculate how much allowance to give your child.

According to the President's Advisory Council, by the age of 13, your child needs to know the following four things to live a “financially smart” life:

- You should save at least a dime for every dollar you receive.

- Entering personal information, like a bank or credit card number, online is risky because someone could steal it.

- The sooner you save, the faster your money can grow from compound interest.

- Using a credit card is like taking out a loan; if you don't pay your bill in full every month, you'll be charged interest and owe more than you originally spent.

Money management activities for kids to help with these lessons:

- How to Teach Kids Financial Responsibility (My M&M Strategy)

- How to Talk to Kids about Money (Money Conversation Guide)

- Fun ways to teach compound interest to your kids

- 9 Investment Books for Kids

- 19 Best Summer Jobs for Kids (Aged 13 and Under)

- 19 Money Management Games for kids

- 57 Action Steps to get your kiddo saving more money today

- Free Money Envelopes for Kids

- 15 Money Saving Tips for Kids (plus How to Save Money as a Child)

- How to Teach Kids How to Pay Bills

- 9 Financial Literacy Week Themes

Teaching Kids about Money – Money Skills for Ages 13-16

You officially are in the teen years. The older your child gets, the more you want to move away from being their money manager, to being their money mentor.

You'll want to let your teenager make more and more decisions with their money (with money guardrails, of course), and allow them to feel the natural consequences – both good and bad – from that.

After all, mistakes they make now will be much smaller than ones they make when they have a mortgage to pay.

Employment is probably in each of your minds, as well as the added life and money responsibilities that come from driving (and possibly owning) a car.

According to the President, by the age of 16, your child needs to know the following:

- You need to compare costs when searching for colleges.

- If you can’t afford something with cash, then don’t buy with them with a credit card.

- Money is taken out of a paycheck to pay taxes.

- Roth IRAs are a great place to save and invest your money.

Money management activities for teens to help with these lessons:

- Teenage Money Management (The Comprehensive Guide)

- How to Budget as a Teenager (Plus Free Teen Budget Worksheets)

- Teen First Job Guide (plus, How to Get a Job as a Teenager)

- Guide to Investing for Kids

- 7 Money Conversations to have Once Your Teen gets their First Paycheck

- 9 Reasons to Save Money as a Teenager

- How to Teach Your Teenager Financial Responsibility

- How to Save Up for an iPhone as a Kid

- How to Spend Less Money as a Teenager

Why You Need to take this Age-by-Age Guide with a Grain of Salt

I wanted to share with you an age-by-age teaching money guide…but you need to know that it's just that – a guide. Not written in stone.

I say this because:

- That list above is not, by any means, going to give your child a complete money education.

- A money education is not cut-and-dry. Children develop the “Building Blocks” of financial capability at different stages, and money lessons kind of all overlap one another throughout childhood. So your child may be “ahead” or “behind” the age ranges above…and that's totally fine.

Let's tackle that first point: The thing is…while I wanted to start you off with what the “experts” say you should be teaching your kids and when – and having a specific list with target money lessons, by age, is very helpful – I can say that that list does NOT cover it all.

I mean, think about the common money situations we all come across in our day-to-day lives, and ask yourself, would learning the above points get your kids through them?

Things like:

- How to weigh the costs of moving for a better job position (taking into consideration things like quality of living in the new place, career track, and cost of the move).

- How to audit your monthly spending and make non-painful cuts.

- How to figure out whether you should keep renting or buy a home.

The answer is, no. It's “no” because there simply isn't a checklist for the kind of day-to-day money situations people face. BUT, there are money “building blocks” that we can teach our kids, so that when they find themselves in the above situations (plus the thousands of others they'll encounter over the years), then they'll be able to work through it.

That leads into my second point. You and I both know that kids develop at differing speeds. And not only at different speeds, but at varying speeds depending on the subject. And money lessons? Well, they kind of all run into one another.

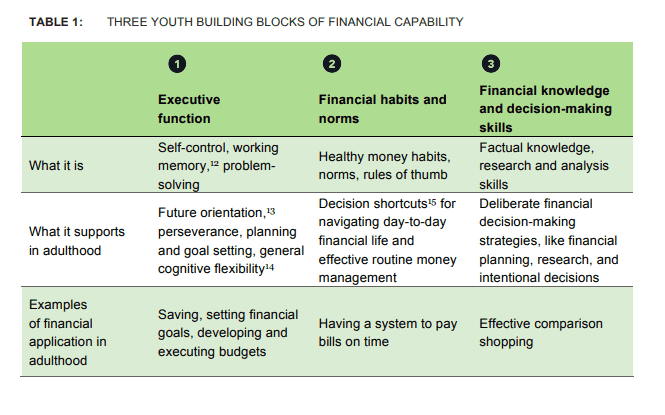

According to the Consumer Financial Protection Bureau, the three Building Blocks that kids need to get in childhood in order to turn into financially capable adults are:

- Executive function

- Financial habits and norms

- Financial knowledge and decision-making skills

Yet they acknowledge that (bold is mine),

“Children begin acquiring these building blocks of financial capability as early as preschool and continue to develop them as teens and young adults. Children and youth do not acquire the building blocks separately or in isolation. Instead, children, teens, and young adults accumulate them in an overlapping fashion during early childhood, middle childhood, and as teens and young adults…The ages linked to the developmental stages are only broad estimates because individuals vary in their maturity level at each age, and many of the attributes and abilities span multiple periods. None of the buildings blocks of financial capability completely emerges during a single broad developmental age. Instead, children, teens, and young adults accumulate them in an overlapping fashion.”

See what I mean, now? An age-by-age guide is awesome, but use it as a GUIDE.

I'm not trying to put my own expertise above, well, the experts. BUT, I am telling you that my own child will be learning wayyyyyy more money skills than is included in the age-by-age guide above.

Because of this, I’m offering up my own list of important money lessons that you do NOT want to skip when teaching your kids about money (many of which aren't included in the list above, but that I would consider necessities).

Pssst: you’ll also want to grab your own copy of my Money Life Skills Checklist, for an overly-detailed list of all the money life skills you want your child to have before they leave home. Or at least, what you should be aiming for (because no one’s perfect, right?).

Don't Forget these Important Financial Literacy Lessons for Kids

Feeling a bit overwhelmed by all those money life skills above? There's even more that aren't addressed in those Presidential guidelines.

That's why in this section, I want to give you the MOST IMPORTANT money lessons you can impart to your child.

And we’re going to do it through what I like to call planting “money seeds”.

Do you ever notice how your child can get introduced to a new thought, and they suddenly become obsessed over it? You can almost see their minds working as they think, think, and think around it.

Well, the same thing happens when you teach children about money concepts!

I want to give you some money seeds to plant into your child’s brain so that they can start getting excited about these age-old money concepts that will help them over and over again throughout their life.

Money Lesson #1: Money Confidence

You might think this one is a bit fluffy, but hear me out. How is your money confidence? How long did it take you to get to the level you’re at?

By nurturing the growth of money confidence in your kiddo, you’ll be setting them up for a successful money life which includes things like:

- negotiating their salary pay

- working through situations life throws all of us without heaping on loads of debt

- saving for the goals they set for themselves

- etc.

The reason why this one is not being taught in school is because building money confidence in your child is mainly done through exposing them to real-life experience. And kids generally can’t get real-life money experience from school.

The best ways to nurture this in your child is to a) figure out your kid money system that gets money into their hands consistently so that they can start making decisions and learning money management skills that way, b) modeling confident problem solving of money situations for your child, and c) helping your kiddo appraise their money efforts.

Money Lesson #2: How to Delay Instant Gratification

This is really a precursor for successful goal setting for kids, and once your child learns this skill, the sky’s the limit as far as what they can accomplish with their money and with their lives.

Kids are impulsive by nature, mainly because their brains haven’t developed the necessary wiring for long-term processing and emotional regulation. But don’t fret; even if your child is very unable to delay instant gratification with their money, it turns out that this is a muscle they can stretch and grow.

Money Lesson #3: How to Make Money Grow

Your child’s school education around money is likely to be basics like learning how to count it, make change, and making purchases at/running the school store.

These are all very necessary money basics for your child to learn, but they don’t necessarily lead to the money management skills that will get your child ahead. Like learning how to make money grow.

Your child has the ability to be a millionaire one day. Time is on their side. But if they don’t understand this concept early on, then it will literally cost them hundreds of thousands of dollars.

I can say this from experience. When I was 16, I was super interested in learning more about the stock market. I knew that somehow it meant that my money could grow, but that there were seemingly huge risks involved as well, and I had no idea where to start. I wanted to talk to a financial advisor in the family, but the meeting was never set up. Eventually I started investing in the stock market through a retirement account I opened up at 23, which was great. But do you realize how much more money my retirement account would be worth NOW if I had started when I was 16 – a full 7 years earlier?

Don’t get freaked out about having to teach your child to invest; you can just start small with showing them how money grows when left in a savings account through interest and compound interest. Once they grasp this concept (and their eyes might pop out of their heads when they do), then you can worry about moving onto the bigger stuff.

Money Lesson #4: Do not spend more than you earn.

You could have a million-dollar-a-year salary, and if you spend $1,000,001, then you’re broke.

You don’t have to take my word for it; there are many high-profile people who haven’t caught onto this timeless lesson and have less money than you do (Nicholas Cage, MC Hammer, Mike Tyson…the list plays on like National Lampoon's Christmas Vacation in December).

There are inputs (income), and outputs (spending) in personal finance. If your inputs are smaller than your outputs, or your outputs are bigger than your inputs, then you’ve got a problem.

Outputs less than your inputs? You’re automatically accumulating money.

Money Lesson #5: Everything Else is Figure-outable.

You don’t need to know everything about money when you leave the house. No one ever does. People are still learning about money – like me – throughout their entire lives. You just need to be resourceful enough to figure out how to find the answers to the questions you have, and what’s a priority for you to learn.

See how clear the path can be when teaching kids about money? These are totally do-able money lessons you are very capable of passing onto your child. They’ve stood the test of time, and their truth rings true through everyone’s wallets and bank accounts.

Mama Pep Talk Time – Why YOU are Qualified to Teach Your Child about Money

I’ve got one more REALLY important thing to get off my chest.

You are fully qualified to teach your child about money — I've waved my magic wand, and it is done.

Yes, I’m talking to YOU.

The one who thinks since they only JUST got their own money together enough to feel semi-responsible, that they can’t possibly be qualified to teach their own child.

I teach kids all about money, and I've got a certification…but today? I want to show you precisely why YOU are fully qualified (and capable) of teaching your child about money.

What qualifies you to teach your child about money through ways like teachable moments at home, you ask?

I’ll give you three money qualifications that you have.

Qualification #1: You’ve made a money mistake.

Money mistakes are material!

These are golden opportunities when teaching your child about money, not something to be ashamed by.

Take a few minutes to remember the mistake that you made, the details involved, and the lesson you learned from it.

When put in that same situation in the future, how did it go the second time-round?

Examples (nah…I didn’t make these at all…):

- Opening up a new checking account and closing the other one, only to have several automatic bill-pays bounce.

- Graduating college with a huge debt monkey on your back. (Sure, you knew you'd be in debt. But $36,000?!?)

- Missing a mortgage payment.

- Getting a letter from the IRS.

Use these nuggets and show your child that a) you’re human, and all humans make mistakes, and b) it’s okay when THEY make money mistakes, as there’s a way to work out of them.

Pssst: Want more on how really successful money people have made huge blunders – think bankruptcy, 401(k) cash outs, and $250,000+ in credit card debts? Then check out my post on how to turn your biggest money mistakes into assets here.

Qualification #2: You’ve been in the banking system for any number of years.

You know how to make a transaction (at least I would hope so, at this point), and you know the difference between a debit purchase, a credit purchase, and cash. You’ve got a checking account, you’ve got savings, and you know the difference between the two.

Got a retirement account set up at work? Bonus points.

Walk your child through each of these accounts, and each of these ways to pay for things and you’ll have given them more information than they’re likely to receive in personal finance education at school.

Qualification #3: You care.

Seriously. In a world where 69% of parents are reluctant to even talk about the subject of money with their kids, just showing up and opening up dialogue about the subject will put your child ahead of the pack.

You are reading this article, so you obviously want better for your child than you had (qualification #3 met!). You’re taking the right steps to get there, and by clicking through content here, you’ll find lots of resources to partner with you on your quest for your child’s bright money future.

You’ve GOT this!

Pssst: still feeling a little unqualified in the money realm? Here are 5 personal finance books that, once you read, are like getting your Money GED. Financial literacy for parents for the win!

**************************************

Here's my money mission statement to Conner that outlines what I want him to be, do, and have when it comes to money:

Dear Conner,

First of all, your father and I are just so proud of you. You've been a blessing in our lives, a gift we prayed for, and then waited for (10 months) and then really waited for (40 weeks and 4 days, to be exact).

Money is nothing to you at the moment, and is specifically much less important than, say, your rubber snake you love to carry around, or the cat toy we can't seem to part from your little, chubby hands.

But money is going to play a major role in your life, both when we are there to help you with it, and when we can no longer be there for you.

Since your mother is a bit of a money-geek, I thought I'd write down what I want for you.

- To know that, yes, you must work hard in life to get money…but you can also watch your money grow with some awesome management.

- To make it through life's many seasons with money not being the driving factor behind each of your decisions and choices.

- To be able to help others from a strong money situation yourself.

- To learn some solid money foundations you can fall back on for when the sh*t hits the fan.

- To be able to handle the money your father and I leave you.

- To feel ease around money, never afraid, and never intimidated. After all, it's just another tool.

- To stay out of the debt cycle, or at least to not enter into it blindly.

- To be independent from your father and I after finishing college (we love you, Son, but it is in your best interest to spread your wings).

- To have a great handle on your money and be able to extract as much life enjoyment as possible no matter what your paycheck is.

- To save for your future, and to know the value of doing so.

- To be an independent thinker with some entrepreneurial spirit in you.

It's a tall order, especially since you're still in cloth diapers. But we've got years to work on this together. So, don't fret.

Just know that we love you, no matter the size of your bank account, no matter the mistakes you are going to make, and no matter, really, anything. And always remember this: Net Worth does not equal Self Worth. Ever.

Love,

Mama Bear + Papa Bear

Amanda L. Grossman

Latest posts by Amanda L. Grossman (see all)

- 50 Banking Activities for Kids (Student Financial Literacy) - February 14, 2024

- 14 Christmas Activities for High School Students (they’ll Actually Find Cool) - December 1, 2023

- 3 Fun Selfie Scavenger Hunts for Teens (Christmas, Fin Lit, etc.) - November 27, 2023